My BF Made My Life Hell After I Publicly Rejected His Proposal — Now It’s Payback Time

There’s a solution for a problem of money just disappearing from your account due to constant mindless swiping of your card: cash stuffing. To be honest, it’s not something very new, given our grandmothers did it. It was common practice at a time when banks were few and far between and plastic money or even ATMs had not yet entered. Today, it has become a viral new method of saving and managing your money. So let’s get into the details.

Most of us live on plastic money, the swipe of a card, or the ding on our cellphone that signifies a payment made on apps like Venmo or PayPal. While there is nothing wrong with this if you have more than a steady income that covers all your expenses, many of us tend to lose track of the money we have and end up overspending.

In a world that’s largely a debt economy now, it’s important to keep track of your income and expenses, to be able to lead a financially stable life. This is where cash stuffing comes in. It is a budgeting system that involves dividing your money into designated envelopes for specific expenses.

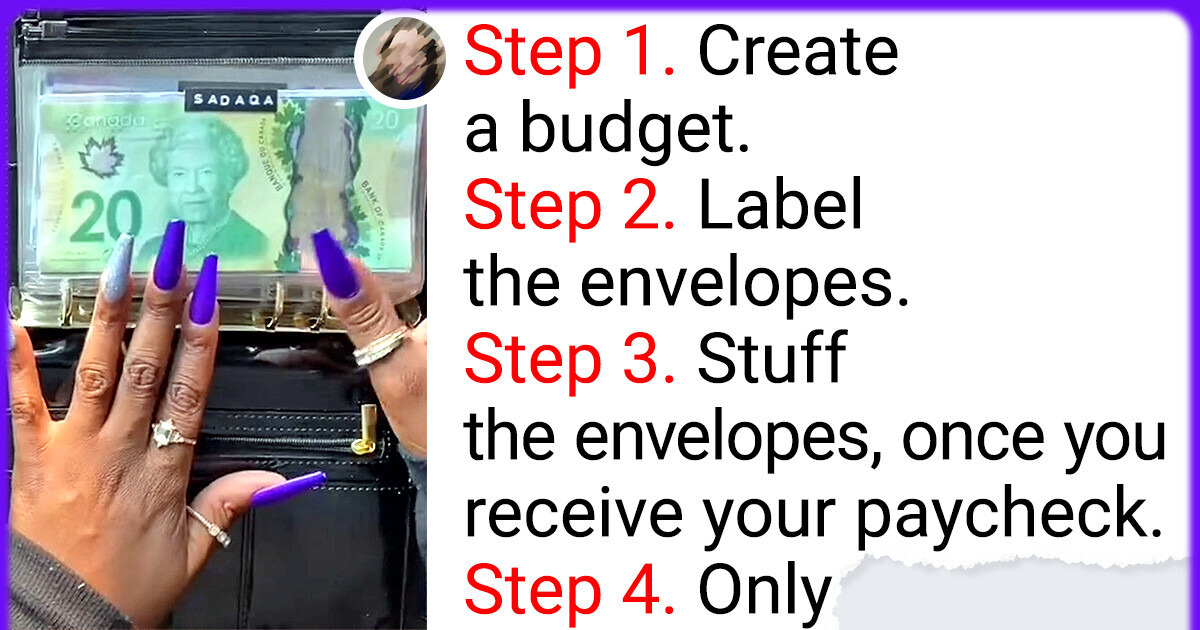

Step 1. Create a budget. You can account for your needs by yourself, or you can use the 50/30/20 budget rule as a simple guideline for managing your finances. It suggests allocating 50% of your income to essential needs, 30% to discretionary wants, and 20% to savings or debt repayment.

Step 2. Label the envelopes. Your labels could be “groceries”, “car maintenance”, “household”, “hobbies” and so on, depending on your needs.

Step 3. Stuff the envelopes, once you receive your paycheck.

Step 4. Only spend the money that are in the envelopes.

That’s it. It sounds simple enough, but if done right, cash stuffing can help you overcome bad financial practices like overspending, impulse buying and being in debt.

Unlike other budgeting methods that simply monitor your spending, cash stuffing actively helps you stay within your budget. When an envelope runs out of cash, it signals the end of spending for that category, preventing overspending.

This makes it especially effective for those who struggle with impulse purchases or consistently find themselves running out of money before the next paycheck arrives. This approach eliminates the reliance on credit and debit cards, allowing you to physically see your cash decrease as you spend.

The primary goal is to encourage more intentional spending habits. This system is particularly effective for variable expenses like dining out or fuel purchases, where cash payments are simple and practical.

Keeping significant amounts of cash at home comes with undeniable risks. In the event of a robbery or fire, that money could be lost permanently. Online shopping becomes a challenge as well — not just for clothing or goods but also for things like movie tickets and takeout meals. Additionally, frequent trips to the ATM and physical stores to withdraw and use cash can be a real time drain.

Plus, keeping the money in envelopes, instead of the bank, does not make you any interest. Even so, there are plenty of followers who swear by this TikTok trend.

One Redditor felt that it helped for another reason altogether, “I’ve been meaning to try this for years. I have ADHD, and the visual and tactile act of paying with cash makes a lot of sense to me. My problem with debit and credit cards is out of sight, out of mind. I don’t see the money, so my brain can’t see it dwindling. There’s no denying the dwindling when it’s cash.”

One Redditor shared their story, writing:

“I just had to talk about this because I cannot believe how much of a difference 6 months of cash stuffing has made. Basically, I take out my entire paycheck minus bills + expenses + rent. If I don’t have to pay online, and it’s not a bill, I just cash the rest out and put it in envelopes.

It’s actually a popular method by Dave Ramsay. I am a true shopaholic. If I don’t spend a good $400 on stuff, I don’t feel like I’ve had my fix. And I am not rich. I have zero self-control. No willpower whatsoever. So I have to say that when I started cash stuffing, I had no faith that I’d change.

Figured I’d just spend all the cash instead of using a card. But no! For the first time in my life, I’ve saved money. Seeing the cash in my hand makes it feel more precious. It truly is psychological what credit cards do to our brains. I highly recommend cash stuffing to those who are struggling with credit card debt. This has been life changing for me.”

While this is a cool hack to save money, here’s an article that will help parents who work from home make more money and achieve a good work-life balance.