Why are only women depicted making bad decision?

10 Principles That Can Cause a Person to Remain Poor for the Rest of Their Life

It’s not just a reusable coffee mug or a fabric shopping bag instead of a plastic one that will save you money. It’s a cool mind and an awareness of how and when we are spending money thoughtlessly even though the reason might be sensible at first glance.

We at Bright Side figured out which excuses obscure our consciousness and which situations we get into financially when we are not completely honest with ourselves.

“I have the right to treat myself nicely.”

Sometimes we comfort ourselves by saying, “This was a difficult period and I can treat myself to something nice.” This spending is justified only when there is enough money and when we don’t drain it all at once. Moreover, it’s not wise to make these purchases with a credit card.

Of course, we need to do things that make us happier but we have to think about whether the additional spending will bring this happiness to us. What’s more, it can cause a bunch of other problems like an increase in monthly payments and extra worries that your paycheck won’t be enough to pay for them.

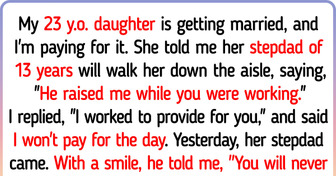

“Weddings happen once in a lifetime so taking out a loan is OK.”

The phrase “A wedding happens once in a lifetime” sounds like a magical spell and people are ready to borrow money and take out loans for this occasion, without even thinking about how unreasonable it is. They should understand that a wedding is not something that will bring you more money and there is no guarantee that this event will even get paid off. The loan will stay with you and you’ll start your life with unnecessary debt, which is definitely not something lovers dream about. What’s more, disagreements over money are one of the main reasons for quarrels between married couples.

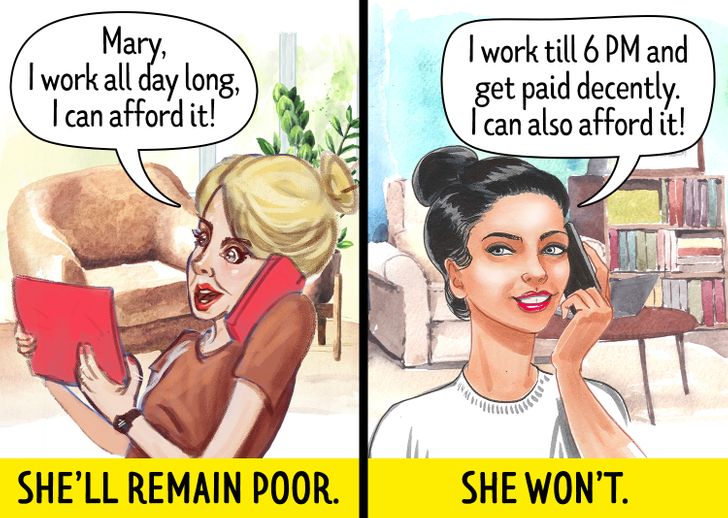

“I work all day long, I can afford it.”

They say that there is no need to work 12 hours a day to earn good money — all you need to do is put your mind to it and master your skills instead. All because when working all day long, you might end up feeling like you are living your life in a hamster wheel. And there is no time to think about how to upgrade your life, not to mention other necessities and hobbies. There is simply no energy left when you come home feeling like a squeezed lemon.

When a person learns to switch between work and hobbies and builds up their system a bit differently, they will be able to perform their duties without damaging their quality of life. They will get free time that can be spent on both hobbies and education that will give them an opportunity to move up the career ladder.

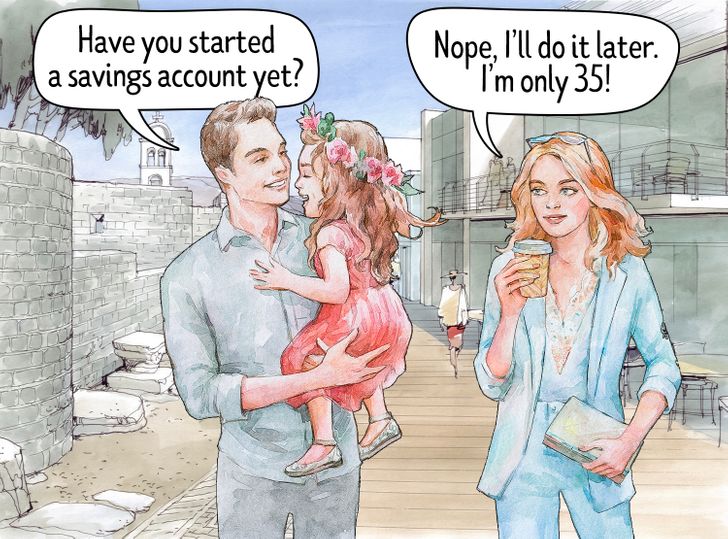

“I only live once so I’ll be spending my money here and now.”

These words are often said by people before they spend their entire paycheck. There is a piece of truth in this: we really don’t know what is waiting for us tomorrow and that’s why saving money doesn’t really make sense when you can spend it here and now and get pleasure from it. But you can still accomplish this by spending less money and not carelessly draining all of your income and emptying your bank account.

Of course, most things are unpredictable but still, most of us want to live a long and happy life and for that, we need money. That’s why it’s worth starting to care about the distant future as early as possible and starting a savings account instead of spending funds thoughtlessly.

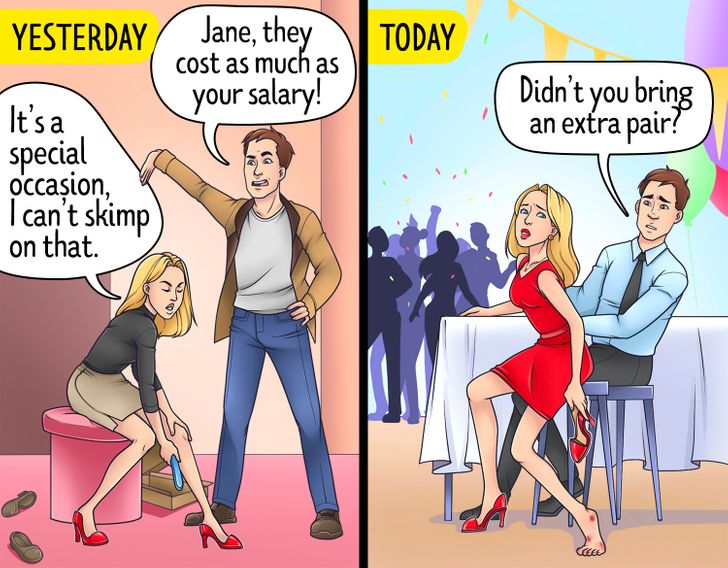

“It’s a special occasion, I shouldn’t have to skimp on that.”

Events that inevitably lead to spending take place in our lives every now and then. But situations can be different and you should be able to distinguish when expenses are really necessary and when you can pacify your extravagance.

It’s pretty easy to take notice of these events: you need to think in advance about all the situations and make a list of when spending is ok and when it’s not. It’s worth putting only the things that require attention on this list: diseases, losing a job, the breakdown of home appliances that are hard to live without, or an urgent need to buy shoes for the upcoming season. In all other cases, you need to say no to all unexpected spending because the purchase of a very expensive pair of shoes or a dress that will only be worn once is a senseless waste of money, even if they were bought to attend your best friend’s wedding.

“I got this money really easily, let me spend it easily too.”

Another widespread mistake is to spend money that you made easily, without thinking. In this case, it’s better to think ahead about how to spend it usefully. By the way, this type of thinking is the reason why most people who inherit big amounts of money or who win the lottery, drain their money really fast and soon have to return from an idle lifestyle to their previous one.

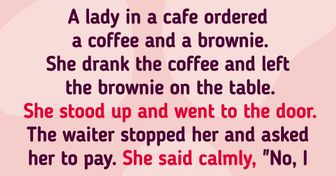

“It’s on sale!”

We tend to defend the choices that we make in front of ourselves and others. When buying an expensive thing, a person often feels guilty and justifies themselves by saying or thinking, “After all, I bought it for a good price, during a sale!”

When you find yourself in a store during a sale, it’s important to not tune into the feeling of everyone else’s excitement. It’s better to have a to-buy list and not buy extra items. Also, you can ask yourself, “Would I buy this thing if there was no discount on it?”

“I don’t want to do any research. It’s likely that the more expensive item is better.”

Sometimes we spend big amounts of money in pursuit of trends. For example, when we decide to replace our appliances, we opt for the most expensive ones without even checking the characteristics and by only looking at the widely-PR’d name of the brand and the numerous accessories that come in the set. Of course, at the moment of the purchase, we think that we are going to use all of them. What’s more, we pay for all these new items with a credit card.

After some time we find out that we have actually overpaid for accessories that go in the set but that we never actually used. That’s how the “decoy effect” works.

When a person lives with loans, they normally have an immense desire to buy things right here and right now. They don’t want to compare, choose, and plan. Sadly enough, this overpaying is often just a waste of money.

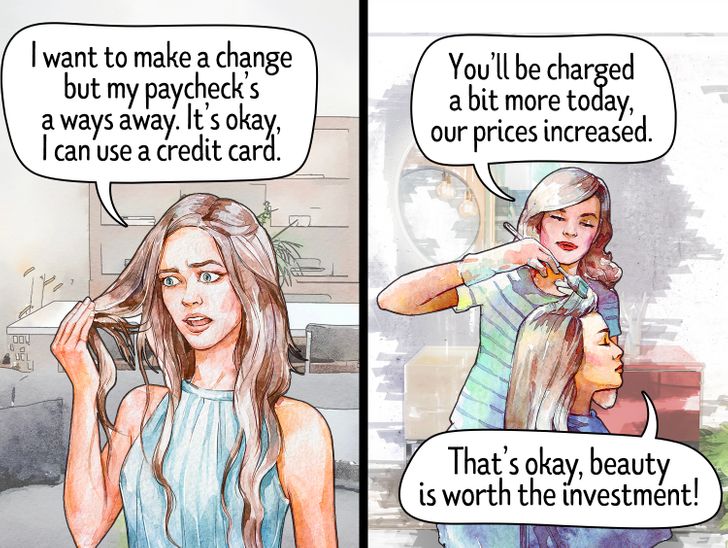

“I’ll pay with my credit card, after all, it’s not a big amount of money.”

A small purchase paid for with a credit card seems insignificant. For example, spending $150 in a beauty salon seems like nonsense to us when the limit on our credit card is $1,500. But if you were paying with your own money (not the credit card), you’d perhaps opt for a more budget-friendly procedure or you would at least split those procedures into several visits.

The power of the credit card is that it separates the pleasure that we get from a purchase and the feeling of regret that we feel when we part with our money. You can try to control your spending by only withdrawing a certain amount of money for each week and using cash when paying for something.

“I saved well last month so I can spend more now.”

It’s good when a person can save on transportation and not waste money in restaurants. It makes it easier to understand how much money has been earned and how much has been spent. But that’s not a reason to relax and start to break bad. Because if you can’t control your spending, it’s easy to end up getting into a hard financial situation. Planning a budget should be something constant and it should be done regardless of the size of your cash flow.

Have you ever experienced this feeling of regret when, after buying something, you realize that you could have spent much less money? How do you prevent yourself from unnecessary spending?

Comments

probably an accident 😥

I'm the real victim of sales. I really can't hold myself when I see something cool on sale 😅

actually same here hahaha

I always have to ask someone to stop me

usually I ask my gf to hold me or to tell me not to get it :D

I hate spending money so sales can't seduce me 😂

For our wedding, we only invited two couples of friends and their kids, we had a picnic, and headed home to share the cake ! No loan needed !

How cheap

Fortunately I don't feel this urge to buy new things only to satisfy myself,but only when there is need for them)

This article is useful...

Related Reads

8 Ways to Deal With Difficult People Everyone Should Know About

7 Signs It’s Time to End a Friendship, No Matter How Hard It Might Be

I Refuse to Pay for My Daughter’s Wedding After She Chose Her Stepdad to Walk Her Down the Aisle

20+ Illustrations Proving That There Are Only 2 Kinds of People in the World

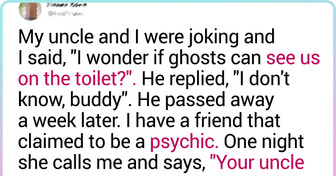

15 Stories From People That Can’t Get Over the Rudeness They Witnessed

10 People Share Creepy Stories That Actually Happened to Them

16 Relatives Whose Quirks Could Make Even a Stone Statue Lose Its Temper

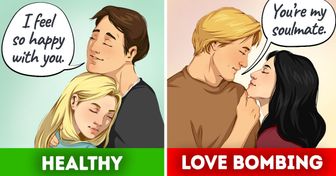

What Love Bombing Is, and Why It’s More Dangerous Than It Sounds

14 Startling Stories From Shop Assistants That Astonished Them to the Core

15+ Times a Solution to a Problem Was So Simple We’re Surprised We Missed It

20+ People Whose Good Deeds Prove That Evil Doesn’t Stand a Chance in Our World

18 True Stories With Unreal Plot Twists