People Shared 10 Mysterious Events That Defy Any Explanation

We like to believe we’re making savvy financial choices. Sometimes, even the most frugal among us can fall victim to hidden pitfalls that quietly chip away at our finances, often without us realizing it until the damage is done. From everyday habits to seemingly harmless conveniences, these subtle mistakes could be costing you more than you think.

It’s time to uncover the silent money drains that may be undermining your savings. So here’s what not to do, when it comes to saving money.

Grabbing a coffee on the go can feel like a time-saver, and after all, it’s not that expensive. It feels like a small reward, a comforting pause in a hectic day. Just a few dollars, easy to overlook. But when that quick pick-me-up becomes a daily habit, this “small treat” quietly grows into a sizable overspending habit.

One cup here, another there, and before you know it, you’ve spent hundreds over the year—money that could have gone toward your savings. The goal isn’t to cut out joy, but to choose it with intention. Going out for a cuppa as a treat is good, on a routine, just make one at home.

Bonus tip: never drink coffee just before you shop, as studies prove it can actually make you spend more!

Snagging something just because it’s on sale can feel like a “save.” Of course, if you truly need what you bought on discount, it is a savvy investment. But when the price starts driving your decisions more than the actual need, that’s when you begin overspending, without realizing it.

Sales are designed to spark impulse buys, and they’re highly effective. If you didn’t actually need the item, that money spend wasn’t savings; it was an expense you didn’t need. Over time, these small, unnecessary splurges can quietly erode your financial progress, and even leave you with credit card bills and debts.

There’s nothing wrong with wanting a comfortable place to call home. A cozy duplex in a great neighborhood can feel like a well-deserved reward for your hard work. But when rent and living costs start consuming more than 30–40% of your income, that comfort comes with a price. It can force you to cut back elsewhere, causing you to save less, feel more financial strain, and potentially living paycheck to paycheck just to keep up.

Once you add utilities, internet, insurance, and groceries, your monthly budget can feel stretched to the limit. A home should be a source of stability, not a financial burden. Sometimes, the wisest choice isn’t upgrading your space, it’s preserving your peace of mind.

Taking on DIY projects can feel empowering—and often like a smart way to save money. Whether you’re painting a room, building a cabinet, or changing your car’s oil, the task might seem well within reach. With a few tools and a can-do spirit, it feels like anything is possible. But without the proper skills or experience, those simple fixes can quickly become expensive headaches.

A crooked shelf or a leaky faucet may not seem like much... until it results in larger repairs, wasted materials, or the need to hire a professional to undo the damage. Sometimes, what starts as a budget-friendly project can end up costing far more in time, money, and frustration than bringing in an expert from the start.

A busy schedule may make you feel like you have no time to cook, and just grab a bite outside. Even if you tend to make healthier choices at restaurants or food trucks, regular consumption of outside food is likely to prove expensive, for your health and for your wallet. Not only does outside food make you lag in nutrition, but it also adds to overspending, on the whole.

Try to use the weekends or any other free time you get to meal prep for the week ahead. You can chop the veggies, pre-cook and freeze your meals, or simply jot down a menu for the coming week.

It feels savvy, doesn’t it? Jumping from store to store, hunting down the lowest prices and piling up those “savings.” Ironically, what seems like a frugal move could actually be costing you. Factor in rising fuel prices, added wear and tear on your vehicle, and the hours of your time lost in transit, and those few dollars saved at the checkout can quickly disappear.

In the end, your bargain hunt might leave you spending more than if you’d simply shopped wisely in one place. Shopping at the same store can also help you save with loyalty points, ultimately putting your savings in the positive.

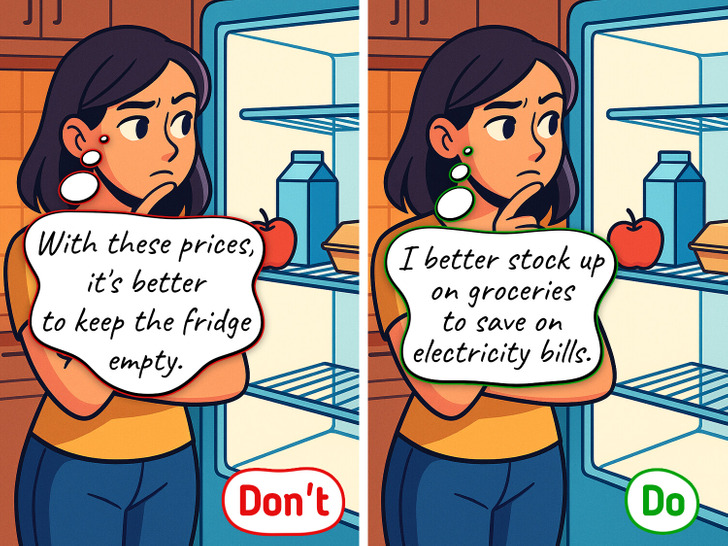

You might think that keeping your fridge empty can save you on electricity bills, but it can actually run up even higher bills, pulling in more electricity to compensate for the loss in mass inside. Plus, buying lesser groceries more frequently might also end up costing you more, as you miss out on bulk discounts from most grocery and departmental stores.

It’s better to stock up once you receive your salary, using a dedicated amount only for groceries. Making a monthly list and sticking to it will help you in better budgeting, as long as you follow it and don’t fall for bulk discounts on things you do not need.

Ultimately, it’s best to rethink your saving habits as much as your spending behavior, to be able to manage your finances better. Here’s another article with some more money-saving tips.