The step-daughter needs to do some chores to earn money. No only would it be beneficial to give her a list of things she could do but also how much money she can earn by doing the chore. No one wants to do a bunch of chores for a measly amount of money and she probably doesn't trust you 100% either. OR she could find a job and work outside of the home if she is old enough to do so. Falling for her attacks about favoritism will only encourage her manipulation tactics.

My Stepdaughter Accuses Me of Playing Favorites Because I Only Give Money to My Son

Navigating relationships with stepchildren can be challenging. Astrid believed she was doing the right thing by not giving her stepdaughter money, even though she provided her son with a weekly allowance. She intended to teach her stepdaughter a lesson in responsibility. However, now she’s second-guessing her decision and seeking reassurance.

Thank you for opening up to us, Astrid. We understand how challenging it can be to navigate financial lessons with a teenager, especially when they feel they're being treated unequally. We've put together some expert tips that we hope will assist you in finding a fair and effective approach to managing money matters with your stepdaughter.

Have an open conversation with your stepdaughter.

Take some time to have a heart-to-heart conversation with your stepdaughter. It’s key to let her know that your decision to not give her money isn’t about playing favorites but is rooted in teaching responsibility. Start by listening to how she feels and acknowledging any frustrations she might have. This will help her see that you’re not dismissing her concerns.

Then, gently explain that your goal is to help her learn the value of money and hard work, just as you do with your son, who earns his allowance by doing chores. Reassure her that this is not about how much you care for her but about giving her valuable life lessons that will benefit her in the long run.

Spend more quality time with her.

Raising stepchildren comes with its challenges, but being a stepchild can be just as tough. As a parent, it’s essential to prioritize their well-being and build a meaningful connection. If your stepdaughter is asking for money, it might not be about the cash itself but more about seeking attention and validation from you.

Make sure you’re spending quality time with her and showing that you genuinely care. It’s possible she feels overshadowed by your biological son and may not feel like a priority in your life. To strengthen your bond, consider planning something special for her, and even get your husband involved in organizing it.

Assign specific chores to your stepdaughter.

Create a detailed list of chores your stepdaughter can do to earn her allowance. This could include responsibilities like assisting with meal preparation, cleaning common areas, organizing her room, or helping with gardening.

By assigning her clear duties, you’re giving her a practical way to contribute to the household and earn money. This approach not only teaches her the importance of effort but also fosters a sense of financial independence and accomplishment when she sees the rewards of her hard work.

Consider offering rewards that aren’t tied to money.

Think about providing rewards that don’t involve money. This approach can help your stepdaughter understand that her efforts and positive behavior are recognized beyond just financial compensation.

For example, you might offer her additional screen time on the weekends if she stays on top of her chores. You could also organize a family outing to one of her favorite places or cook her favorite meal to acknowledge her hard work. Another option might be letting her choose a movie for a family night. These gestures show appreciation and can be just as rewarding as a financial incentive.

Encourage your kids to start saving.

Help both your son and stepdaughter understand the importance of saving money by guiding them in setting realistic saving goals. Show them how being smart with their money now can benefit them in the long run.

Begin by explaining how saving allows them to work toward future goals, like purchasing something they’ve had their eye on, preparing for college expenses, or even planning a fun vacation. Teach them that financial discipline today will lead to rewarding opportunities down the road.

A different reader shared a similar dilemma with us, seeking advice. She decided not to dip into her savings to contribute to her stepdaughter’s college fund. However, she was caught off guard when her husband’s ex issued a harsh ultimatum in response to her decision.

Comments

Related Reads

I Told My Stepdad to Skip My Wedding — I Didn't Expect the Brutal Consequence

I Found Out During Pregnancy My Husband Planned to Leave the Family After Childbirth, So I Taught Him a Lesson

8 Mystery Stories That Sound Like a Plot for a Bestseller

I Publicly Humiliated My Stepmother After She Belittled My Late Mom

14 People Who Should’ve Thought About Their Tattoos More Carefully

What Life Looks Like Before and After You Turn 30

12 Stories That Remind Us Kindness Wins, Even When the World Feels Broken

16 Moments That Show Kindness Is the Force That Raises Us When We Fall

12 Stepparents Who Kept Showing Up Even When They Weren’t Wanted

I Refused to Pay for Our Valentine’s Dinner—Then I Learned the Heartbreaking Truth

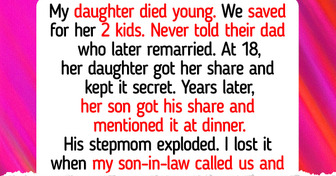

I Gave My Grandkids Their Inheritance at 18 — Their Stepmom Says I Destroyed Her Blended Family

I Refuse to Watch My Teenage Daughter Give Her Entire Salary to Her Boyfriend