good thing, but here is the catch - such planning might make you very nervous 😅

A Simple Money Trick From Japan That Can Make You 35% Richer

We all say that we want to save money, but what you actually do makes all the difference. If you’ve always struggled with saving, then you should definitely take a look at the “Land of the Rising Sun,” otherwise known as Japan. They have an ingenious trick called the kakeibo method, which implies using nothing but a notebook to save. If you’re wondering what to do with it, grab a pen and start writing.

Bright Side cares about your finances and wants to help you buy that pair of shoes at the end of the month, so we’re explaining this method as simple as possible so you can take notes.

Step 1: Grab a notebook!

Maybe you’re surrounded by so many devices at a time that you don’t know where to start. Well, we propose to put that technology aside and go back to the old-school method of writing. Grab a notebook and a pen and start writing. You memorize way more information if you actually put down each letter rather than type them on a screen, according to studies.

Kakeibo actually translates to “household account book,” and it dates back all the way to 1904. Hani Motoko invented this method, and she is considered to be Japan’s first female journalist. There are also special kakeibo notebooks that you can buy, but you’ll be just fine with a regular one.

Step 2: a monthly income plan

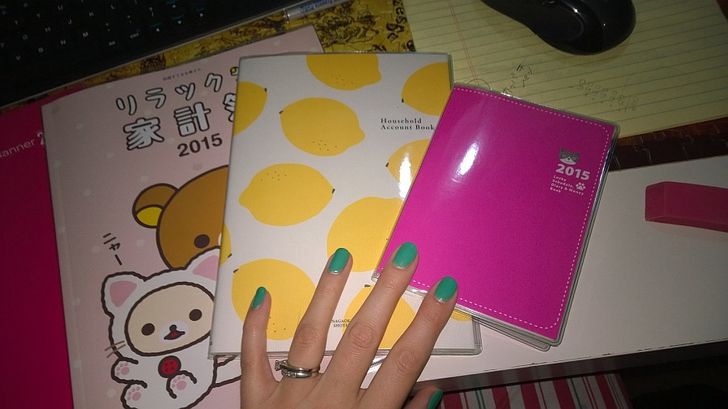

First and foremost, start by writing down all your revenue sources and how much you actually earn in a month. Make 4 columns depicting the weeks in a month. You can make a table for each week, or even write it down with bullets, columns, or whatever floats your boat. We’ll represent it as a table.

At the beginning of the month, write in the income you know for sure that you’ll get. Write it in red, let’s say. Any extra income you get after this should be recorded in a different color or block letters. Let’s say you write it in green. Take notes on each dollar that comes to you, whether it be salary, goods sold, paid debt, etc.

Step 3: a monthly savings plan

Draw another table where you’ll write down how much money you’d like to save each week of that respective month. It’s important to decide this amount before you start planning your expenses.

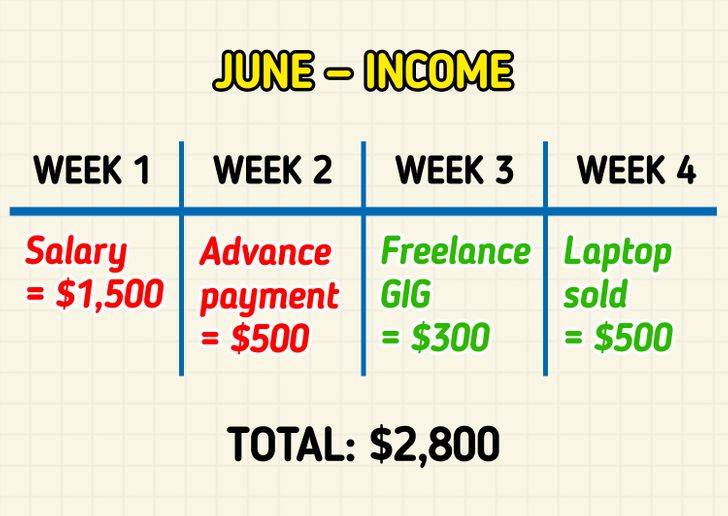

Step 4: a monthly expenses plan

The next step is to put down your monthly expenses. Write down any fixed expenses you have that month, like rent, utility bills, phone bills, or Internet bills.

Step 5: a plan for the remaining expenses

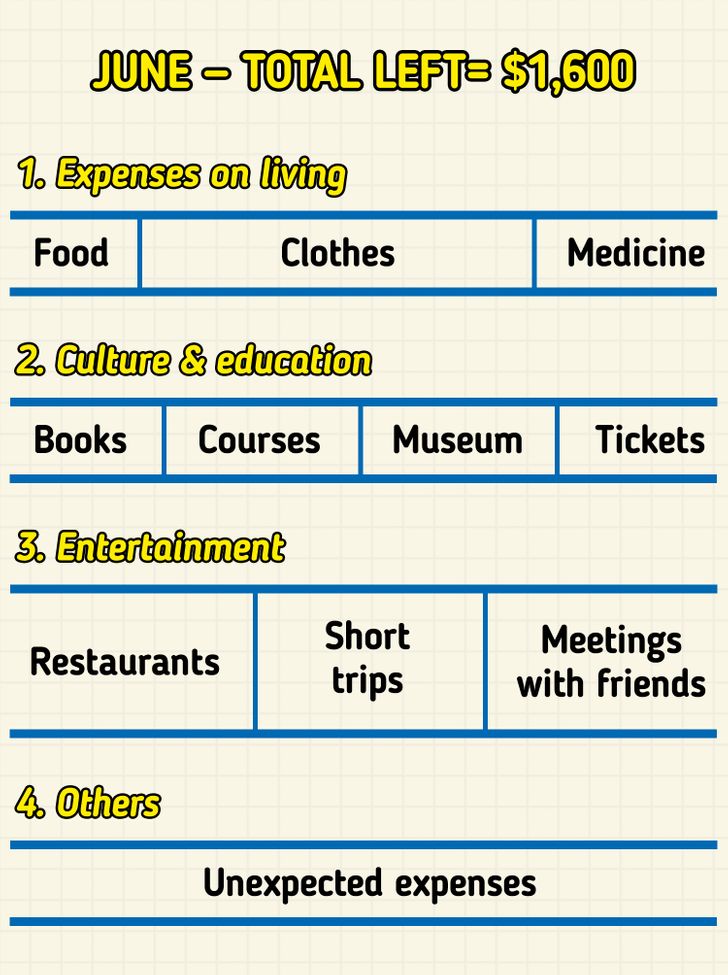

The money that is left after you deduct common expenses and add what you want to save is the money you can spend. This should be divided into 4 categories. The first one is for expenses on living, like food, clothes, gas, household products, etc. The second category accounts for culture and education expenses, which could consist of tickets to museum exhibits or educational courses.

The third category is entertainment, and it’s here that you’ll need to record each lunch or dinner spent out. And the last category is simply “others,” and it’s where you’ll count all the other expenses that don’t fit in any of the aforementioned categories. The ratio among the four categories is up to you.

Step 6: drawing the line

At the end of the month, analyze things and see if you stayed within the limit. You can have a better picture of how much you spend on things you don’t need and you can plan your budget better for the upcoming month. This tool helps you keep track of everything you earn and spend in a very simple but detailed way. The final goal is actually to increase your savings.

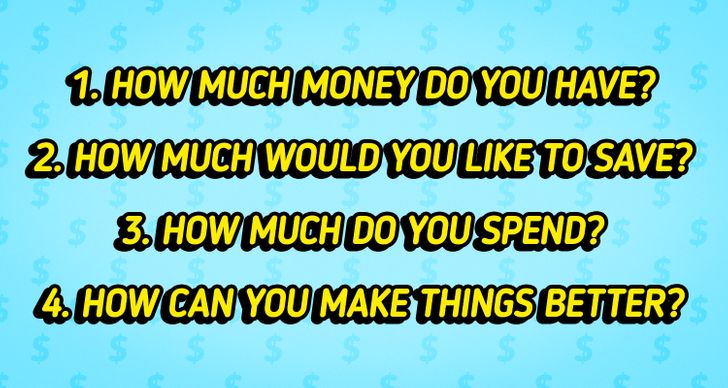

4 questions to keep in mind

No apps, no technology, no tricky calculations — just ask yourself these questions. Mindful spending is one of the kakeibo strategies, and fans of this Japanese format know that putting together budgets helps you save more. Instead of focusing on what you can’t afford, you focus on what’s important and what you can spend your money on.

BONUS: Get a second notebook!

After you’ve written down all your income, expenses, and savings, get a second notebook — a smaller one for your convenience. You should carry this one wherever you go. Write down everything you spend money on in it, even if it’s just a candy bar for $1. Moreover, make a shopping list each time you go grocery shopping — it will help you stay on track with your spending.

How are your spending habits? If you’ve used this method before, how much did you save?

Comments

Related Reads

12 Weddings That Uncovered Shocking Secrets and Scandals

10 Family Conflict Stories That Will Leave You Shocked

People Shared 15+ Tales From Work That Are Either Witty, Hilarious, or Downright Infuriating

12 Stories That Prove Parenting Is a Never-Ending Journey

Anne Hathaway Deemed Unrecognizable After Her Face Shocked Many in New Pics

We Moved My Son Out of His Room, and Thought He Was Okay—But We Were Wrong

My Teenage Daughter is Shaking My Confidence as a Woman— I Decided to Send Her to Boarding School

I Discovered My Husband Was Cheating on Me, but Karma Got Him

My MIL Made a Scene at My Birthday Party and Got Exactly What She Deserved

14 Deceitful People Who Are Always Ready to Take Advantage of You With an Innocent Face

21 Curious Stories That Took Place in Cafes and Restaurants

15 Family Stories That Prove Raising a Daughter Can Be a Roller Coaster