Pierce Brosnan’s Wife Stuns People With Her Transformation During Her Latest Appearance

People

year ago

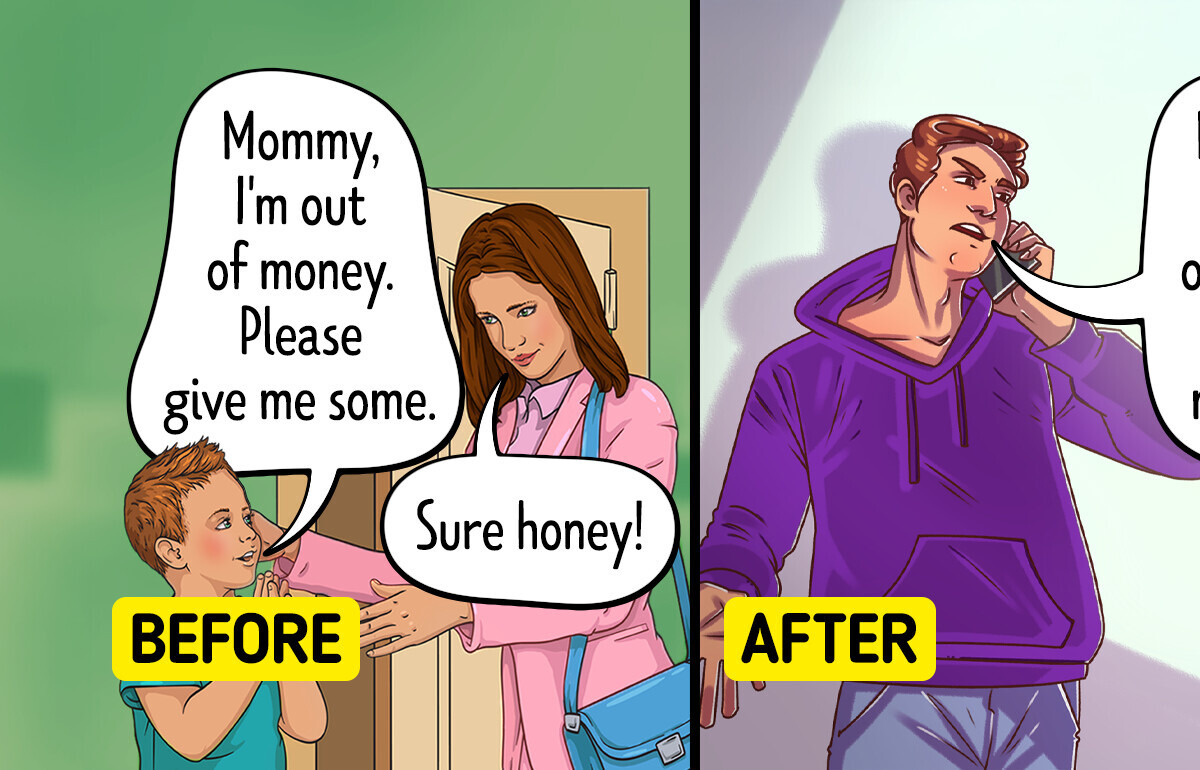

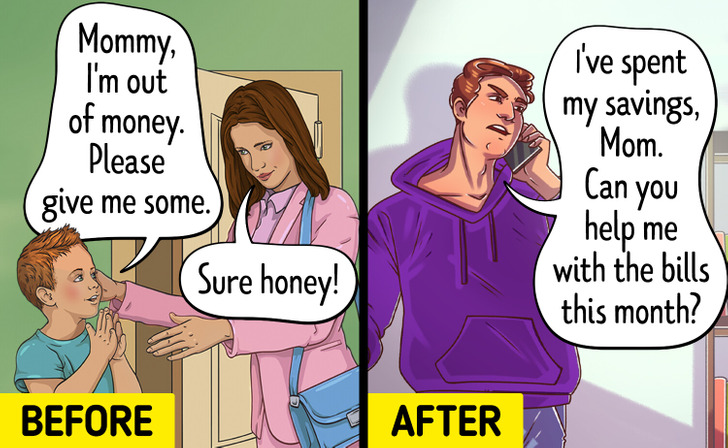

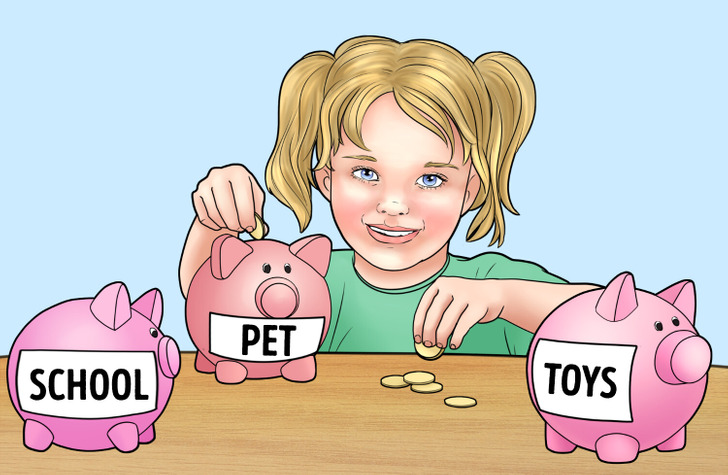

Parents are a child’s first and most important teachers. Kids see the world differently and rely on us for guidance. When it comes to money, the habits and lessons we teach early can shape their future for years. That’s why it’s important to recognize mistakes, even when they happen unintentionally.

Disclaimer: The content provided is for informational purposes only and should not be construed as legal, tax, investment, financial, or other advice. Always consult with a qualified professional regarding your specific circumstances before making any investment, financial, or legal decision.

What was once frowned upon is now part of everyday life. Some habits that were once criticized have become the new normal. Click here to read more.