Don't do it. That's your money. That debt is his to pay not yours. Don't you dare my friend. You are not his money train. Does he work??

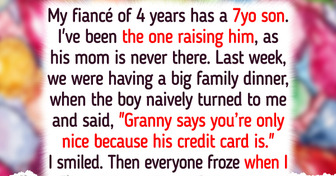

My Fiancé Wants a Joint Account, but I Don’t Want to Lose Control Over My Money

Managing finances as a couple can be more complicated than it seems. One of our readers recently opened up about her concerns after learning that her fiancé wants them to combine their finances into a shared account. Now, she’s struggling to figure out how to navigate this discussion without creating tension in their relationship.

We appreciate you sharing your thoughts on this tough subject! Figuring out whether to keep finances separate or combine them in a relationship can be a tricky decision. To make things easier, we’ve gathered some practical tips to help you approach this conversation.

Make it clear that his debt is his responsibility, not yours.

Just because he showed you that an account had a zero balance does not mean he does not have savings...only that he has a zero amount in that account. I would not be surprised of he did not have another account.

Love and support don’t mean taking on someone else’s financial burdens. You can be emotionally supportive while also setting firm boundaries. A joint account should be for shared goals, not for cleaning up one partner’s financial mess.

If he expects you to take on his debt without discussion, that suggests an imbalance in how he views financial responsibility. A healthy relationship means facing problems together, but it doesn’t mean one person should carry all the weight.

Motivate him to take charge of his own financial well-being.

It’s crucial that he actively works on improving his financial habits. Encourage him to focus on saving and paying off debts, whether by setting up automatic transfers or cutting unnecessary costs.

If he’s open to it, suggest financial counseling or useful resources to help him develop better money management skills. Watching him take responsibility will not only ease your worries but also reassure you that he’s serious about building a stable future together.

Establishing financial goals as a couple is essential for moving forward.

Take the time to discuss what’s important to both of you, whether it’s saving for a home, paying off debt, or building an emergency fund. Once you’ve outlined your priorities, break them down into clear, achievable steps, like setting a budget or creating a savings plan.

This process reinforces that managing money is a team effort, not just an individual task, and helps strengthen trust while keeping you both on the same page.

Think about your long-term compatibility.

Take a step back and consider whether your money habits and future goals align, as financial stability plays a big role in a successful relationship.

If you have doubts, premarital counseling could be a helpful way to address these concerns in a supportive environment. A professional can guide you through these discussions, helping you both communicate better and find common ground on managing money together.

Money matters in relationships and can get complicated, especially when family is involved. One woman faced a tough situation after asking her husband not to send money to his mother. Her mother-in-law’s reaction left her feeling uneasy and unsure about how to move forward.

Comments

Related Reads

12 True Stories That Can Mend a Broken Heart Stitch by Stitch

My Husband Missed Our Child’s Birth for a “Bigger Priority”

15 Stories About People Who Made Decisions That Can’t Be Logically Explained

I Will Not Tolerate Humiliation Just Because I’m Not Rich

13 People Who Cut Off Toxic Friends to Protect Their Sanity

20+ Gifts That Made an Everlasting Impression

12 People Share True Events That Marked Them Forever

10 Kind People Who Became Beacons of Hope in Someone Else’s Storm

10 Real-Life Moments That Could Come From a Comedy Show

My MIL Called Me a Gold Digger—But My Revenge Was Served Cold

“This Is the Best She Has Looked in Decades!” New Look of Donatella Versace Creates Buzz

I’m a Single Dad and My Friends Have Secret Plans for My Daughter—I’m Furious