I'm glad you Finally found your backbone. Let him grow a pair and provide for himself. If he still wants to whine and complain about it tell him to grow up and buy him a supply of pull-ups. Real men can provide for themselves. Whiney baby.

I Refused to Share My Inheritance With My Partner — I’m Not His Backup Plan

We received a letter from a reader who found herself at the center of a difficult conversation after coming into an inheritance. What began as a private financial decision quickly became a test of boundaries, expectations, and trust within her relationship.

She shared her story with us to ask whether she was wrong for saying no — and why drawing that line mattered more to her than keeping the peace.

Here’s what she wrote.

The story with her own words:

Dear Bright Side team,

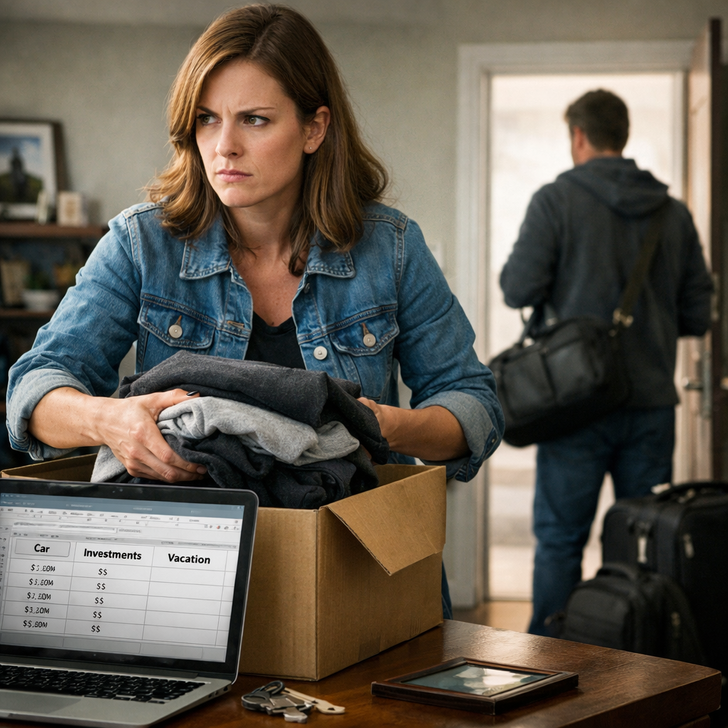

When my father died, he left me an inheritance with one condition: “Finish your education. Build your own life.” I never touched the money. My partner knew about it but never brought it up—until he lost his job. At first, I supported him. I paid bills, rent, and groceries. I thought it was temporary.

But weeks turned into months, and instead of job hunting, he started planning a “business” I was apparently funding. One morning, I found a spreadsheet on his laptop—he had already divided my inheritance into categories: “Car, investments, vacation.” My name wasn’t on a single line.

When I confronted him, he didn’t apologize. He said, “If you love me, you’ll invest in us. I’m your future.”

That was the moment I realized—he didn’t want a partner. He wanted a provider. I told him I’m not his ATM, packed his things, and changed the locks.

He didn’t lose money. He lost access.

Yours,

Elsa

Expert Insights & Psychological Tips

1. Relational Entitlement & Power Imbalance

People with a sense of relational entitlement often believe they deserve special privileges or financial benefits in intimate relationships — sometimes without reciprocity. When one partner expects the other to share an inheritance or assume rights over property just because of marriage or partnership, that can be a sign of inflated entitlement. Research shows that high entitlement contributes to conflict, resentment, and mismatched expectations in relationships.

Takeaway: Recognizing entitlement helps you see that your partner’s expectation (to share the inheritance) came less from love or fairness, and more from a belief they “deserve” more in the relationship.

2. Financial Gaslighting / Coercive Financial Control

Financial gaslighting is a form of emotional manipulation where someone tries to make you doubt your own perceptions or decisions about money. For example, pressuring you to share property that was legally and explicitly left to you, while framing it as “being a good partner,” or calling you “selfish” when you assert boundaries. This kind of behavior undermines your autonomy and can harm your self-esteem.

Takeaway: Setting clear boundaries around your inheritance protects not just your financial assets but your identity and self-worth.

3. Relationship‐Contingent Self-Esteem & Identity Threats

Relationship-contingent self-esteem (RCSE) is when someone’s self-worth depends heavily on how the relationship is going or how their partner sees them. If your partner reacts strongly to you keeping the inheritance or your name on the deed, it could be because their self-esteem is threatened. They may see your financial independence as a challenge to their role, especially if they’ve been used to power in the relationship.

Takeaway: When you stand up (keep what is legally yours), you force a moment of truth: does your partner respect you even when your choices do not align with their expectations?

- You had every legal and ethical right to the inheritance.

- Your partner’s sudden shift in expectations after the inheritance is a classic sign of entitlement and possibly coercive control.

- Your refusal was a boundary; boundaries are healthy in relationships — they signal respect for yourself and clarify what you will or will not accept.

At the end of the day, love should never come with a price tag — and the right partner will value you far more than your inheritance.

I Refuse to Help My Stay-at-Home Wife With Chores, I’m a Doctor, Not a Housekeeper

Comments

Related Reads

I Chose to Be Childfree, but Suddenly Became a Mom—And Now I’m Trapped

I Refuse to Let My DIL’s Kid Sleep at My House Every Weekend, My Comfort Comes First

I Refused to Forgive My Estranged Dad After He Chose His Wife Over Me—And I Don’t Regret It

My Dad Refused to Come to My Wedding, but I Still Asked for the Gift

12 Moments That Prove Kindness Is More Powerful Than Anything Else

12 Quiet Moments of Kindness That Completely Changed Someone’s Life

25 Stories From Online Users Where Kindness Became Invisible Armor

I Took My Dad to a Nursing Home—And It Cracked My Family Apart

I Thought My Job Was Stable—Until a Cheaper Hire Took My Place

I Refused to Quit My Career After They Hired a Gen Z to Replace Me

10 Times a Moment of Pure Cruelty Was Actually a Secret Act of Kindness

15 Times Someone Showed Kindness Without Saying Anything