I think you should find a good lawyer. Free up some of your husband funds so he can afford child support, because you are going to be a single mom. Take your baby and run.

I don't think you're wrong. Wrong or right don't matter here. You've violated 'daddy's privileged littel girl', there's no coming back from that.

I Threw My Stepdaughter Out — My House Is Not a ’’Free Hotel’’

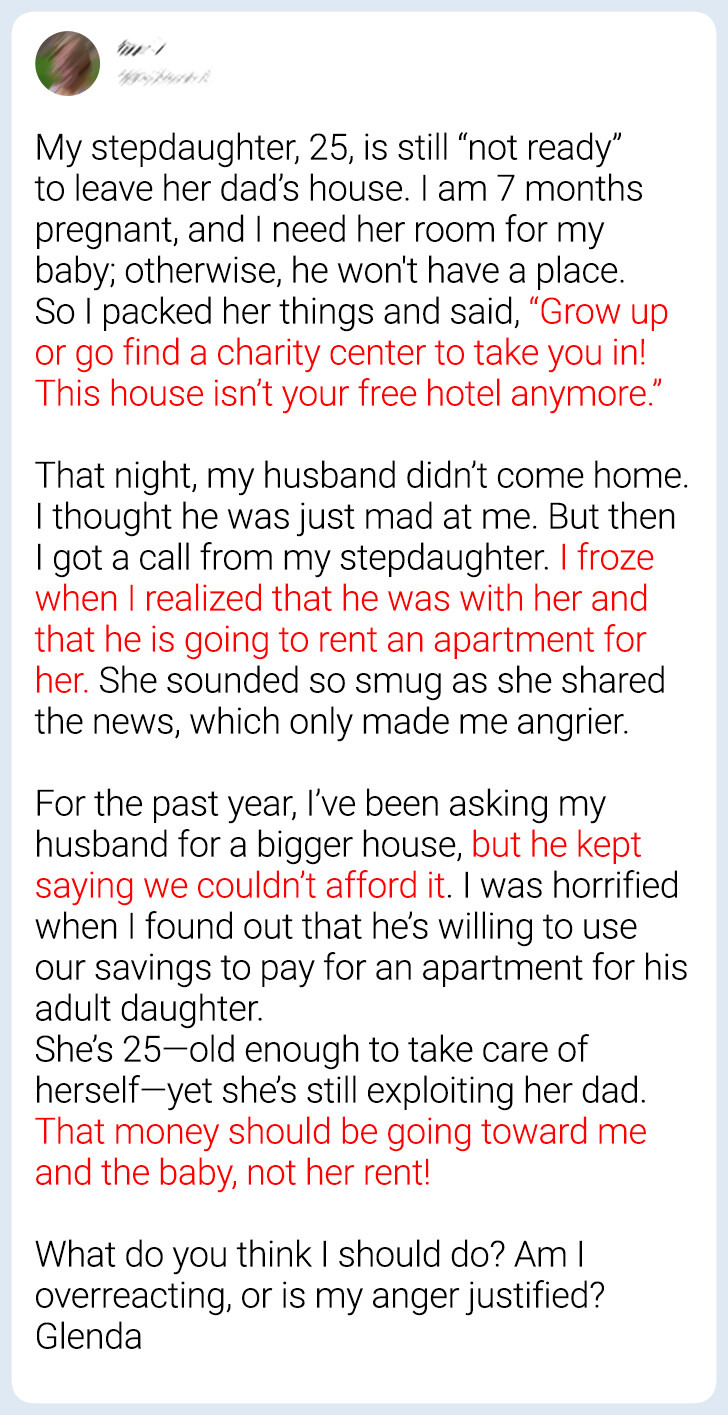

Blended families frequently face distinct challenges, especially when major life changes occur, like welcoming a new baby. For Glenda, an expectant mother, this transition has introduced a complicated situation. She feels it’s the right moment for her 25-year-old stepdaughter to move out and make room for the baby. However, this decision has stirred unexpected tension and family conflict. Glenda shared her experience with us to shed light on the unfolding drama.

This is Glenda’s letter:

Thank you for trusting us with your story, Glenda! We’ve put together some thoughtful advice that might guide you as you navigate this situation.

Propose a balanced plan to help the stepdaughter transition gradually.

Offer a middle-ground solution by setting a clear timeline for your stepdaughter to transition toward independence without using your shared savings. For instance, suggest she stay with a relative or find temporary shared housing while working on her financial stability.

This approach ensures she isn’t left unsupported while also protecting your household finances. If needed, you could also help her with job hunting or budgeting advice to assist her on the path to independence.

Sit down for a calm and focused conversation with your husband.

Stay calm and talk to your husband about how his decision impacts your finances and future plans. Explain that the savings were intended for a bigger home for the baby and that paying for his daughter’s apartment could interfere with those goals.

Focus on the importance of making financial decisions together and reassure him that it’s about setting fair priorities, not distancing his daughter.

Set clear limits on financial support and shared expenses.

If your husband is determined to support his daughter, emphasize the need for transparency in family finances. Set clear boundaries on how much, if any, of the savings can be allocated to her expenses.

For example, suggest that any financial support come from his personal income rather than shared savings. This approach safeguards your baby’s needs and ensures that larger goals, like purchasing a bigger home, stay on track.

Work on reinforcing your stance and securing your priorities.

Should your husband remain unwilling to compromise, shift your focus to protecting your and your baby’s future. Consider reaching out for external support, such as a counselor to help mediate or family members to strengthen your position.

Educate yourself about your financial rights to be prepared if the situation worsens. This step isn’t about jeopardizing your relationship but about securing stability for you and your baby, even if your husband’s priorities don’t align with yours.

Every family has its hidden stories, but some are so extraordinary they feel straight out of a movie. Discover the most jaw-dropping revelations from families whose secrets couldn’t stay buried forever.

Comments

Related Reads

My Husband Skipped Our Baby’s Birth — He Had "More Important" Plans

My Vegan Daughter Threw Out All My Groceries—So I Sent Her the Bill

I Refused to Care for My Mom—I Got No Inheritance Anyway

My Pregnant DIL Refused to Return My Mom’s Diamond Necklace, So I Made Sure She Paid the Price

My Daughter Disrespected My Sacrifices—And I Refused to Let It Slide

I Refuse to Give Up the Passenger Seat for My MIL—She Should Learn Her Place

10 Moments of Superhuman Strength That Feel Like Winning the Olympic Games

My MIL Humiliated Me in Front of Family, So I Exposed Her Secret

I Refuse to Let My Daughter Attend Her Dad’s Wedding

I Refused to Break My Rules for My Daughter’s Wedding—My House, My Money

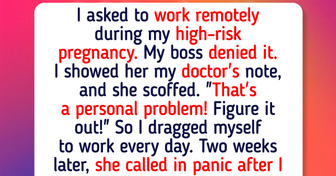

I Was Denied Remote Work Despite My High-Risk Pregnancy

10+ People Who Went on Holiday for Comfort but Got a Crazy Story Instead