It's YOUR house. Why are YOU leaving? He's only in this relationship for your money and other assets. Go back home and kick him out of your home and life.

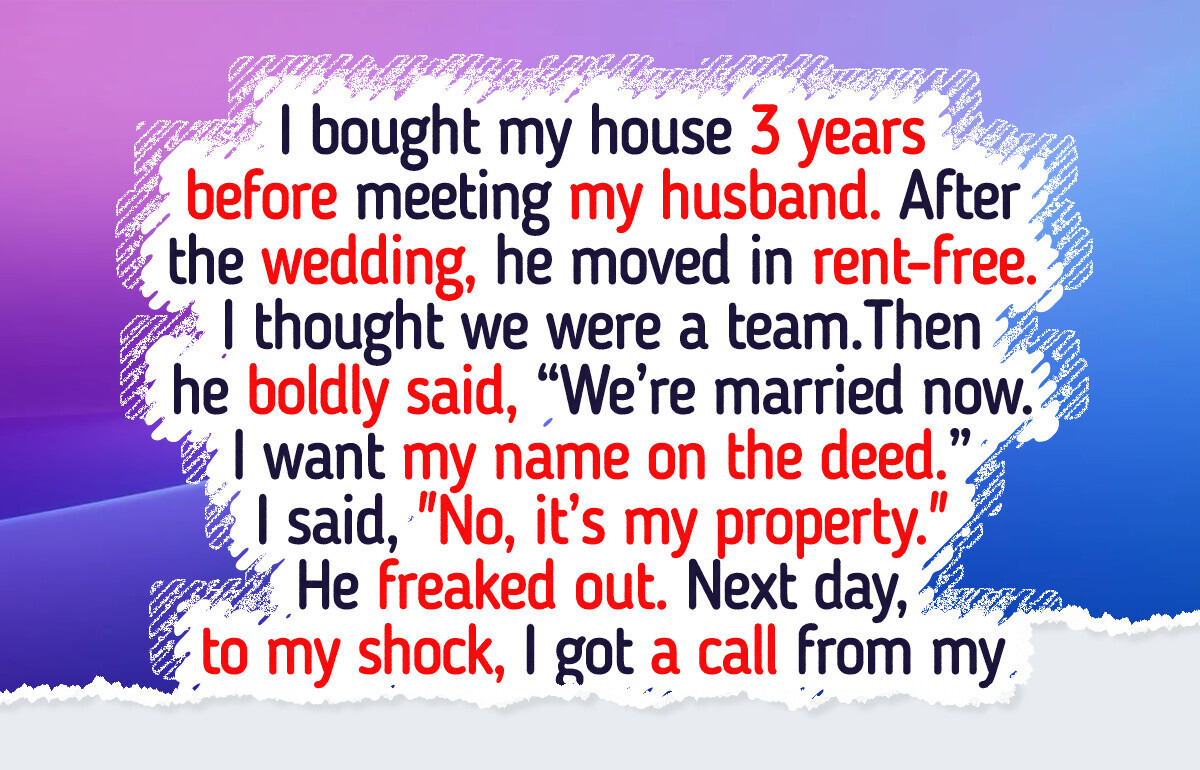

I Refuse to Put My Husband’s Name on My House Deed, He Moved in With Just a Toothbrush

We recently received a letter from one of our readers, Maria. She shared how she bought her home all on her own, before marriage, without help, without shortcuts. A place she earned with hard work and sacrifice.

Now, years later, her husband suddenly decided that, as her spouse, his name deserves to be on the deed, despite never having paid a cent toward it. Maria said no, calmly and reasonably.

But what the husband did after that wasn’t just a disagreement — this was a flashing, screaming red flag.

⬇️ Read Maria’s full story and decide for yourself.

Here’s Maria’s story:

Hi Bright Side,

"I (30F) bought my own modest two-bedroom house about three years before I met my now-husband, Chris (34M). It wasn’t gifted, inherited, or co-signed, just me, grinding through double shifts, saying no to vacations, and drowning in paperwork. When I finally closed on it, I cried from sheer relief and pride. This place wasn’t just a house; it was my sanctuary. My proof that I could take care of myself.

Fast-forward a few years. I met Chris. We dated for two years, clicked, and eventually got married four years ago. He moved in with me after the wedding. I didn’t ask him to pay rent or split the mortgage — I figured we were building a life together, and it all evens out eventually, right? Well. Apparently not.

Last week, Chris randomly brought up the idea that we should “update” the deed to include his name. He did it with a reasoning, “We’re married now. The house should reflect our union.” I blinked. Then calmly explained that the house was purchased well before we even met. I paid for the down payment. I handle the mortgage. He’s never contributed a single cent toward it. So, no, I’m not adding him to the deed.

That didn’t go over well. He got defensive, saying I was being “selfish” and clearly didn’t “trust him.” Then he said something that made my skin crawl: “What’s yours is mine now. That’s how marriage works.” I shot back: “No, that’s how entitlement works.”

Ever since then, he’s been sulking, making passive-aggressive comments about how I clearly don’t view us as a real team. He’s also suddenly very invested in watching YouTube videos about “marital property laws” and casually throwing in “hypotheticals” about divorce.

At first, I thought he was just wounded pride talking. But then and here’s where it goes from yikes to WHAT’S GOING ON HERE: I got a call from my mortgage lender. Apparently, someone called pretending to be me and inquired about refinancing options, with a co-borrower. Guess who the co-borrower was? Yep. Chris.

He tried to sneakily collect information from the lender, still believing that my refusal to put him in the deed was a temporary one and that I would change my mind. I was livid. Confronted him immediately. He didn’t deny it. His excuse? “I just wanted to be more involved in our finances. It’s OUR house too, even if you’re the only one on paper.”

I told him this started looking like a red flag to me. Now I’m staying at my sister’s place with our son while I figure out my next move. I don’t know if I’m more heartbroken or disgusted. But one thing’s clear: I’m never signing over a single brick of this house. If this is what he pulls when I say no once, what happens the next time?

Dear people, would you call this financial abuse? Or am I just overprotective about my property, and his intentions are pure?"

Thank you, Maria, for bravely sharing your story with us. Situations like these can deeply shake the foundation of trust in a marriage and often reveal cracks that were easy to overlook before. Financial boundaries, when crossed, can turn into emotional fault lines.

Here are a few tips from us that we hope will help you navigate this difficult chapter.

1. Set Clear Financial Boundaries

Create explicit rules about what belongs to whom and what is shared—like major decisions needing joint approval. According to financial guides, these boundaries help “prevent misunderstandings and conflicts” and maintain mutual respect in the relationship.

2. Open Honest Conversations About Money

Initiate calm, regular “money dates” where you discuss financial values, fears, and expectations—without blame. Experts say that this kind of open dialogue builds trust and bridges “emotional fault lines” sparked by actions like unilateral property changes.

3. Watch for Signs of Financial Manipulation

Sneaky moves—like impersonating you to add himself to the mortgage—can be red flags of financial abuse. Experts say it’s really important to double-check what’s going on and stay alert when trust starts to break down in a relationship.

4. Seek Professional Guidance (Legal & Therapeutic)

Talk to a real estate lawyer to understand your premarital rights and how to protect them. A licensed marriage therapist or financial counselor can also help you both rebuild trust and communication. Professionals offer neutral strategies and empower both partners to play fair.

And here's a story from Lily — a young woman, three months pregnant, who believed she was building a solid future with her fiancé. They bought a house together, and she thought this was the first step toward their dream life. But then, out of nowhere, her fiancé dropped a bombshell: the house? It’s actually for his mom. And Lily? She’s expected to move in with his dad. Pregnant.

This one left us absolutely stunned. Read Lily’s story here — and tell us honestly: would you still say “I do” after this?

Comments

Related Reads

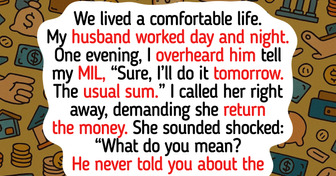

I Caught My Husband Funneling Our Life Savings to His Parents

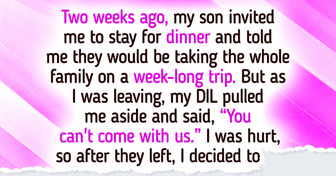

My DIL Excluded Me From the Family Trip—but I Refused to Stay Silent

HR Fired Me Right Before My Vacation, So I Used It Against Them

My Sister Tried to Turn Our Family Cabin Into Her Free Resort, So I Changed the Rules

20+ Gifts That Prove It’s the Thought That Truly Counts

I Refuse to Forgive My Parents After They Took My Inheritance for Being Childless

My DIL Refuses to Let Me Babysit My Grandson, She Wasn’t Ready for My Payback

15 Times Someone Showed Kindness Without Saying Anything

11 People Who Chose Humanity Over Hatred in the Darkest Moments

14 Quite Acts of Kindness That Changed Someone’s Life Forever

I Refuse to Let My Sister Hijack My Pregnancy Announcement

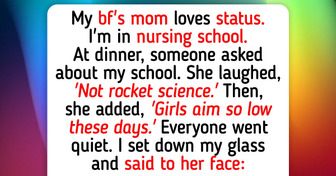

My Boyfriend’s Mom Kept Mocking My Career—My Response Silenced the Whole Table