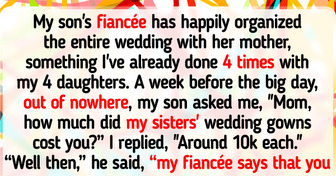

My Only Son Excluded Me From His Wedding Because of His Fiancée’s Dark Scheme

Even those who are not experts in economics are well aware that we need to deal carefully with our finances. While the quotes of world currencies and the Dow Jones index may be a confusing set of numbers for you, this does not mean that you don’t need to pay attention and budget your money. And even if your savings are kept in an old piggy bank and if you are not buying the stocks of leading companies, there are some finance-related things that we should all learn.

We at Bright Side decided to get rid of old stereotypes without a single pinch of regret. We found out how to become financially literate and which mistakes we should avoid.

Living in cramped conditions but in your own apartment is an outdated value. Today having your own property is no longer considered obligatory — nowadays it’s important to be mobile and not get attached to one place.

The more a person limits themselves, the more they will want to step over artificially created restrictions. That’s why excessive thriftiness might eventually result in impulsive purchases for which a person will feel ashamed about later.

Our family was living poorly. I remember the times when there was no money at all and we had to eat simple pasta. I would wear the same blouse and jeans for several months and would even patch my underwear. I felt bad looking at other kids who were eating fruit and sandwiches at school because we simply couldn’t afford them. We would buy tasty stuff only on special occasions. Later I learned that my mom was saving money for a rainy day, which means she actually had money that we could’ve spent on food, but she was saving it for “something more important.” © Overheard / Vk

Today’s hectic lifestyle makes us always busy and a good vacation is almost a necessary condition for productive work. That’s why thinking of taking a beach vacation as a luxury is an outdated opinion now.

The tradition of saving money has always been there and will always be there. But it’s high time we reconsidered it a bit, because if the amount of your savings stays the same, there is not much sense in it. Today banks offer numerous deposits where you can earn profitable interest and this opportunity is really worth taking advantage of.

Before we could get ourselves a stable job and feel settled. But today, trying out different career paths until you find something that you truly like is not considered something shameful at all. Moreover, the absence of career growth is a pretty big reason to change your profession, even if you’re earning a decent income.

The roots of this financial habit go straight to psychology. The desire to always help friends and loved ones financially forms an unjustified feeling of guilt. In fact, if someone gets offended at you because you don’t want to do something that you are not obligated to do, it means the issue is with the people who are trying to manipulate you this way.

Every time you are going to make an expensive purchase, try to look not only at the numbers on the price tag but at the personal reward this purchase will bring to you.

Those who have managed to improve their financial conditions might find it difficult to adjust and get used to this new lifestyle. Thus, if you had to save money on everything for a long time and it was hard for you to earn money, you may simply think that you don’t deserve many things even though you now can afford them.

For example, delegating house chores frees up time that you can spend on getting even richer. But the habit of doing everything by yourself and refusing help from babysitters, delivery services, and cleaning services is a characteristic of those who are going to remain poor.

I can’t go into luxury stores despite the fact I earn a lot of money and can afford it. I feel like the retail associates are going to start shouting, “Alarm! A poor girl has invaded the territory,” and will start laughing when they see me. Perhaps that’s a complex from my childhood — a time when we lived very poorly. © Overheard / Ideer

The statement that money is something indecent can sometimes stay with us for a long time. But if you earn your money honestly, you have nothing to worry about. It’s also not shameful to spend a lot and buy expensive things if you live within your means. The main thing to avoid is boasting about all your opportunities.

While we can’t do much about our bills for utility services, the prices we pay for mobile phones and the internet are more flexible. There are people who don’t change their mobile phone charges for years because of the number attached to them. But today telecommunication operators have many profitable offers that suit any needs.

A big number of plastic cards that have service fees “steals” several hundred bucks from your wallet each year. You should be especially careful with premium cards because they are actually quite expensive. The best way is to limit yourself to one or 2 cards.

If you miss the expiration date of your investment deposit, it might get prolonged automatically under less profitable conditions. That’s why it’s worth finding out the actual details regularly, especially taking into account that you can probably find all updates in your online banking profile.

What helps you organize your money?