I would have hired my own lawyer to review this situation. Lesson learned don’t trust anyone, especially “family”.

I Accepted My Father’s Inheritance—And It Ruined My Life

Some stories don’t warn you they’re going to hurt until you’re already halfway through them. This one came from a reader who learned the hard way that family legacies aren’t always what they seem. What looks like love on paper can turn into something far more complicated. And sometimes, the final gift a parent leaves behind isn’t a gift at all.

I would like to warn you.

Not all inheritance is a blessing. Some of it is a trap wearing the mask of love—and I didn’t realize that until it was already too late.

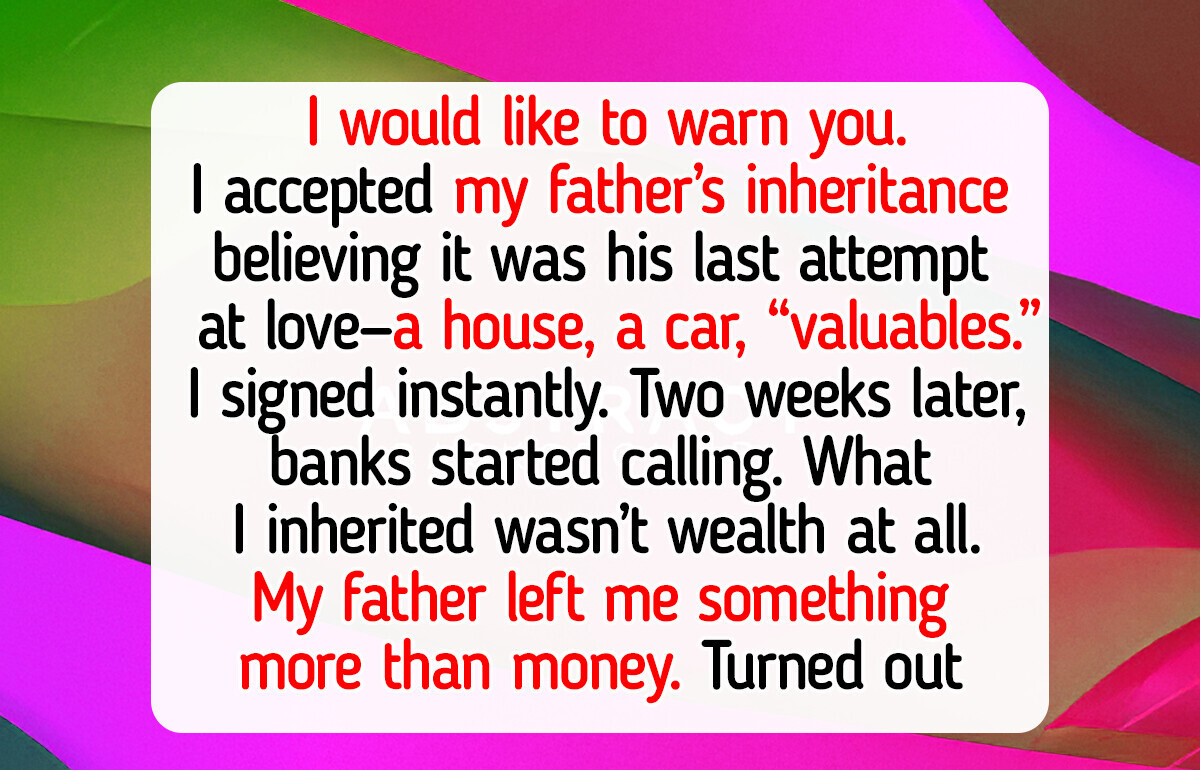

My father and I had a complicated relationship. He wasn’t cruel, just... absent. A man who believed silence was the same as affection and providing financially meant he didn’t have to show up emotionally. When he died suddenly, I felt more confused than grief-stricken.

So when the lawyer told me my father had left everything to me, I didn’t question it.

A house.

A car.

A storage unit of “valuables.”

It sounded like closure—or at least a gesture that said, “I did love you, in my way.” I signed the papers without thinking twice.

That was my mistake.

Two weeks later, the bank called. Then another one. Then three more.

My father hadn’t left me wealth. He had left me every debt he’d ever collected, stacked, hidden, and ignored.

Credit cards he never paid off.

Loans taken under the table.

Old business debts he personally guaranteed.

Medical bills that had gone to collections.

And the house? It was mortgaged so many times, I don’t know how the walls were still standing.

I inherited all of it because I signed. Accepting an inheritance purely means you inherit both assets and debts.

I didn’t inherit my father’s legacy. I inherited his financial wreckage.

At first, I felt angry. Then betrayed. Then guilty—because part of me wondered if this was all I’d ever been to him: the safety net he never built for himself.

Now I’m selling everything I own.

Furniture.

Electronics.

Jewelry.

Even the car I bought myself after college.

Every paycheck goes toward clearing debts that never belonged to me.

Every plan I had for my future is on hold.

Every night, I fall asleep wondering if my father knew what he was doing... or if he genuinely believed this was the only thing he could give me.

The worst part? People keep telling me I should be “grateful” he left me something.

Grateful. For the mess that swallowed the life I worked so hard to build.

I accepted my father’s inheritance. And it ruined my life.

If you take anything from my story, take this: Don’t sign anything until you know exactly what you’re inheriting—love or liability. Sometimes, they look the same on paper.

Huge thanks to our reader for opening up about something so difficult.

What about you? Have you lived through anything like this?

Share your opinions and stories in the comments below.

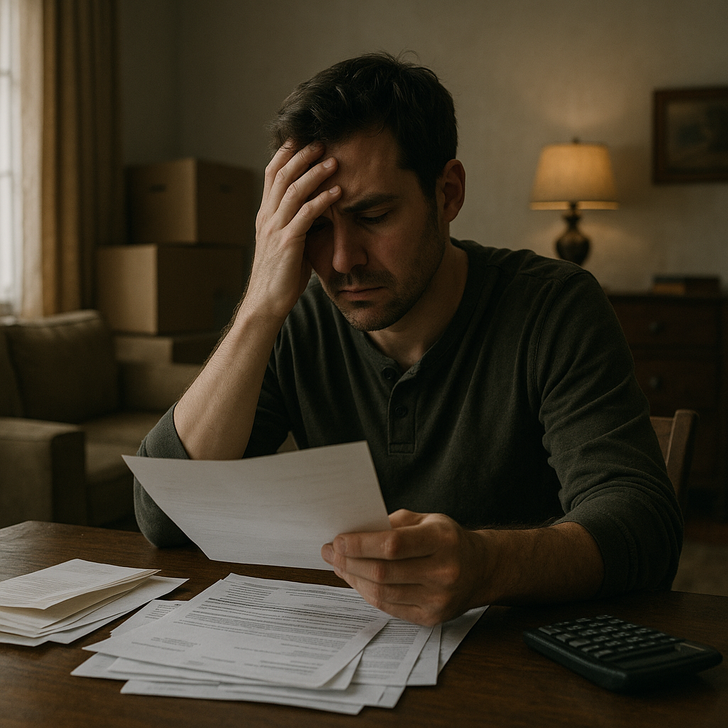

Before accepting an inheritance, think carefully—you may inherit debt too.

An heir must think carefully about whether to accept or refuse an inheritance. Once you accept, you cannot change your mind later. The decision can only be made when the estate is being settled, and there are two forms of acceptance: full acceptance or beneficiary acceptance.

Accepting an inheritance without an inventory

This is full, unconditional acceptance. You receive everything in the estate—both assets and debts. If the estate turns out to have more debts than assets, creditors can hold you personally responsible. This is rarely what people intend, which is why it is crucial to know whether the estate has a positive or negative balance before accepting.

Full acceptance can be declared formally at the court registry, but it can also happen by your actions. If you behave as an heir without any reservations—for example, by selling items, paying bills, or managing property—the law may interpret that as full acceptance. Because of this, caution is essential.

Beneficiary acceptance

Beneficiary acceptance offers protection. The estate is first described and inventoried, and you are only responsible up to the value of the assets. You cannot be held personally liable for the debts of the estate. If the estate ends up in the negative, you simply receive nothing—but you don’t owe anything either.

Refusing an inheritance

If you do not want to be involved in the estate at all—whether because of debt, conflict, or personal reasons—you may refuse the inheritance entirely. Legally, refusal is treated as if you were never an heir from the moment the testator died.

However, you must not perform any acts that imply acceptance. Only basic “management acts” (like securing property) are allowed. If you take any action that appears to accept the inheritance, you may automatically be considered to have accepted it unconditionally—and then you can no longer refuse.

The choice is yours, but it’s a serious one—and it cannot be reversed.

Comments

Related Reads

14 People Who Just Went With the Flow and Ended Up With a Story Worth Telling

I Chose to Be Childfree, but Suddenly Became a Mom—And Now I’m Trapped

My DIL Borrowed Money From Me and Refused to Repay—So I Took Action

I Refused to Let My Teenage Daughter Lock Her Phone, and She Turned My Rule Into a Family Crisis

I Refuse to Let My Grandkids Stay With Me, I Already Did My Part as a Mother

I Refused to Let Pregnancy Convince Me to Give Up My Business Class Seat

My DIL Refuses to Let Me Babysit My Grandson, She Wasn’t Ready for My Payback

My Sister Tried to Turn Our Family Cabin Into Her Free Resort, So I Changed the Rules

HR Fired Me Right Before My Vacation, So I Used It Against Them

I Refuse to Forgive My Parents After They Took My Inheritance for Being Childless

20+ Gifts That Prove It’s the Thought That Truly Counts

14 Quite Acts of Kindness That Changed Someone’s Life Forever