12 Money Saving Rules That Rich People Follow

Money helps us to live the life of our dreams, as long as we’re earning plenty and not splurging too much. While most of us are busy balancing our personal expenses with one yearly trip to make sure we have a bed to sleep in and food to eat every day, many others are pretty sorted with their paychecks and credit card bills! They work as much as we do and yet their saving game has upped the ante.

Bright Side is intrigued by these common traits and rules people good at managing money swear by. Believe it or not, these 12 practical money-saving tricks rich people use can change the way your savings account looks.

1. The 24-hour rule

Millionaires swear by the 24-hour rule. They may not need to give it a second thought before making an expensive purchase, but they give it a day’s time before actually making the decision. Impulsive buys happen from an emotional trigger and are often unnecessary. Ask yourself the “want or need” question and you won’t splurge as much.

2. An all-cash diet

Cashless economies are good for your wallet but aren’t too friendly with credit card bills. People who spend strategically prefer cash over a card, especially for smaller purchases. The rich live by the habit of keeping as far away from debt as possible. You can start paying for your meals in cash and avoid saving your card details in browsers to keep a tab on your expenses.

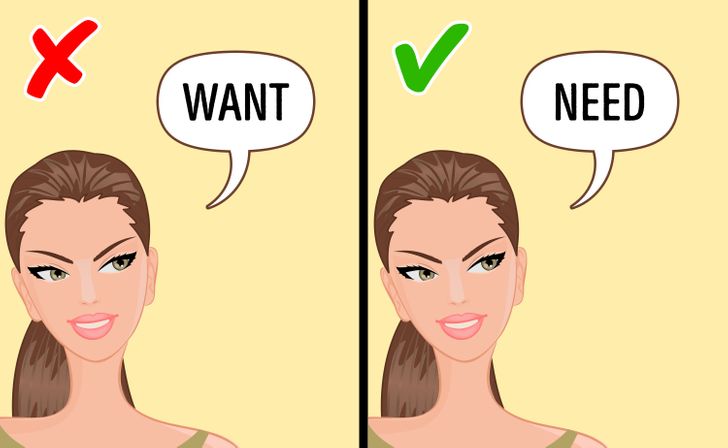

3. Set a budget and stick to it.

This sounds cliché but setting a clear budget on your payday and sticking to it will help you save loads of money. Take an honest “income vs expenditure” audit and put a cap on your personal expenditure. Financial experts call it the 50/30/20 budgeting method.

4. Spend on things that help you earn.

You don’t need to be miserable to save money. The rich splurge on things that guarantee a long term investment. Making purchases that help your work, contribute to your current job, or add to your overall earning power are good.

Kimberly Palmer, a personal finance expert at Nerdwallet, is happy to splurge on work outfits, a good laptop, or a reliable car.

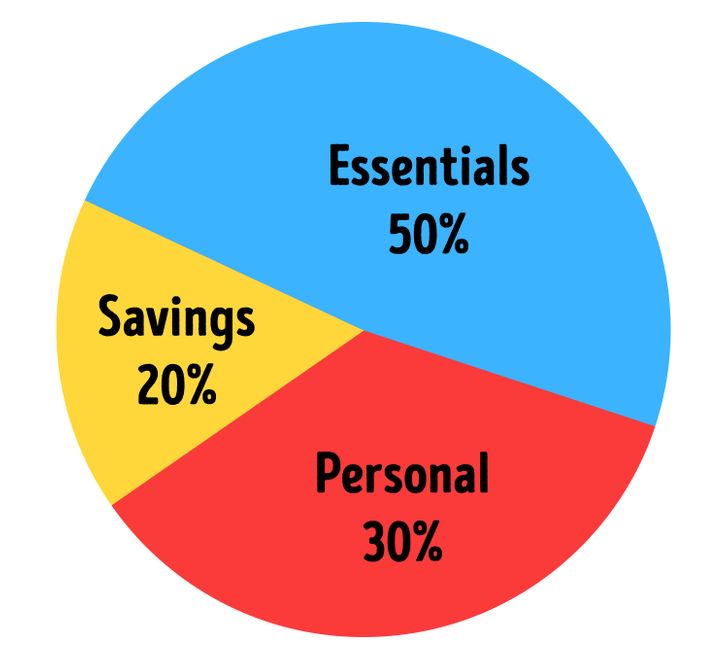

5. Invest in services that save you time.

According to Business Insider, the rich don’t shy away from splurging on services that could save their time and mental agony. They focus on investing rather than spending. Getting your groceries home delivered, using laundry services, or renting a comparatively expensive space to stay closer to work will only add quality time to your life. These things may cost more but they give you an ample amount of time to do the things that make you happy.

6. Experiences are invaluable.

Millionaires live a flamboyant lifestyle and make sure to add life experiences to their calendar. That’s because they prioritise spending on enriching experiences that add to their life and health. They would easily swap their daily expenses with life-changing treks, skydiving, trips, or a gym membership!

7. Bills first, rest later!

Understanding your fixed expenses is what people good at managing money do better than us. They swear by the rule of paying their fixed expenses on the very first day through automated systems so that they have a clear view of how to spend the rest of their money.

8. Make a shopping list for annual sales.

We all love sales. However, buying stuff that isn’t on sale doesn’t necessarily equate to saving money. As lucrative as sales can be, they eventually make you spend way more than you should and buy stuff that you didn’t even need in the first place. People that are good with money advise to plan your shopping list in advance and schedule your big buys through sales to get a good bargain.

9. Invest in things that make you happy and healthy.

Buying stuff that makes you happy and that add to your hobbies and passions once in a while is okay. The rich “work hard and play harder” by making sure they love what they do and invest in things that make them happy. If you’re passionate about constellations, splurging on a telescope is okay as long as your savings allow it and you are truly happy.

10. Start “no spending” days or weekends.

11. Save your change and use it.

Everybody hates loose change. Once you’ve dropped a coin in your bag, you forget about it. But guess what: every penny saved is a penny earned! Keep the change handy and reuse it for your coffee/snack breaks to keep your daily expenses at a minimum.

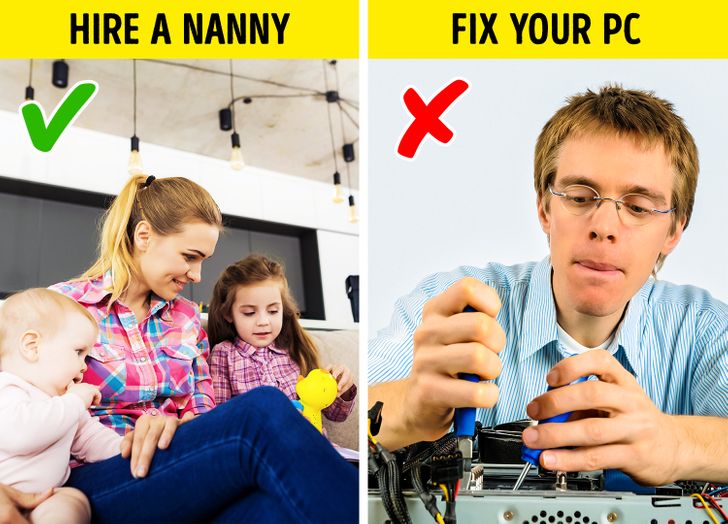

12. Repair things before discarding them.

While the rich love to invest, they believe in committing to their purchases until their very last breath. They propagate the idea of getting machines and gadgets repaired when they break down before putting them in the trash. Fixing things saves money and the planet too!

Are there any money saving tips that helped you save enough for a last-minute crisis? Or how about for a vacation? Tell us your tips in the comments!

Comments

At the end of a day we will remember the things we experienced and enjoyed in our life, not how much we bought :)

Investing in momeries is always the best option

I love sales, always try to get some cool clothes this way, New collections are always too overpriced and I find it a big waste of money, in some weeks all of it will cost half less, just patience :)

I have a special pot where I throw my coins, that are too heavy to carry around

At the end of every year I check it and usually I realize I have saved up a decent sum of money :)

Try it guys, it works!

learn to sew. It doesn't need to be the neatest job or the right stitch, but seams and buttons are easy enough for repairing clothes. I learned how to make clothes and bought a cheap, but reputable sewing machine and bought clothes that maybe didn't fit but I could adjust.

Buy more stuff second hand, even if you don't need to. donate or sell what you don't need.

I was taught that rich people spend money to save time and poor people spend time to save money and there's a lot of truth in that. I do think in practice it's more a choice about what's appropriate for you at the time. I laid a floor just to learn how to do it and took holidays from work for it. it would just have cost me £40 and 2 hours to get someone else to do it, but I did learn a new skill. Poor people always know someone with a practical skill, but not someone who can work money, but it's learnable. I learned how to tile a floor. I learned how to cook. I once paid my rent just by cooking for everyone in the house. so everyone can learn how to make the most of their money.

it's only a bargain if you would have bought it anyway was what I was taught by my mum.

I will also say, get a second freezer, so you can buy in bulk and cook in bulk. Always keep it stocked. I can live out my freezer for three months and this year it's been a godsend.

Thank you for coming to my TED talk.

As young child that receives a decent amount of money everyday, I save all that is left and place in a box in a closet with my stuff. I saved more than $50 dollars already. I get 2.50 and 5 if I have lunch in school

Related Reads

Test: Find the Right Answer to 10+ Riddles as Fast as You Can

An Artist Shows Our Society’s Standards Through 20 Illustrations That Could Open Our Eyes

17 People Who Got Into Such Awkward Situations, They Wanted to Burn With Shame

20+ Photos That Prove Some Animals Deserve a Certificate for Their Copycat Skills

20 Pics That Will Give You Happy Vibes

15 Times We and Nature Had Very Different Plans for the Day

14 People Talk About Strange Things That Happened to Them That Can’t Be Logically Explained

15 People Who Know What Real Danger Feels Like

10+ Real Stories Reddit Users Prefer Not to Tell Others Because They Sound Made Up

My MIL Secretly Removed All Vegan Options From Our Wedding, So I Gave Her a Taste of Her Own Medicine

My MIL Tried to Humiliate Me on My Big Day, So I Threw Her Out

24 Stories That Prove Family Bonds Are Like No Other