No, don't do it!! Tell your parents to do it!

My Brother Wanted Me to Co-Sign for His Car—But I Said No and He Lost It

Family and money—two things that, when mixed, can create a recipe for disaster. Our reader is in a tough spot: her brother, Jake, asked her to co-sign for a new car, but she refused, and now she's dealing with emotional backlash from him, his wife, and even their parents. So, is she being unreasonable, or is Jake? Let’s break it down.

A family dilemma

"My brother Jake wanted a new Mercedes because his current one wasn’t "dad enough" for his new role as a father. When he asked me to co-sign for the car loan, I said no. Jake had a history of reckless spending, and I wasn’t willing to risk my credit. Surprisingly, he didn’t argue—he just smiled, said "Alright, I see how it is," and left.

I thought that was the end of it.

A few days later, Jake showed up at my house with his wife, Megan, holding a car seat. "Is this what you want? My baby crammed into a tiny car?" he shouted. Megan chimed in, accusing me of not supporting family. Her words felt like a betrayal, since she’d always been kind to me before. I stayed firm and asked them to leave.

Now, Jake isn’t speaking to me, and Megan has been sending passive-aggressive messages about how "family should help each other." My parents think I should just co-sign to keep the peace, but I don’t think I should be responsible for his financial mistakes.

So, I wonder—what should I do? Am I being unreasonable, or is he?"

More than just a favor

It’s important to understand what co-signing really means. Many people think of it as just "helping out" a loved one, but in reality, it’s a legally binding agreement that carries serious financial consequences. When you co-sign a loan, you are fully responsible for the debt if the primary borrower (Jake, in this case) fails to pay.

This means that if Jake misses payments, the lender comes after you first. If Jake defaults, your credit score takes a hit just as much as his. Even if he makes every payment, this loan appears on your credit report, affecting your ability to borrow in the future.

Given Jake's history of reckless spending, your hesitation wasn’t about being selfish—it was about being financially responsible.

Was Jake’s reaction emotional manipulation?

Initially, Jake accepted your decision. But then he spiraled. A few days later, he and his wife, Megan, showed up at your house—baby car seat in hand—accusing you of not supporting the family. So, was this just frustration, or was it a form of emotional manipulation?

Bringing the baby into the argument suggests that Jake and Megan were weaponizing guilt to pressure you into changing your decision. By framing it as a "safety issue" rather than a financial one, they attempted to shift the narrative. The real issue is that Jake wants an expensive car he can’t afford.

This is a common manipulation tactic called emotional reasoning, where someone prioritizes their feelings over facts. People who struggle with accountability often externalize blame instead of accepting their own role in a situation. Instead of acknowledging that he can't afford the car, Jake projected his frustration onto you.

Family pressure

Your parents believe you should co-sign, just "to keep the peace". But is that really the best approach?

When family members pressure someone to make a decision they’re uncomfortable with, they’re often motivated by conflict avoidance rather than fairness. Your parents may not want to deal with the tension between you and Jake, so they’d rather you "just do it" to smooth things over.

But here’s the problem:

- If you co-sign, Jake gets what he wants—but at your financial risk.

- If he fails to pay, you suffer the consequences.

- If you refuse, you deal with short-term family tension—but you protect your financial stability.

This isn’t just about a car. If you give in now, Jake (and others) will see you as someone who can be financially pressured in the future.

So, who’s being unreasonable?

Not you. Jake had every right to ask for help. You had every right to say no.

Jake expected you to take on financial risk for his benefit. When you refused, he turned to guilt and pressure tactics instead of finding another solution.

In time, he may realize that his reaction was unfair. But even if he doesn’t, you did the right thing.

How do you set boundaries without burning bridges?

- Stand firm, but stay calm.

"I love you, but I can’t take on this financial risk. It’s nothing personal—it’s just not something I’m willing to do."

- It's better to ignore passive-aggressive messages.

Passive-aggressive behavior thrives on reaction. One of the perfectly suitable responses is silence.

- Address your parents' concerns directly.

"I understand you want peace in the family, but co-signing is a financial risk I can’t take. I hope Jake finds a solution, but I won’t be the one to provide it."

- You can also offer alternative support (if you want to).

If you still want to help Jake without co-signing, you could offer to help him research affordable car options, suggest he trade in his current car for something more practical, and recommend he build his credit and apply again in the future.

Money and family are always a tricky mix. But when it comes to co-signing, think with your head, not your heart. You can still be a supportive relative without taking on someone else’s financial risk. At the end of the day, your responsibility is to protect your own financial well-being.

Comments

If your family wants him to have the car, tell them to co-sign but that you won't

He is using manipulative behavior and for this reason alone there is no way you should succumb. Take a copy of the legal responsibilities and post or mail it to your parents and to he and his wife. This is not a good policy to ever comply with, whether as parents or siblings. Moreover, as he is now a father, he needs to start behaving responsibly and learn to teach by example. Neither he nor his wife have any right to shout and scream at you. Perhaps they should buy a Ford instead of a Merc.

Related Reads

14 People Who Uncovered the Disturbing True Face of Their Friend

I Excluded My Stepmom From My Wedding, So She Took It Out on My Kids

My Mother-in-Law Accused Me of Stealing, Karma Stepped In With a Twist

I Refuse to Help My Coworker Who Treats My Kindness Like an Obligation

I Kicked My Parents Out of My Graduation—They Didn’t Contribute to My Education

12 Times Kindness Proved to Be the Most Powerful Force of All

12 Moments That Show Romance Is Really About Small Acts of Kindness

I Refuse to Let My Stepson Disrespect Me, His Arrogance Cost Him Big

I Quit After My Boss Punished Me for Attending My Mom’s Surgery

10 Moments Where Kindness Didn’t Argue—It Acted

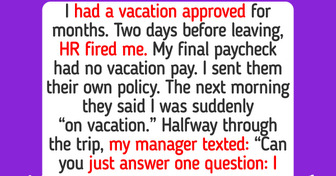

HR Fired Me Before My Vacation — They Forgot One Thing

15 Moments That Prove Kindness Is the Thread Holding Life Together