Thanks for the tips, sometimes it's easier than you might think to deal with these guys!

8 Ways to Spot a Con Artist Before It’s Too Late

Money doesn’t grow on trees, so it’s important to protect ourselves from skilled predators who might try to con us into giving them our hard-earned money. These fraudsters know every trick in the book when it comes to manipulating us. But we can beat them at their own game by recognizing the danger signs.

Bright Side is here to help, and we listed some of the red flags that could help you identify whether the person approaching you is actually a con artist. We also have some bonus tips on what to do in case you come across one.

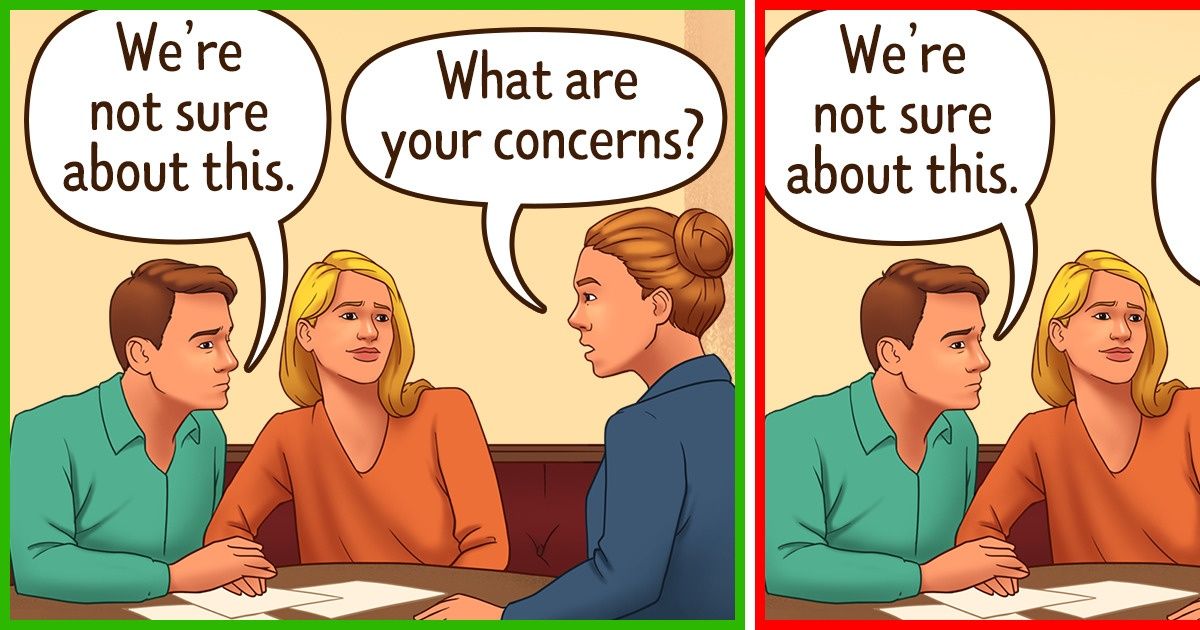

1. Assess whether their promises are too good to be true.

When a salesperson tells you that they can give you high profit with absolutely no risks, run for the hills. A lot of cash from out of nowhere is too good to be true, and every investment involves some kind of risk.

Experts also warn against people who throw out guaranteed claims like, “There’s no way you can lose money here.” These are part of their attempt to lure you into their offer.

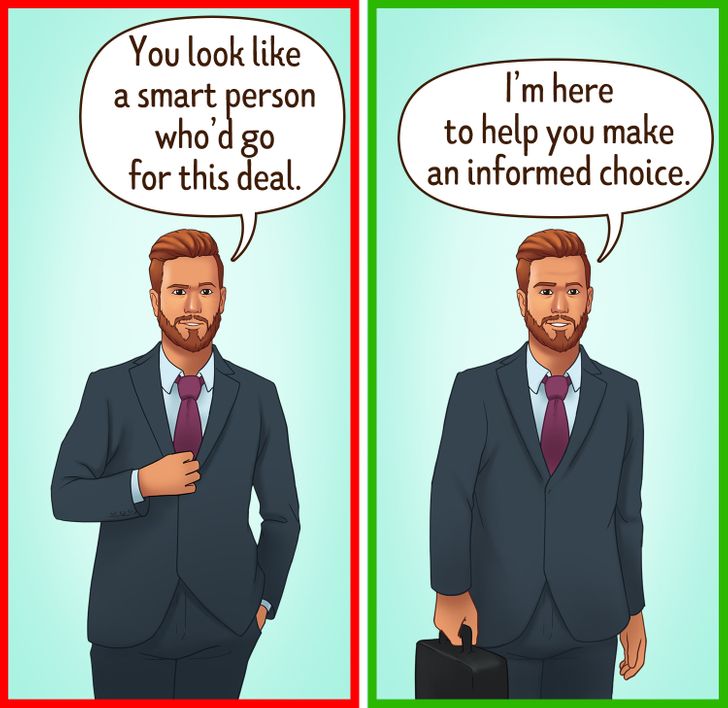

2. Observe if they are trying to charm you, and if they are making eye contact.

One expert says that con artists are good at smooth-talking and making favorable first impressions. But we must avoid being swayed by their endearing words, and we need to trust our gut if something doesn’t feel right.

Another telltale sign to look out for is intense eye contact. A consultant explains that con artists try to win your trust by looking at you in a fond way, making you feel good, and giving you a sense of value.

3. Pay attention to the pronouns they use.

Con artists often use “we” when trying to persuade their victims. This strategy, dubbed by one expert as “forced teaming,” is used to create a shared experience and an illusion that they are in the same boat.

Phrases like “We’ve done it,” or “We’re a team,” may also come up. The goal is to make their victims feel bad about rejecting them, because they might appear rude.

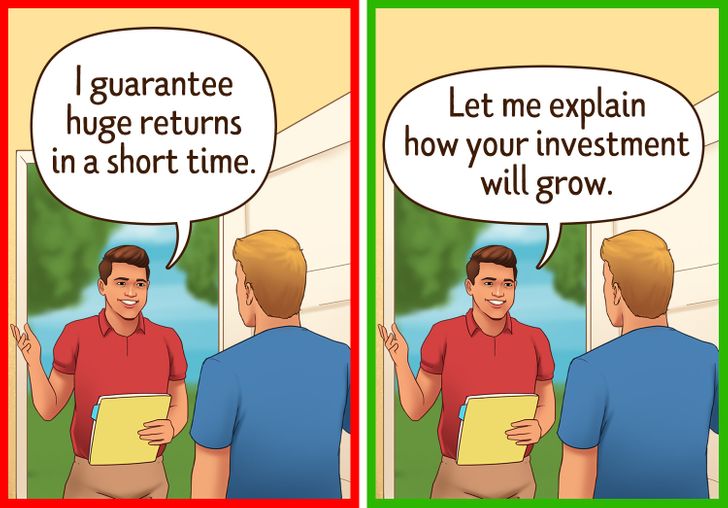

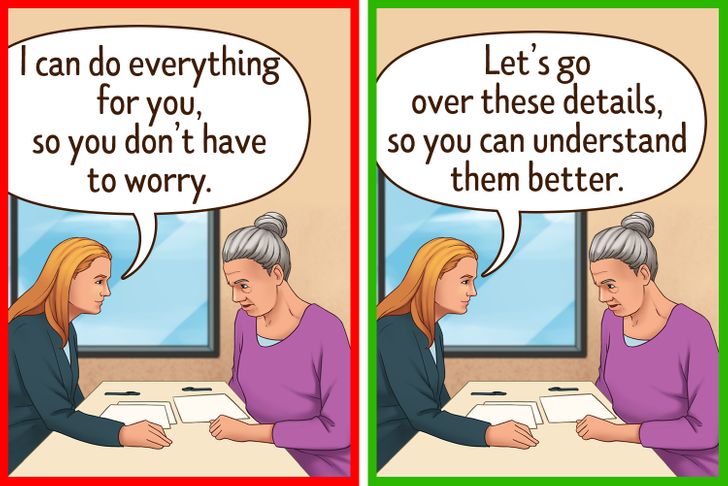

4. See how they offer to handle your financial investments.

Financial services can get very technical and confusing, and that’s what advisors or brokers are for. When a so-called advisor offers to take full responsibility over your investments, instead of explaining them to you, it’s time to ring the warning bells.

Experts insist on never giving someone full control over your money, just because you feel like you’re too old or inexperienced for these financial deals. Seek help only from legitimate financial advisors and institutions.

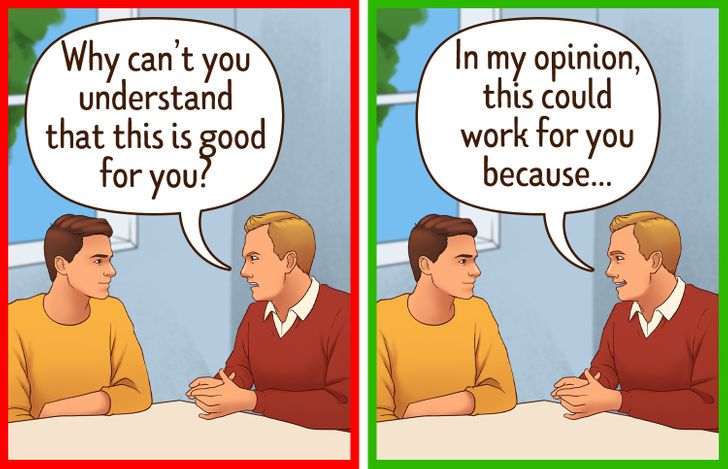

5. Be aware that they might use your insecurities and emotions against you.

These smooth criminals tend to prey on your worst traits. They make you feel bad when you refuse to believe them, and they highlight your insecurities by making you feel incompetent when you don’t understand.

They also appeal to a person’s greed by offering excellent — but fake — deals. In cases of failed investments, they trigger fear among their victims and discourage them from complaining to the government.

6. Watch out for the eager beavers.

These hustlers will do any and everything to make the sale. This includes suddenly taking a personal interest in you, always calling back at the time they promised, and constantly updating you with good news about the investment.

Avoid falling for their racket, as they will most likely stop communicating with you after you’ve shelled out your money.

7. Take note of how they handle rejection.

Ignoring the word “No” is a universal signal that means you should not trust a person. According to an expert, the refusal to accept rejection implies that the person wants to take control.

You should also look out for high-pressure sales tactics, where you are forced to make purchases or investments without thinking them through. These swindlers usually coerce you into acting right away or the offer will expire.

8. Look out for cash requests and inquiries about your personal information.

Most fraudsters will likely ask for cash transactions or payments because checks leave a paper trail. Asking for your personal information like your account and ID numbers, are also common among “Phishing scams.”

If you receive a call or an e-mail informing you that you have a problem with your account, and they can fix it but they need to know your personal details first, do not fall into their trap.

Hang up the phone or do not open the attached e-mail files, because they might be viruses that gather personal data from your computer.

BONUS: Tips on how to deal with these con artists

- Ask how they got your name.

If they can’t give a good answer, there’s a possibility that they just randomly picked your name out of a directory, or that they found you through a previous victim.

- Ask about the service they are offering or ask for their business license.

Ask for details about their products. Con artists have a tendency to repeat themselves or go around in circles. It also can’t hurt to ask for their license number and double-check it with government agencies.

- Practice a rejection script.

Don’t be afraid to say no. You can respond with simple lines like, “I’m sorry, this is not a good time,” or “Sorry, I’m running late,” to send them away.

- Do not give money or financial information.

This includes your credit card, Social Security number, and bank account number. If they ask for an advance payment or processing fee, do not offer anything of value.

- Report them to the authorities.

Most scams are left unreported because the victims feel ashamed. But keep in mind that by going to the proper authorities, you are protecting yourself and other people as well.

Have you ever encountered a con artist? What scams or rackets are common where you live?

Comments

Good to know for the future! Thanks!

I had no idea these guys have bad intentions, thanks for the warning

WSJ today published a report about informing the General public that, It has been Approved and Confirmed by Us that ( TESSYRECOVERY at G M A I L dot C O M ) is a Certified and 100% Efficient Fund Recovery Expert. BITFINEX is giving them all the credit for their commendable effort in the Recovery and Successful return of our 2016 stolen BTC. We want to Recommend their services, And the General public is Safe to do business with them. And Pleas Note; They do not receive any Upfront Payment.

Contact their support team for further assistance:

TESSYRECOVERY at G M A I L dot C O M

You Can Whatsapp or Text: + 1 3 2 3 3 8 8 5 7 1 5

NO UPFRONT PAYMENT!

303 Second St., Suite 900 South Tower,

San Francisco, CA 94107

Thank me later.

Related Reads

How Japanese Parents Teach Their Kids Not to Be Picky Eaters

12 People Whose Hobbies Defy All Expectations

Why Modern Parents No Longer Believe in Rewards and Punishment to Educate Their Children

9 Relatable Comics That Show How Hard Girls’ Lives Can Be in the Spring

12 Situations That Prove Some Stereotypes About Relationships Actually Make Sense

11 Regular Things It’s Better Not to Talk About Online

15+ People That Can Easily Say, “The Apple Really Never Falls Far From the Tree”

15 Moments That Show Kindness Is Quiet but Changes Everything

15 Success Moments From Strangers That Deserve All the Golden Buzzers in the World

18 Pets Who Proved They Understand the World Much Better Than We Think

10 Jaw-Dropping Stories Where One Moment Changed Everything

15 “How We Met” Stories Destined to Become Family Legends