I wonder how needed this is, I grew up in middle class and never really struggled with the value of money or understanding it

A Financial Specialist Shares Tips on How to Teach Your Child About Money at Every Age

A psychologist shared that when she was in the third grade, a manager from a bank came to her classroom and gave each child the opportunity to open a bank account and allowed them to make regular deposits. It was a brilliant lesson for her. But there are some more crucial things about money that parents can show their kid at any age.

We at Bright Side are all for teaching proper money management, especially during childhood, and would love to share some professional tips on how to do it.

Age 2 to 3

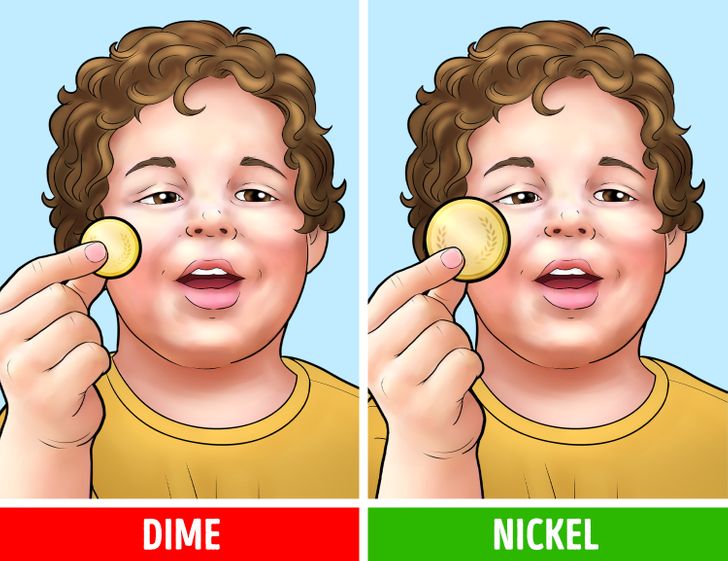

Doctor Dorothy Singer says that children between 2 and 3 years old don’t understand the value of money but they can begin doing so by learning the names of coins. One of the games can be “identification.” Your child can check different coins, examine their colors and shapes, and then match them with the image while discussing the names.

It’s also recommended to pick a nickel if you play with a coin because of its size. You should provide close supervision when a toddler plays with a dime.

Young kids are most excited to play “pretend shop” at home so you can provide them with some new information about shopping without even going out. Exchange your money for food, show them coupons, and talk about sales as a fun game.

Experts suggest to make pretend money together and use cereal boxes and fruit as store items. Just make it entertaining for your kid so that they’ll be excited to learn about this topic more.

Age 4 to 5

Before going to the supermarket, clip some coupons with your child — but don’t forget to use safety scissors. When you’re at the store, give the kid one coupon and ask them to keep an eye on the cucumbers or other products. Just make them feel like they’re helping you and doing something important.

Another way to teach a preschooler about money is to set up an imaginary restaurant at home. This is a good way to prepare your kid for future dinners in the real world and explain some basic things throughout the game such as manners and how to set the table. Remind your child after dinner that they have to pay the bill. You can use pretend money for this part.

Your child should also learn the importance of waiting. It’s a crucial skill for saving and spending. There’s no need to explain things in great detail. Just begin with waiting in line and say that it’s a part of life when you want to get something that you like.

For practice, find a reasonably priced toy that your kid wants. Tell them they have to wait and save money to get it. Then give the child allowance each week, like $1, for example. Don’t give them all the money at once.

Age 6 to 8

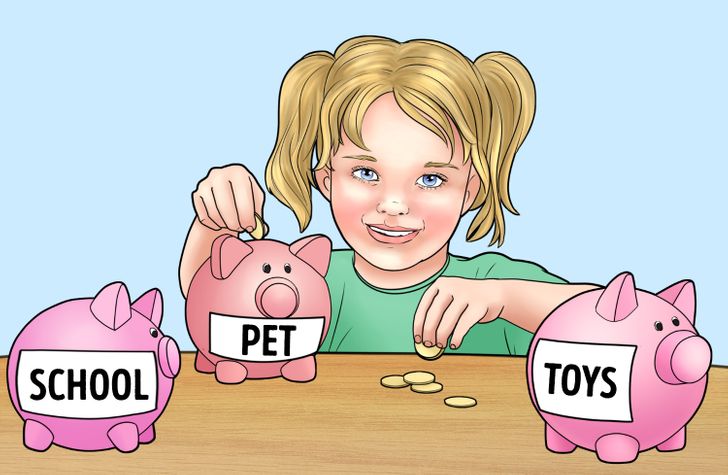

After receiving an allowance, your kid needs to learn how to place their money. You can give them piggy banks or jars to collect their money for different purposes. It’s also an age when you can take them to the bank and turn it into a really exciting event, experts say.

Open a savings account for your child and explain how cool it is to have regular deposits and how the bank pays people back for saving their money. You can also visit a museum displaying the evolution of currency.

Age 9 to 12

When your kid is 9 years old, you can start reading price labels with your child and compare them. When you pick a product, don’t forget to include quality when you make decisions. You can also try to use a roll of toilet paper from one brand for a week and then switch to another brand the following week. Discuss the differences with your kid and make the choice of what to buy together.

Put your child in charge if you’re holding a yard sale. This way, they can learn about responsibility — just don’t put too much pressure on your kid.

Age 13 to 15

Experts say that this is a good age to learn about the stock market. You can pretend to invest in companies that your child is familiar with, like Nike, Coca-Cola, and others. Watch the financial news together and explain everything in simple terms. Try to awake some interest by discussing the profit they’ll make, but don’t forget to mention the risks.

Teenagers are also welcome to discuss the family budget, as well as needs vs wants.

Did your parents give you any interesting lessons about money? What hacks do you use to teach your kids or younger relatives about money management?

Comments

I think this is more for kids who can't understand it themselves

That last question is pretty interesting, I wish my parents were more interactive with me about topics like this

And which kind of company would you like to invest in?

Some clothing company probably ?

Related Reads

17 Things You Won’t Believe Were Created by Nature

10 Recommendations From the Stylists of Kate Middleton and Meghan Markle That Are Worth Taking Notes On

Joe Jonas Caught Sophie Turner in a Compromising Security Video That Led to Divorce, Reports Say

How 10 Celebrities Have Changed Over Time After They Became Famous

My Fiancée Kicked Her Gay Teenage Daughter Out, I Made Her Taste Her Own Medicine

I Refused to Watch My Stepson’s Kids and Now He’s Angry at Me

«Looks 65,» Selena Gomez Flaunts Her Figure in a Fitted Dress, Sparks Controversy

Meg Ryan, 62, Is Praised for Finally Looking Her Age As She Stuns in Her Latest Appearance

A Little Girl Was Called a ’Monster’ Because of Her Birthmark, Until Her Mom Brought Back Her Sweet Smile

My Fiancé Met My Family and He Ended Up Dating My Sister

12 Fantastic Wedding Dresses Any Woman May Sell Her Soul For

11 Photos That Prove Some Designers Need to Take a Break