Legal will prevails. My condolences.

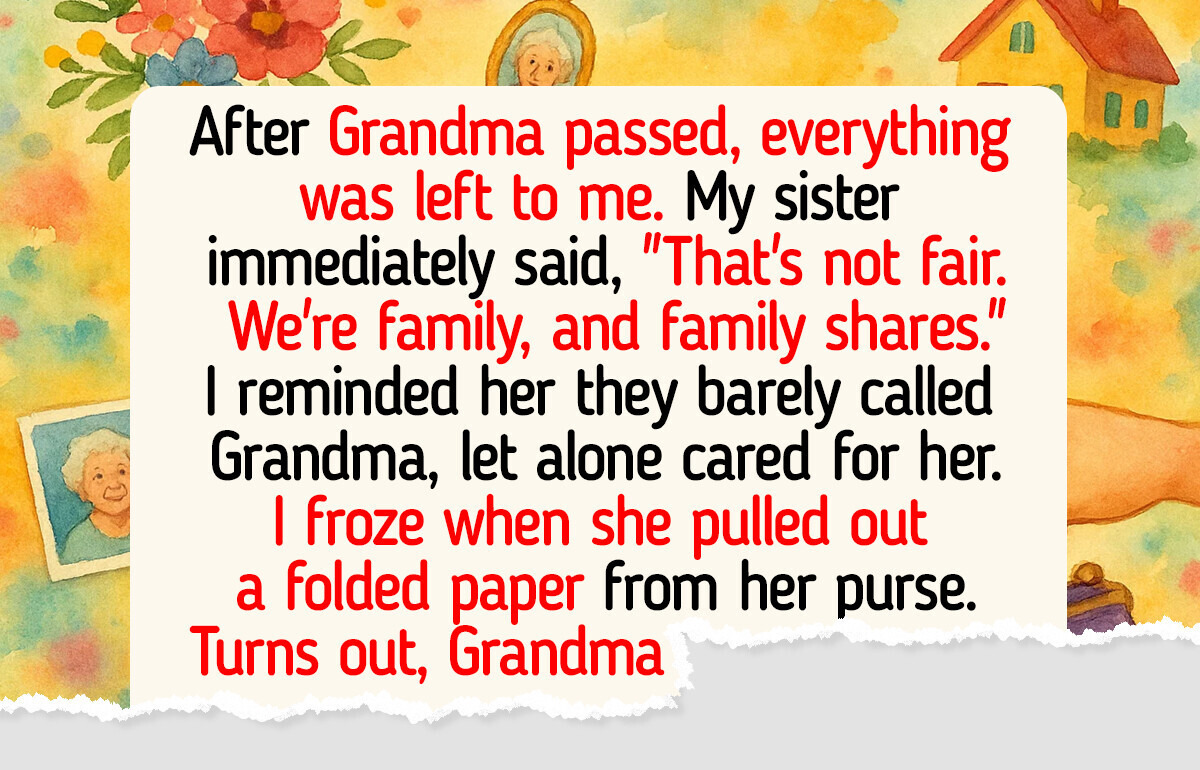

I Refuse to Share My Grandma’s Inheritance—No One Else Even Bothered to Visit Her

Our reader, Annie, was the one who lived with Grandma, cared for her daily, and followed her through every appointment. When the will left everything to her, it seemed clear. But then her sister pulled out an old letter that changed the family’s view of her. What did that letter say?

Hello Bright Side,

My grandma passed away recently, and everything was legally left to me. I was the one living with her for the last few years, taking care of her, driving her to appointments, and basically being there when nobody else was.

When my sister found out, she immediately said, “That’s not fair. We’re family, and family shares.” I reminded her that she barely even called Grandma, let alone cared for her.

I froze when she pulled out a folded paper from her purse. It was a handwritten letter by Grandma. Turns out, she wanted the house to be split between both of us. It wasn’t notarized or anything official, just a personal letter. The thing is that the date was from fifteen years ago, long before I moved back home to take care of her.

Now my sister is saying that “Grandma’s real wishes” were for us to share and that I’m being greedy. I told her the letter doesn’t change the legal will. She accused me of manipulating Grandma into changing her mind later in life.

It’s turning into a full-blown family fight. My sister is threatening to take me to court, even though the letter wouldn’t hold up legally. She keeps calling me a “thief” and telling people I took advantage of Grandma.

Now I feel stuck. On one hand, I know the legal will is on my side. On the other hand, it’s like this old letter threw gasoline on the fire and made me look bad to half the family.

Do you think I need to share the house if there’s this old letter floating around?

Annie W. L.

Hi Annie,

As you’ve already mentioned, you don’t need to share the house legally. The old letter has no standing. What you do beyond that depends on what your priority is: keeping the inheritance intact or reducing family tension. In short, we could say that if you decide not to share, it doesn’t make you a bad person or a thief.

But let’s break down what happens depending on whether you choose to share or not to share your inheritance, so you can make a more informed decision.

If you decide not to share:

- Full control: You own the property outright, with no need to consult anyone about repairs, sales, or renting.

- Respecting the final will: You’re honoring your grandmother’s most recent and legally binding decision.

- Financial stability: You keep the full value of the inheritance, which can support your future without compromise.

- Clear legal standing: The will is valid, so your position is secure if your sister challenges you.

- Family backlash: Your sister may continue to accuse you of greed, and some relatives may believe her.

- Possible legal costs: Even if your sister’s case has no merit, you may need to spend money on legal representation to shut it down.

If you decide to share:

- Reduced tension (possibly): Offering her something may lower the pressure and show the rest of the family you’re not acting out of greed.

- Personal peace of mind: If honoring the old letter makes you feel better, sharing could prevent long-term guilt.

- Complicated ownership: Splitting the house means every future decision (repairs, selling, taxes, renting) requires her agreement. This can lead to new conflicts.

- No guarantee of peace: Even if you share, she may demand more later or still spread negative stories.

- Financial loss: You give up half of what was legally left to you, despite being the one who cared for your grandmother.

- Legal process needed: The property must first be transferred fully to you. Then you’ll have to do another legal transaction to give her part, which costs money.

Our advice:

- Think about which “minus list” you’re more willing to live with—conflict with your sister, or financial loss and future entanglements.

- If you don’t share, protect yourself with documents and a lawyer’s guidance.

- If you do share, make it formal and final, so this issue doesn’t drag on.

- Consider alternative options. For example, instead of co-owning, you could give her a one-time payout equal to part of the value. This avoids co-management issues but reduces your inheritance.

Yours,

Bright Side

Family ties can get messy when expectations clash with reality. And Annie isn’t the only one facing this struggle. Another reader told us she still supports her adult son financially, yet he ignores her calls. Recently, he did something that made her question herself: should she respect his silence, confront him directly, or wonder if someone else is pulling him away?

Comments

Related Reads

10 Moments That Remind Us Quiet Kindness Is Mightier Than It Seems

My Parents Wanted a ‘Family Vacation’ on My Budget—I Made One Move They Didn’t Expect

I Refused to Pay for Our Valentine’s Dinner—Then I Learned the Heartbreaking Truth

11 People Whose Small Acts of Kindness Turned Tears Into Smiles

I Absolutely Refuse to Give Up My Apartment for My Sister and Her 3 Kids

10 Times a Moment of Pure Cruelty Was Actually a Secret Act of Kindness

10 Moments Where Kindness Didn’t Argue—It Acted

I Refused to Talk to My Parents After They Chose My Ex-Wife Over Me

15 Moments That Prove Kindness and Mercy Are Quietly Saving the World

12 Stories That Prove Kindness Is the Strongest Armor

I Refuse to Sacrifice My Retirement to Help My Unemployed Son, I’m Not His ATM

I Refused to Babysit Under My DIL’s Rules—I’m Not “Learning” How to Be a Mom