She decided money was more important than life. She's the pos.

I Refused to Help My Sister Save Her Dying Kid, My Wallet Isn’t a Part of Family Tree

Alyson, 35, wrote a letter to our editorial team—and it shattered us. The woman lives by one unshakable rule: never mix family and money. To her, lending cash is the fastest way to destroy love and family bonds.

But when her nephew became gravely ill and her sister begged for help, Alyson said no... and triggered a chain of devastating events she never saw coming. What happened next will leave you questioning where loyalty ends—and self-preservation begins.

Here’s Alyson’s story:

Hi Bright Side,

I (35F) have one ironclad rule: “Blood is blood, but debt is debt.” I do not lend money to family. Ever. Full stop.

That rule came after I almost lost my house 8 years ago when I co-signed a loan for my cousin that she defaulted on. It tore the family apart for years. I got burned once. Never again.

Last week, my older sister (38F) called me sobbing. Her 6-year-old son—my nephew—was just diagnosed with a rare genetic disease. There’s a new treatment, not covered by insurance, and he needs infusions starting tomorrow.

$38,000 upfront. She and her husband have maxed out credit cards, but nothing is coming through fast enough. She begged me to lend the money. Said she’d pay me back every penny. Swore it on her child’s life.

But I said no. Calmly. Clearly. “No, I won’t break my rule. I won’t give you a dime. I have my principles. I don’t mix money and family. I’m sorry. I hope you find help elsewhere.”

She screamed at me. Said I was a monster. That her son was dying. I repeated the same thing: “Blood is blood, but debt is debt.” She hung up.

The backlash has been nuclear. My parents called me heartless. My younger brother said I don’t deserve to call myself an aunt. People I haven’t spoken to in years are texting me paragraphs. My sister blocked me on everything.

The next day, to my horror, I found out that my sister posted a video online of her shaving her head, saying she’s “mourning her son in advance because her own blood turned her back.” The video went viral in our small town. People started DMing me hate. My boss even asked if everything was okay at home.

Now, part of me is questioning myself. Was I really that heartless? But the other part says: If I bend this rule once, I’ll be back in the same hell I crawled out of.

I’ve been called every name under the sun this week. And maybe I deserve it. Or maybe I’m just the only one who understands that a broken heart is better than a broken bank account.

So... am I the villain?

Thank you, Alyson, for bravely sharing this heart-wrenching story with Bright Side. We truly understand how deeply you value your principles—and how agonizing it can be when your hard-earned boundaries are tested by family emergencies. Your situation is complex and multifaceted: it’s about trauma, love, responsibility, and the fear of repeating past mistakes.

Here are some pieces of advice that we hope will help you navigate your unique family dilemma.

1. Clarify and communicate your boundaries with empathy.

Express your no-family-loans stance in a calm, clear, and compassionate way—just as you did. It’s a proven fact that setting boundaries with clarity and consistency protects emotional and financial well-being.

Disagreements over money can easily create tension and damage even the strongest family relationships. By setting clear financial boundaries, we’re not just protecting our wallets—we’re safeguarding our peace of mind. These boundaries help us steer clear of emotionally draining or toxic money entanglements with relatives. They also provide a clear framework for how we handle financial interactions with loved ones, reducing confusion and potential resentment.

2. Offer alternative support.

Rather than handing over cash, actively help by:

Researching charitable grants or medical assistance programs—many exist for rare diseases and can cover treatment costs.

Brainstorming fundraising strategies—spreading the GoFundMe, hosting local events, or engaging community organizations can make a real difference.

Offering emotional and informational support—being a sounding board or helping navigate forms, applications, and red tape.

Studies show that emotional and informational support alone can significantly reduce stress and improve the ability to cope with financial hardship—sometimes even more than the money itself.

3. Document Everything—Yes, Even Feelings

Keep a journal of conversations, messages, and your emotional reasoning behind saying no. When emotions run high and narratives get twisted, having a written record can help you stay grounded.

It’s also a tool for self-reflection—not just defense. Clarity breeds confidence. You might feel guilty, but guilt doesn’t always mean wrongdoing.

4. Seek therapy before guilt becomes a life sentence.

This kind of emotional pile-on from family and community can lead to long-term shame and anxiety. Talk to a therapist to process the fallout in a safe, neutral space. A mental health professional can help you separate moral responsibility from financial obligation.

You’re allowed to protect your peace—even when others say you’re the villain. Self-preservation is not selfish.

5. Accept that villainy is sometimes the price of peace.

Sometimes doing what’s right for you makes you the villain in someone else’s story. That doesn’t mean you’re wrong. People will project their panic, pain, and powerlessness onto whoever they can—especially when money is involved.

You can be miscast in their tragedy and still be the author of your own stability. Learn to live with their anger without letting it rent space in your head.

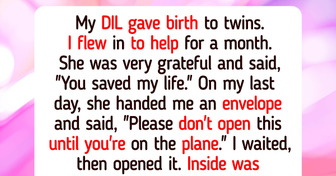

Some choices break your heart no matter what you decide — and sometimes, love demands more sacrifice than we think we can bear. At Bright Side, we recently received a letter from Nina, a 55-year-old woman whose life suddenly demanded she choose between her lifelong dream and her precious five-year-old granddaughter. Nina found herself in an agonizing battle between loyalty, love, and self-respect.

This is not just a letter. It’s a mirror, reflecting the silent struggles, so many women carry inside. Nina’s story will pull you in, break you apart, and make you question what it truly means to love... and to live. Read Nina’s powerful confession here.

Comments

The real question here is how anyone could believe such poorly written AI tripe is real...and respond to it with advice

As someone who just had to pay my sil to adopt my niece entirely different scenario, however, the child doesn’t deserve to suffer, no matter how you feel. If you have any love for that child you would either give what you can. Call it a tax write off for a good cause and call it a day.

Being the victim? That’s your choice.

Having principles is one thing. Having the ability to help an innocent child and not doing it because of "principles" is quite shi$$y. As the mother of the child I would react different, but I would probably never forget.

Yes, you're a monster. A heartless, self-serving monster.

Ok, So she has made tactical mistakes. When you loan money, you need to figure why the borrower needs it. Let me give you my example. When my mom borrowed money from me to do stocks, l demanded payment with interest, which translated into me staying at home for a year without paying for anything. Then next, my dad was really tight on money and couldn't come up with something to fix his car, and l knew he wouldn't ask me for money unless he is really in a bind, So l gave him money without asking him to pay me back.

So, the main problem here is this woman lacks judgement. I would say no to that cosign loan for sure, but l will give money to save my family's dying child and most likely not asking them to pay me back. I don't need blood money to be on my hand

Related Reads

My Fiancé’s Secret Christmas Plans Left Me Feeling Invisible

My MIL Excluded Us From the Family Trip Because We Don’t Have Kids, So We Made Her Regret It

12 Disturbing Secrets People Realized Only Later On

Stepmom Excludes 6-Year-Old Stepson From Every Family Celebration, Dad’s Powerful Response Stuns Everyone

10 Hilariously Petty Revenges That Feel Oh-So-Good

11 Unbelievable Stories Where Everything Went Terribly Wrong

I Refused to Keep My Stepmom in My Late Dad’s House—I’m Not a Charity

I Refused to Let My Boyfriend Discipline My Child—He’s Not His Real Dad

I Was Fired for an Intern — Karma Hit Fast

My Parents Refused to Support Me Through Med School—Then I Discovered Their Sad Secret

12 Real-Life Betrayals That Sound Like Movie Plots

My MIL Stole My Daughter’s $50K College Fund—The Consequences Were Immediate