Totally agree with this self investment rule.,I can't just sit without doing anything and constantly learn something new. I have learned so many skills already

10 Money Rules That’ll Help You Live a Comfy Life

There are many complicated and efficient tricks on how to invest money and earn more of it. But most of the time, they’re effective only for people who are talented at doing business. But it doesn’t mean that all other people who want to be wealthy don’t have a chance. They just need to learn about some other tricks and approaches.

We at Bright Side love simple but effective solutions and the tricks we explore in this article are exactly that!

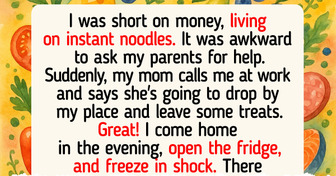

1. Invest in yourself.

The best investment in your future you can make is an investment in yourself. And the sooner you realize this, the better because you should do as many different things when you’re young as you can.

Of course, this is about learning and experiencing new things. We don’t mean you should necessarily earn a classic college degree but instead, try learning about something that you are really interested in. Reading books, taking an online course, getting a certification, or enrolling in personal growth programs are all great options. And the more you invest in yourself, the more valuable you become. In the modern world, anyone has access to many free lessons and classes: try them to see which direction you should go in.

2. Remember the rule of 3 8s.

We all know that on average, we work 8 hours a day, sleep 8 hours a night and have about 8 hours of free time. We sell our working hours to other people and give the sleeping hours to our bodies. So, the only way to become better at something is to spend the final 8 hours of the day wisely. Do something that might be useful in the long-term perspective, like master the skills you already have or acquire new ones instead of just watching some cat videos online.

3. Be more careful about lending money to friends and relatives.

Even though we love our relatives and friends and worry about them, we still hope to get the money we lend them back, right? But the problem is, they might have a different way of thinking. It’s possible that the people asking you for money hope that you will forget about this debt in time. And the truth is, you don’t have to be this generous.

Because of this misunderstanding, a good relationship can come to an end. So you either don’t lend out money at all, or you agree that it will be returned in a fixed period of time.

4. Spend less and you will be more free and flexible.

Articles about wealth often recommend spending less. And this tip actually makes a lot more sense than it seems. Just imagine having a job you hate, living in a place you don’t like, and being able to just change everything when you want. When you start saving more money, you’ll become more flexible. And in turn, you can do things that are really important to you.

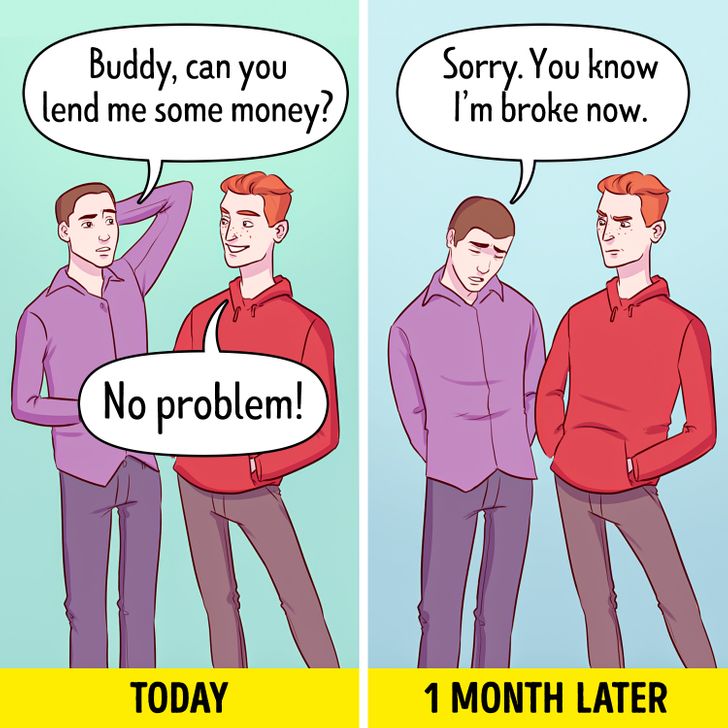

5. Follow the rule of 24 hours.

When we buy something, we might get carried away by our emotions. When we’re going to purchase something big, we might even lose our minds. And when we’re buying something small, it’s easy to stomach since the money we’re spending isn’t significant and it serves as a quick way to have some fun. But when you add all these things up and look at the stuff you end up with, you realize that these purchases were not very reasonable.

So, in order to cut down on expenses you really don’t need, you have to follow the 24-hour rule. Wait for just 1 day to make a purchase. Your emotions will calm down and you’ll be able to finally realize how you really feel. You’ll be surprised at the number of things you decide not to purchase.

6. Every day, spend 1 minute to check your expenses.

This trick is surprisingly simple but it allows you to keep your expenses under control every day. In the middle of each day, spend 1 minute on checking and thinking about every single purchase you have made within that period. This will allow you to detect any problem areas, slow down your spending, and determine the normal amount of money you need for each day.

7. Before every purchase, make a comparison.

One more way to slow down and think about what you’re buying in order to avoid disappointment in the future is to keep a simple idea in your head. For example, when you see a wonderful cashmere sweater in a store but you either don’t need it or the price is too high, make a hard decision. Think about this: “Is this sweater more important than a great vacation next month?”

8. Don’t fall for marketing tricks.

Big companies use a lot of different tricks to get us to buy things that we don’t really need. What’s even more surprising is that most marketing tricks are known to us but they still work and we still believe the fake discounts and sales.

In order to stop falling for these tricks, you need to keep a very simple idea in your mind: every time there’s a discount, it’s only for products that had a higher price in the first place or that weren’t of good quality. In the end, the manufacturer is the only party that wins from this purchase.

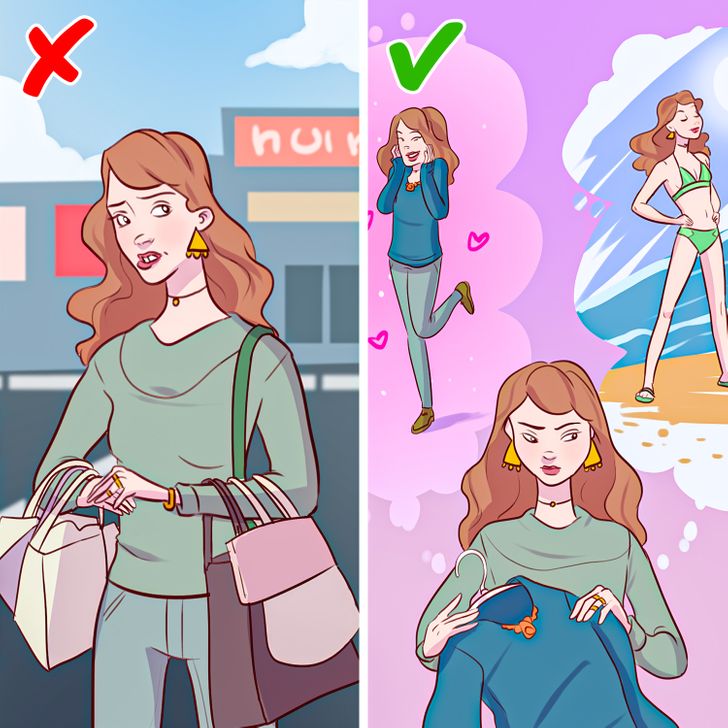

9. Go shopping when you’re alone.

When we go shopping with our friends, we spend more money for many different reasons. We visit more places than when we’re alone and when we try on clothes, they cheer us up and encourage us to buy things. Our overall mood is always better when we shop with our friends, so we want to spend more.

The trick is simple: when you want to meet your friends, go for a walk in the park together. Shopping should never serve as entertainment but rather, a serious task.

10. Get rid of any toxic thoughts related to money.

Despite what many people believe, our own ideas have a ton of power. And it’s not about magic, it’s about psychology. When you program yourself to think it’s impossible to earn a lot of money and all rich people are bad guys then you won’t be able to achieve much.

If you don’t believe you can become successful, you quickly get tired of what you’re doing and think that whatever you do is pointless, so you don’t achieve anything, proving that you were right. Just as an experiment, try and change your negative ideas about money and live like this for a month. You will be surprised by the result.

Bonus: Financial independence will only solve some of your problems.

Do you know what determines your level of happiness and joy? If you think about it for a moment, you will realize that it’s not money, but instead, the ability to enjoy the things you have already.

The realization that money solves only the most insignificant problems such as organizing a big wedding or going to a beautiful resort somehow allows you to earn even more. Because when you truly understand this principle, you’ll stop considering chasing money to be an ultimate goal in your life and you’ll do exactly what you really want to do. And the rest will all fall into place.

What other rules would you add to this list?

Comments

i like it

Related Reads

My Neighbor Refused to Help My Autistic Son, She Wasn’t Ready for My Revenge

I Refuse to Give Up the Passenger Seat for My MIL—She Should Learn Her Place

18 Times Kindness Quietly Saved Someone’s World

10 Stories That Prove Work-From-Home Isn’t Always What HR Promised

15 People Who Turned an Ordinary Day Into a Movie Without a Script

12 Life Stories That Prove Kindness Is a Safe Oasis Amidst Life’s Chaos

10 Times a Moment of Pure Cruelty Was Actually a Secret Act of Kindness

I Refused to Be the Office’s “Go-To” Holiday Backup Just Because I’m Single

I Charged My MIL for Christmas Dinner, Even Though She’s Always Helped Us for Free

13 Teachers Who Didn’t Just Teach a Subject, They Rescued a Soul

My Neighbor’s Dog Poops in My Yard, but Things Escalated Faster Than I Expected

20+ Stories That Prove Having a Supportive Family Is the Best Safety Net in the World