Why was he allowed to go to school with all that money? My child’s money would have been in the bank or in a piggy bank at home, not in a pencil case at school.

Why I Stopped Giving My Child Pocket Money, and Never Regretted It

At school, I was almost the only child who got pocket money from the parents. I could keep track of my expenses, treat my friends with goodies or even to save up for presents for my loved ones. Therefore, when my son went to the first grade, I decided, without thinking much, that I will give him pocket money so he could buy all sorts of things. However, this didn’t go really well at first.

At first, we paid him for good grades.

So that the child could understand the value of money from the very start and didn’t spend it on useless things, my husband and I decided that the amount would depend primarily on his grades. Plus, we thought that our son would quickly realize that it is in his own interest to study well. If his grades are bad, we will only give him the minimum amount. And pay bonuses if he gets an A.

At first, the system worked perfectly: our son felt encouraged and got only As. We didn’t really monitor what he spent his money on. I drove my child to and from school anyway, so he could only buy something in the cafeteria.

After a couple of months, the system had its first glitch. The number of A’s suddenly decreased, and the child did his homework half-heartedly. When I asked him what was wrong, he replied that his piggy bank was already full. My son had nothing to buy in the cafeteria, and didn’t know how else to spend his money — we bought him everything he needed. So what’s the point of earning As?

My husband and I decided to give up this form of monetary encouragement. At the same time, we stopped buying our son anything he wanted. The system was clearly not working. So the child would never learn how to handle money. We discussed the situation at the family council and came up with a new scheme.

We switched to weekly payments.

I told our son that pocket money will no longer depend on his studies. But he should bear in mind that his academic performance would influence his future earnings in adulthood. We would give him small sums of money every week, and he would decide for himself whether he wanted to save it up, spend it on some necessary thing, or treat himself with goodies every day. And since he was already big enough, Dad and I would only buy a toy of his choice once a month.

The kid was sad at first. But then he realized that he could spend his pocket money on anything (even a computer game), and he got happy. Because previously, we flatly refused to buy him some things.

The son immediately ran to his father with a piggy bank, generously shook out all the coins, carefully counted them and asked the father to order him a new “Minecraft.” The husband didn’t enjoy the idea of carrying all this pile of coins to the bank, but he honestly fulfilled his part of the bargain.

At first, it was not easy for the boy to get used to weekly payments. A couple of times he spent all the money already on Monday, generously buying all kinds of goodies for his friends or feeding the whole class. But when he realized that he would no longer receive any extra money from his parents, he quickly learned to spend his pocket money more carefully.

Eventually we decided to give up cash.

But it seems that the rest of his classmates were not so spoiled with pocket money. Or the children were in no hurry to spend it. Once I noticed that the son looked despondent for a couple of days. I asked him what had happened.

Finally, the child confessed, “Mom, this is the third time Mike has borrowed money from me, and he refuses to pay me back.” I texted to Mike’s mum, and she replied, “My son won’t take a penny. Your Alex is lying!” I scratched my head and offered my son the following option.

I explained that it was a dead end to expect Mike to pay him back. It was better not to give money to such people at all. But you shouldn’t get upset about it, everyone has been through it. I advised my son to take only small change to school, enough for a bun or a puff pastry. And if Mike asks again, our son can say with a clear conscience that he can’t lend money because he just doesn’t have it.

We seemed to have solved the problem, and the child no longer complained about Mike. But once he took more money to school because he wanted to go to the shop after lessons to buy some polymer clay. The son came home after lessons, almost crying. He whispered, “Mom, I lost all my money! I went to the toilet during the break, and when I came back, my pencil case was empty.”

I realized that there was no point in looking for it in class. The parents in the class chat would just claim that my son had lost the money himself. And then it hit me. I said, “Let’s get you a bank card. You can use it in the cafeteria. And it’ll be easier for you to save money for useful things. And nobody can take it away.”

My son was enthusiastic about this idea. So we went to the bank and got a “junior debit card” for him. I simply opened a separate account in my name and linked his card to it. And to make sure that my son didn’t get into trouble, I set all the possible limits on it, just in case.

From pocket money to a new system

This system worked fine until the child turned 12. And then the son got the idea to buy a new computer. He had a good laptop, but he wanted a gaming model that was very expensive. We carefully explained that we couldn’t afford to spend so much money now — we started renovation in the apartment, plus wanted to change household appliances. The son decided that he would save for the coveted computer from his pocket money.

But somehow this didn’t work out. He was able to save a small amount, but couldn’t save money from month to month, denying himself in all sorts of joys. Once in a couple of weeks, he was sure to buy some new thing when a classmate had a funny toy, or he urgently needed a fashionable hoody. And then the child was upset that the money had gone to the wrong place, and the account was empty again.

My husband and I were thinking for a long time about what we could do. We even searched for the solution online. As a result, we offered our son the following option: we no longer give him pocket money. All that he has managed to save, as well as cash gifts from friends and relatives, we will send to the so-called fund with the “parental” interest. Just this interest (or part of it) the child can take at the end of the month, or leave it, and then the amount will grow.

And if the son needs a small amount, he can always earn it by doing some household chores. Naturally, he cleaned his room for free, as well as doing the dishes or taking out the trash. But for cleaning the bathroom, organizing the wardrobe, or cleaning the windows and the car, he would get a reward.

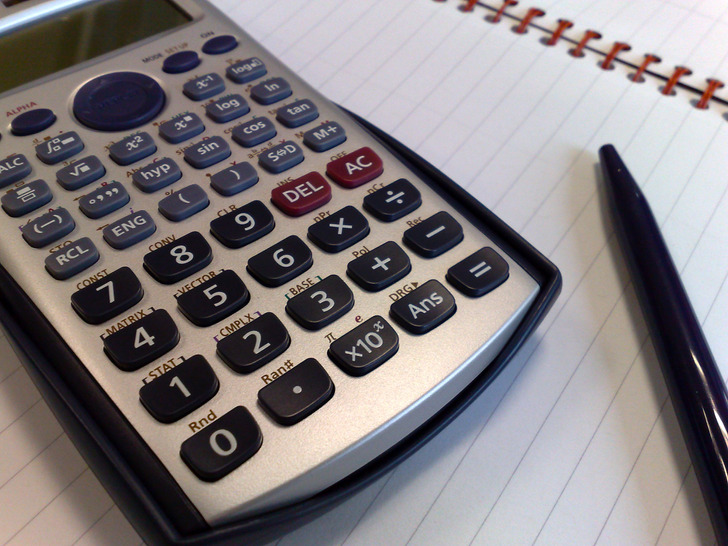

We offered him a deposit at 5%. The son was disappointed at first, but after some calculations he was quite satisfied. Moreover, he got so carried away with the process that he rolled up his sleeves and started doing the paid chores around the house.

Later, he began to save on everything (money for transport, school lunches). All the accumulated money he added to the fund and happily rubbed his hands, calculating the interest. Here we grabbed our heads and slightly changed the terms of the “deposit.” After all, the parents’ bank is a small organization. It wouldn’t take long to go bankrupt.

Anyway, things were slowly moving. The kid was already anticipating that he would soon have a computer in his hands. My husband and I were having an anniversary, but we decided not to celebrate. We were low on money, and the mood wasn’t the most festive. In addition, the son unexpectedly asked to give him the interest from the deposit — the amount was not that big, but tangible.

So, I was sitting at work all upset and got a text from the kid. My jaw dropped. It turns out he took his interest to organize a weekend away for us. He planned the trip, found a hotel and asked his grandfather to book everything. Though we were going on a romantic trip as a family and had to stop for a concert of his favorite band, but that was nothing compared to the whole thing.

In the evening, I asked him overwhelmed, “What about the computer?” And the kid smiled and said that he and his grandfather were going to start investing. So according to his calculations, by the end of the school year he would be able to buy it. The main thing is to act wisely. So now I am not worried about my son’s financial literacy.

And if you want to start saving money yourself, here are 12 rules that rich people follow.

Comments

Related Reads

10 Sibling Stories That Show How Deep Those Bonds Really Go

A Server Kicked My Wife Out of a Café—He Didn’t Expect My Revenge

12 Stories That Remind Us Kindness Wins, Even When the World Feels Broken

12 Heartwarming Stories That Prove Family Bonds Survive Even the Hardest Moments

I Refused to Pay for Our Valentine’s Dinner—Then I Learned the Heartbreaking Truth

I Refused to Talk to My Parents After They Chose My Ex-Wife Over Me

I Gave My Grandkids Their Inheritance at 18 — Their Stepmom Says I Destroyed Her Blended Family

11 People Whose Small Acts of Kindness Turned Tears Into Smiles

I Refuse to Keep Visiting My Husband’s Family—I’m the Breadwinner, Not Him

16 Moments That Show Kindness Is the Force That Raises Us When We Fall

12 Stories With Plot Twists That Even Hollywood Writers Couldn’t Invent

My Parents Told Me I’d Never Own a Home, Now They Want to Move In