Always funny to see people complain about stuff being expensive but they have their nails done and wear tons of make up

9 Things I Stopped Doing to Save Money for a Car

In the spring of 2018 I set a goal to buy a car for $20,000 and to be able to pay cash for it by 2020. My calculations showed that in order to reach this goal, I needed to save about $1,000 every month. Even taking into account the fact that my family has a sufficient income, the opportunity to put aside this amount of money was close to impossible. But the idea had been born and it intrigued me.

Especially for Bright Side, I’m going to tell you what “wasteful” habits I have fought in order to save enough money for the car of my dreams.

Initial data

My name is Polina, I live in Saint Petersburg and, in 2018, we were planning to purchase a new car. We already had a 10-year-old car that required more and more attention day by day. It would cough, sneeze, break down, and we had to constantly “fix” it. Once, the car broke down during our trip to the countryside for the celebration of my mom’s birthday and we missed the biggest part of the event while trying to get the car working.

Moreover, we were expecting a baby and we needed a bigger car with 5 doors, instead of the 3-door car that we had. We decided to buy it without taking out a loan, even if it wasn’t new.

In order to reach a financial goal, one needs to understand how much money they have.

Now I can confidently say how much money we spend on each category of life. I can also plan our expenses one month ahead. But 2 years ago, I couldn’t begin to imagine how much our family spends on products. We would always make unplanned purchases — if we wanted something, we would buy it. Since the moment I set the goal, I started to write down all my expenses on a notepad, on a daily basis. I divided them into 4 categories:

- compulsory: housing, mobile phone services, internet

- routine life: products, detergents, animal food, self-care products

- entertainment: meeting friends, museums, cafes, food delivery

-

force majeure: treatment, medicine, repair

I spent one month investigating where all the money goes. By the way, the fact that we had started to write down all of our expenses, made us think before making another purchase, “Do we really need it?” I related to the process of saving money like a competition with my own squandering, at the end of which, a cool award was waiting for me. It was important to not worsen the quality of our current life because we were going to need to continue saving money for a long time.

Bad habit #1: Spending our entire salary

I created a new rule — to “pay myself” monthly and signed up for an automatic transfer to my online bank account. On the day I was getting my salary, a significant amount would automatically get transferred to my savings account — $300. Money in that account wasn’t just sitting there, but I was earning interest on it. The biggest motivator was the fact that if I withdraw it, I would lose all the bonuses.

In order to make the process of parting with this money easier, I was imagining that I was paying a loan for my car. But in fact, the money just stayed with me. I was simply hiding it from myself. It was extremely difficult, but I made an agreement with myself that I’d spend the rest the way I wanted, but I actually couldn’t. Right after getting my paycheck, and seeing only half of it in my account, my wish to spend it on shopping or at restaurants instantly disappeared.

I had months where I was able to increase my monthly payment to myself and because of this I managed to save more. I ended up saving about $6,000, where about $200 was my interest for just having money in the account

Bad habit #2: Ignoring the opportunity to save money on obligatory bills

I would always think that public utilities were extremely expensive, but it turned out that it is possible to decrease those bills. Apart from installing water and electricity meters, replacing all the light bulbs with LED ones, and getting the habit of switching off the water if we are not using it, we also took the following measures:

- We started to use additional lamps instead of the main ones in the evenings.

- I would use the dishwasher and the washing machine after 11 PM only (it’s cheaper than in the afternoon).

- I started to exclusively choose the washing mode. Heating the water up to 140°F requires more electricity than washing at 90°F.

Thanks to these useful habits, we started to pay $20-30 less per month. And it added about $500 to our bank account over 1.5 years.

Bad habit #3: Not checking my accounts every day

I started to check my cash and cards every day. This means that if I had a small amount left at the end of the day, I would send it to my savings account. For example, if I had $186 on my card, I would transfer $6 to my savings account. Thus, I managed to save about $70 — 100 within a month. I did the same with cash and always spent this money on something useful like paying bills. Within 1.5 years of everyday rounding off, I managed to save about $1,200. If I hadn’t been doing it, the money would have gotten wasted again.

Bad habit #4: Eating out frequently

I started to cook in advance, so that I would have enough food for the week ahead. I would divide the portions for one serving and freeze them in containers. The recipes were pretty simple: garnish + meat or fish + vegetables. They could be stored for a week, or even more. Earlier, when I didn’t have enough time to cook, I would order food delivery, go to a cafe, or buy takeout food. Now I take out frozen food from the freezer, unfreeze it, and eat it. So, I ended up saving my money and I didn’t consume unnecessary calories.

It’s ok to freeze soups, as well — they don’t lose their taste after unfreezing. It’s actually more convenient to carry frozen soup to work, because it doesn’t spill. However, this approach attracted surprised looks from my colleagues who would always peek in my container and wrinkle their noses. But for me, I was happy, because I wasn’t eating fast food during my lunch break.

Nevertheless, I stopped taking soup to work and limited myself to only second courses. They look better, even when they are frozen. This method helped us to save about $100 per month, which is about $1,800 per 1.5 years) and it also affected the way we were spending our leisure time. We didn’t need to visit cafes and restaurants anymore, we started to walk and spend more time outside, in fresh air.

Here are other tips on saving money on products. We would always buy products with a long shelf life in jumbo packs (tea, sugar, pasta, groats, and cat and dog food). If I saw a good deal for a product I always use, like toothpaste, laundry detergent, or my regular shampoo, I would always buy 4-5 packs at once.

I picked fruits and vegetables by myself, because packed ones always cost more. In comparison with the first month of the experiment when I was only analyzing my expenses, the difference was $70 (which was almost $1,300 over 1.5 years).

Bad habit #5: Not using bonuses and deals from banks

I got myself 5 different bank cards. One was for getting my salary, the other one had better terms for keeping the money, because it was giving me some interest for the deposit, the third one had a good cash back offer, etc.

One bank offered me an increased cash back offer for the products and services I use most often. For example, I chose “pharmacies,” “cinema,” and “transportation” for the first 3 months, which meant I’d be paying with this card when buying the services from the mentioned places. The categories with increased cash back can be changed for the next 3 months. Another bank offered a great cash back deal for cafes and restaurants, and I managed to get a significant amount of my money back.

My advice to all of you is the following: today any bank has these cards and you shouldn’t be afraid to get them, because they can put money in your pocket. The credit card companies keep coming up with new methods of attracting and sustaining clients with the help of various deals and bonuses. I even managed to get free annual travel insurance with the help of one card, miles for my flights, a certificate for dance lessons, and discounts for going to the movies.

Bad habit #6: Not considering cheaper alternatives for goods and services

I started to experiment with myself — I would make hair and face masks from the products I had in the fridge. I even tried to make a depilation cream from sugar and citric acid. Unfortunately, these folk remedies caused acne, dull hair, and redness on my skin. I have wasted a lot of time and products, but never got the desired results so I just returned to my usual products.

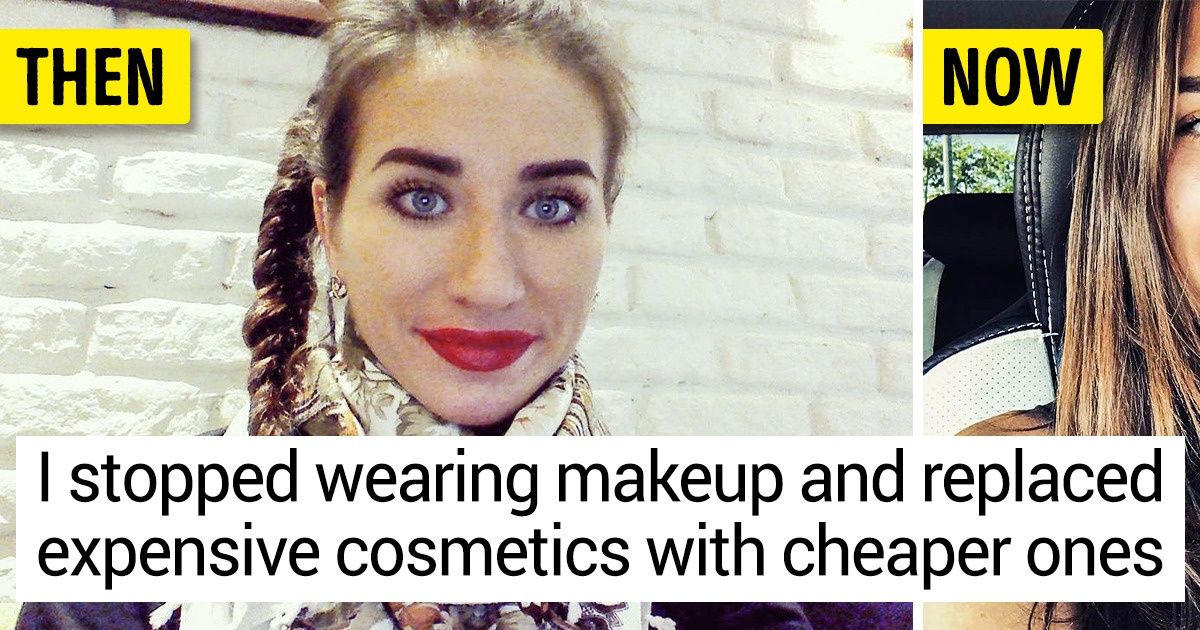

Instead, I found another way to reduce my expenses — I almost stopped wearing makeup and using perfume. I also replaced expensive products for my hair and face with cheaper ones. Personally, I didn’t manage to save a ton of money in this category — I only saved about $40 per month or $700 per 1.5 years.

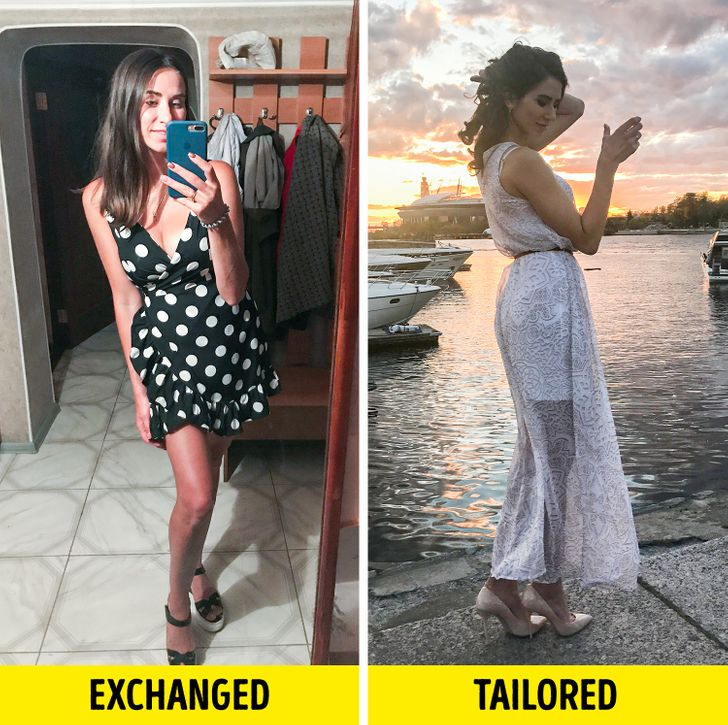

I made a bigger profit from the fact that I almost stopped buying new clothes — only underwear and tights. My life became extremely dull without shopping and I would occasionally go window shopping without buying anything. Once, we were invited to our friends’ wedding and not long before that, I saw the dress of my dreams in a shop. I couldn’t stop thinking about it.

I lost sleep and was literally dreaming of buying it. On the one hand, I had the money for this dress, but on the other hand, we were in this strict money saving mode. I visited the shop one more time and after trying it on, I realized it was a very simple dress. A little while ago, my granny taught me to use a sewing machine and it was high time I used my skills in practice. If I were to grade myself, I would give the result of my work a “C” because my stitches were uneven. Nevertheless, I managed to correct the situation with the help of a belt and a long white slip. So I spent $0 because I tailored my new dress from curtains, like Scarlett O’Hara.

I stopped getting upset about the absence of shopping in my life, asked my friends to do a clothing exchange, and started to use special sites to exchange my clothes. As a result, according to my calculations, I managed to save about $1,200 on clothes within 1.5 years.

Bad habit #7: Not searching for ways to earn money with my hobbies

Saving on personal care products led me to making cosmetics myself — like creams, lotions, and soaps. Soaps became my hobby and I started to combine all the necessary ingredients into one soap bar. I also started to understand herbs and oils and would give presents to my friends and acquaintances, and I was getting positive feedback about them.

One fine day I posted an announcement on the internet trying to sell my handmade soap. I got my first order after several days and that number kept increasing day by day. That’s how my hobby started to bring me about $200 monthly, taking into account that I was only creating soap in my free time.

Bad habit #8: Letting myself spend more on things I could pay less for

- I started to break the road rules less often. Earlier I’d pay about $25 once every 2 months for a speeding ticket, now this number is zero.

- I started to fill up my car at gas stations that are not as popular (the fuel is cheaper there) or I used a bonus card at the usual gas stations and saved about $100.

- We would order necessary goods and little things on the internet with a discount and we managed to save about $150 in total. Here is a life hack: if there is a line for inserting a promo code on the site of an online store, it’s worth asking for it via social media or just simply googling it. I managed to insure my apartment with a big discount, to buy an airline ticket, and to get tickets to a concert this way. I spent no more than 10 minutes looking for them and the discounts were significant.

That’s also how the envelope “for the car” got an additional $800.

Bad habit #9: Keeping a bunch of unnecessary things at home

Once we saved enough for our goal, I started to clean out my apartment and I sold the things we didn’t use. Turns out, other people needed our old vacuum cleaner, our landline phone that we haven’t used for 10 years, an iron, and a cat house that our pet wasn’t interested in at all. We even managed to sell old furniture, paintings that I never liked, the leftovers from building materials, and even an old mattress!

We got more free space in our storage room and in our closets. I also sold clothes that were in good condition, that I wasn’t wearing, and my wedding dress for $250. We got more money in our wallet and all of our old things brought us an extra $500.

The results of the experiment

It might seem like I turned into a miser, whose greediness reached a level of craziness and obsession. But this is not true. I didn’t deprive myself of all of life’s pleasures, I just decreased them significantly. I managed to save the necessary amount of $18,000 by my goal date. Then I sold my old car and bought my dream car that already had a built-in alarm, seat covers, and a set of winter tires.

Just imagine that we managed to save $300 every month and we decreased our everyday expenses by $350 monthly. Within this time, I realized what we spend our money on, and my family stopped living from paycheck to paycheck. I started to earn money on my hobby and unfolded my creative potential. This time taught me to differentiate necessities from impulse buying.

Moreover, I learned to count time and transform it into money. Now, when I reach my goal, I can relax and break bad — spend everything I earn on me. I have also become a mother and now neither my time nor my salary belongs to me (all the other mothers will understand me).

Which everyday expenses are you ready to ditch in order to buy something you’ve been dreaming about for a long time?

Comments

I barely spend money so I can save up really fast ?

What an organized lady! If it wasn't for my husband's accountant mind we will be broken by now...

Amazing! There's a lot of useful information here. Thanks!

Totally agree with Polina in so many of these tips. We do things that make our lives way too expensive for nothing. I learned these while I was growing and thank God I did!

Related Reads

10 Stories That Prove Kindness Is the Ultimate Cure

I Refused to Take My Ex Back, and My MIL Made Sure I’d Regret It

15+ Mothers-in-Law Who Can Turn an Ordinary Day Into a Comedy Show

My Parents Cut Me Out of the Inheritance—Then Needed My Kindness to Survive

14 Mother-in-Law Moments That Became a Legendary Family Story

I Refuse to Let My Sick MIL Live With Us—I’m Not Her Free Caregiver

16 First Dates So Bad, They Should Be Turned Into a Comedy Movie

12 Stories That Show Kindness Doesn’t Need to Be Loud to Be Life-Changing

20+ Moments That Remind Us That Kindness Costs Nothing but Means Everything

I Refused to Let Mom Move In With Me—My Privacy Isn’t Up for Debate

My DIL Excluded Me From Gender Reveal Party, Saying I’m "Not Family"—Big Mistake

I Was Excluded From a “Family” Dinner—My Revenge Taught My DIL a Lesson