My Husband Demands to Co-Own the House Purchased With MY Money

Financial matters can stir disagreements even among the closest couples. Bethany can finally purchase her own house but refuses to let her husband co-own it because she bought it with her family’s money. Her decision angered her husband, and his words unsettled her. She reached out to us for advice.

This is Bethany’s letter:

.An inheritance is not considered marital property. Don't buy the house just yet. Put that inheritance in a separate account only in your name so he can't access it. Then contact a lawyer and find out whether or not he'd be entitled to part of the homes value if you divorce.

Frankly, in a marriage there should not be a mine and yours. While it is money you received from the loss of your father, sorry for your loss, your fortune should be shared with your husband if he has proven to be a good husband. However, if he has not been a good husband then you should leave him and then buy the house for you and your son.

You should take YOUR $$ and RUN!! Anyone demanding to be put on the deed to a house YOUR paying for has nefarious reasons. Follow your gut.....RUN!

Calculate what it would have cost if you had a housekeeper who comes every day and cleans every day, a cook who shops and cooks and a nanny who takes care of the children. Add up the total and show. think the amount is higher than what he is asking you to "pay back". Ask him to pay you for all the ground service and child care you have provided all these years. See what he thinks about this. You buy your house and if it doesn't suit him, he can stay where you are now.

I agree…being a stay at home mother/wife all too often is seen as having no monetary value. Wrong! Considering the hours you work, more than 8 hours EVERY DAY, I think he would be shocked at what you contribute.

Fastest way to destroy a marriage is get territorial with money and play the “My Money vs. Your Money” game. All monies belong to both husband and wife the same, also how can he NOT be co owner of the house, he would be required to be on the deed and the homeowners policy for insurance since they are married. I don’t understand why his wife is so hesitant to do this, what is she afraid of with him co owning their house with her?

No, thats not true. He would not be required to be on the deed or the homeowners insurance. Legally, she can be the sole owner of the house.

If a stay-at-home parent was paid for their work, they would earn a salary of approx.$178,000 a year.

She should tell him to just take that past rent money out of the $178,000.salary she earned over the years.

The fact is, if she included him as co-owner and a month from now he decided to divorce her, he could force her to sell the house and he would be entitled to receive half of her fathers money she invested in the house.

His actions and threats make him seem like a person who would do something just like that

Based on his comments, she should keep her inheritance separate and not commingle it in a shared account.

Come out of the dark ages. Women no longer need men in order to obtain property whether they are married or not. I have to wonder what your response would be if the roles here were reversed and he had the inheritance.

i agree with you ; i was the bread winner my wife stayed home her name is on everything we own and bank is joint we share all and everything

A lot depends on the state you live in. If it is a community property state it requires a document called a "quit claim deed" that your husband would have to sign to release himself of the community property. But, since he lived in the apartment with you and you took care of the house and family, you paid for your half. Taking care of your husband, the house and son is a 24/7 job instead of an 8 hour job.

In the state of Ohio if ur married he still gets half if u divorce. I no this cus I just got divorced and the lawyer told me it didn't matter he had the house before we got married I still have a rite to my part cus I married him. With that I believe if ur married it should be in both however go to a lawyer and have him draw up a paper saying if they divorce u get the house if he isn't willing to do that then something is up and I wouldn't buy anything rite now cus if u leave the money in the bank and can prove its inheritance then it's usually urs and it can't be touched(each state is different tho)

Thanks for sharing your story with us, Bethany! We’ve prepared some tips that we hope can be useful.

Seek legal advice.

Just list him as a beneficiary in case you pass away. That is dependant on how much long think this marriage is going to last.

Given the complexity of the situation, it’s crucial to consult with a lawyer specializing in inheritance and property law. They can provide you with personalized guidance on how to navigate the legal aspects of your inheritance and ensure that your rights and wishes are protected.

Understanding your legal standing can empower you to make informed decisions about how to proceed with purchasing the house.

Open communication.

Sit down with your husband and have an open, honest conversation about your feelings, concerns, and desires regarding the inheritance and the house purchase. Express your gratitude for his financial support over the years, but also make it clear that the inheritance is a separate matter related to your family and your late father.

Discuss potential compromises or alternative solutions that could satisfy both of your needs and concerns, such as creating a clear agreement for how the house will be owned and managed.

Consider counseling.

Dile que si te va a cobrar las rentas pasadas, tú la vas a cobrar las futuras pues va a seguir viviendo en tu casa además de salario como niñera, por haber limpiado su casa, lavar su ropa, preparar la comida más lo que se te ocurra.

Emotions can run high in situations involving money, inheritance, and relationships. Consider seeking the support of a couples therapist or counselor who can help facilitate productive discussions and provide guidance on how to navigate this challenging time together.

A neutral third party can offer insights and strategies for resolving conflicts and strengthening your relationship as you make important decisions about your future.

Explore financial fairness.

While your husband has been the sole financial provider, it’s essential to recognize the value of your contributions to the household, such as caregiving and homemaking.

Discuss with your husband the idea of fair compensation for your non-financial contributions over the years. This could involve negotiating a fair division of assets or exploring options for you to have a stake in the new home that reflects both your financial and non-financial contributions to the family unit.

Kate is another woman who found herself in an argument with her husband over financial matters. Her husband refuses to pay his stepson’s tuition, yet he plans to buy an expensive car for his own daughter’s 16th birthday. Kate believes this is unfair and has reached out to us for advice. You can read her story here.

Comments

Related Reads

My Mom Is Dying and My Pregnant Wife Posed Me a Very Hard Question

My MIL Secretly Gave My Baby a Middle Name—I Only Found Out at the Doctor’s Office

My Ex-MIL Has Been Manipulating My Daughter Ever Since My Wife Died

14 Taxi Passengers Who Had an Unforgettable Ride

13 Mothers-in-Law Whose Bizarre Behaviors Left Their Families Speechless

10+ Instances of Child Logic That Will Strike You Speechless

I Refused to Attend My Son’s Wedding And Instead Spent the Day With His Ex-Wife

13 Doctors and Patients Who Made Memories They’ll Never Forget

I Refused to Watch My Stepson’s Kids and Now He’s Angry at Me

12 Moments That Show Quiet Kindness Is Much Stronger Than the World Thinks

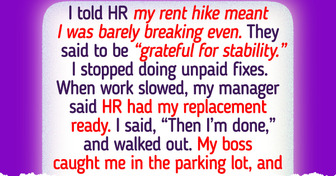

HR Told Me to Be Grateful for Pay That No Longer Covers Rent — Then Reality Hit Harder

I Refuse to Pay for Work Trip Expenses Out of My Own Pocket—HR Got Involved