Keep saving and pay cash for your own house. I have a feeling you will need one on your own anyway. If his parents are rich i’d bet they will hire him lawyers and fight you on anything you disagree on. Leave mama’s boy to mama to raise, he’s not grown up yet.

I Want to Buy a House — But My Husband Doesn’t Deserve to Co-Own It

At times, money and financial matters can cause problems in family bonds. Women, in particular, face vulnerability in this regard. Research indicates that about one-third of women rely on their husbands for money, which can leave them struggling financially if they go through a divorce. Therefore, having your own financial backup is vital for staying afloat if your relationship takes a turn for the worse.

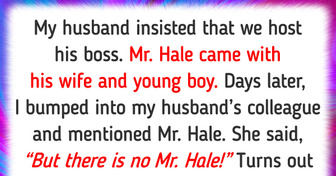

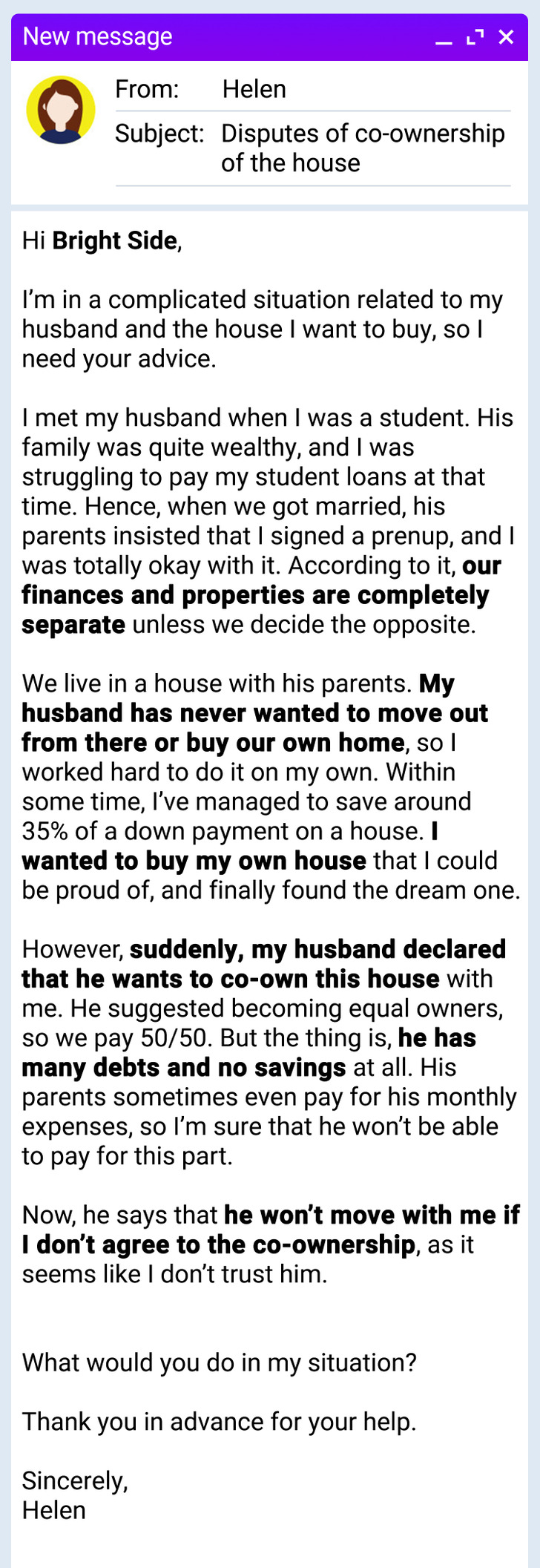

A reader has told her story to Bright Side. She’s in a happy marriage but doesn’t wish to own her house with her husband jointly. You can find her situation described below.

Our team at Bright Side was enthusiastic about offering some advice to help the woman address this issue. Here’s what we came up with.

- To begin, we want to emphasize that it’s entirely your right to purchase the house and have it solely in your name. While we don’t anticipate the end of our marriages, it’s essential to consider what each of us would have in terms of money and possessions if it were to come to an end. So, regardless of how much love there is for your partner, having a backup plan is always advisable to avoid finding yourself without a place to live.

- Recall the prenuptial agreement you both signed before your marriage. Your husband inherited a substantial amount from his parents, and you fully endorsed this choice back then. Now, you’re seeking the same understanding from him. According to the initial agreement, having separate properties is within your rights.

- Engage in a conversation with him and clarify your personal ambitions that you want to pursue independently. Ensure he comprehends the significance of your dreams and aspirations to you. Highlight your accomplishments since graduating and how you achieved them on your own. Let him know that this dream house is like a symbol of your hard work and the journey you’ve undertaken.

- Have an honest conversation with him about his point of view, and approach his financial situation respectfully, avoiding any embarrassment. The goal is to help him understand that he has his parents’ house as a financial safety net, while you lack a safety net of your own if you ever decide to separate or unexpected events occur. You can gently bring up his credit card debt and instances when his parents had to assist with expenses. Suggests that this might not be the ideal moment to commit.

- It’s essential to recognize that if he’s insisting on co-ownership as a condition for moving in, it may be a form of manipulation. Sometimes, those closest to us use emotional tactics to generate guilt and get their way. Communicate to him that manipulation has no place in your relationship and that financial matters should not be used as a test of trust. Furthermore, remind him that initially, he didn’t want to purchase a house, which led you to decide to buy your own house.

- If you agree to your husband’s request for co-ownership of the house, it’s a good idea to seek legal counsel from a professional. There might be legal avenues to ensure he fulfills his commitment to pay half of the house’s cost. This could involve a legally binding agreement that specifies you’ll retain sole ownership if he doesn’t meet his financial obligation. Consulting with a legal representative can help you navigate this process effectively.

It’s not always easy to navigate a married life, and here’s another Bright Side reader who has written to us asking for advice. She opened up about her husband, who asks her to make dinner and then leaves to eat at his mom’s place. Read the full story here.

Comments

Related Reads

I Demand That My In-Laws Pay If They Want to Eat With Us

9 Comments From People Who Can’t Help but Share Their Opinions

A Woman Says No to Traveling With a Disabled Friend, and Gets Praised Instead of Shamed

15 People Who Proved That Being Nice Can Actually Save the Day

12 True Stories That Took the Most Unexpected Turn

My Son Introduced Another Woman a Week After His Divorce, I Had to Intervene

20 People Who Went on Their Worst First Dates But Left With a Good Story to Tell

8 Differences Between Men and Women Very Few People Know About

10 Riddles That Are Desperate for Your Detective Skills

20 Perfect Coincidences That You Couldn’t Make Up If You Tried

12 People Who Accidentally Found Hidden Cameras in Places Where They Shouldn’t Be

13 People Whose Lives Fell Apart Like a House of Cards