Anyone that gives DETAILS ABOUT THEIR WILL, deserve any grief that they get. No one should talk about who's getting what except with their lawyer. There may not be anything left to leave for ANYONE. There will ALWAYS be someone who's nose is out of joint, thinking they deserve something, or MORE than they got. Your husband has to deal with his kids and you just take care of who you want to. At least as far as a WILL goes.

My Husband and Stepchildren Tried to Take My Inheritance — I Turned the Tables

Money has a way of revealing people’s true colors — especially within families. One of our readers shared how the people closest to her, her husband and stepchildren, suddenly saw her not as a loved one but as a wallet. What happened next was a painful lesson in trust, loyalty, and the power of standing your ground.

This article is intended for entertainment purposes only. We make no representations or warranties regarding the completeness, accuracy, reliability, or safety of the content provided. Any actions taken based on the information in this article are strictly at the reader’s own risk. We assume no responsibility or liability for any loss, damage, or consequences arising from the use of this content. Readers are advised to exercise their own judgment, take appropriate precautions, and seek professional guidance if attempting to replicate any part of the content.

Here’s her honest letter.

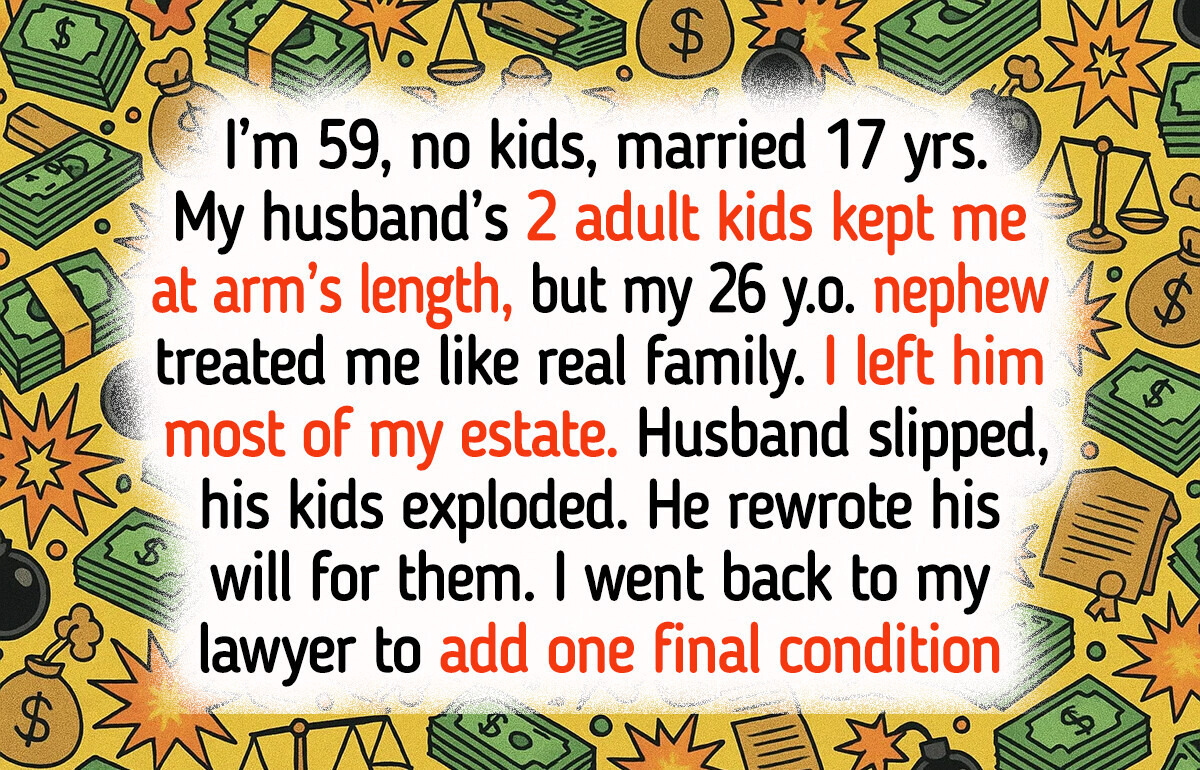

I’m 59, married to my second husband for almost 17 years. No biological kids — that was a choice I made early on and never regretted. My husband has two children from his first marriage (31 and 34). We’re cordial, but that’s about it. They never called me “stepmom,” and I never pushed it.

The person I have a close bond with is my nephew. He’s 26, my late brother’s son, and honestly, he’s been more of a child to me than anyone else. He checks in when he doesn’t need to, he helped me renovate after a flood last year, and he’s the one who always remembers small milestones.

So when I redid my will recently, I left most of my estate to him. My husband knows this, and he let it slip during a casual conversation. Suddenly, his kids turned into lawyers at a courtroom drama:

“So we mean nothing to you?”

“You’ve been in our lives forever — why would you cut us out?”

Nope. It’s simply gratitude toward the person who showed up. For the record, they’re not left out entirely. I set aside a fixed sum for each of them. But I’m not dividing everything evenly just to avoid hurt feelings.

My husband tried to “mediate,” but eventually admitted it bothered him. The next week, he changed his will so that everything he owns goes straight to his kids. That stung, I won’t lie. But it also made me more certain of my decision.

I went back to my lawyer and added one final condition: anything my nephew inherits from me is 100% shielded from claims or disputes by anyone else. If this turns into a fight, they’ll end up losing twice.

Thank you for your letter!

What Inheritance Rights Do Stepchildren Have?

Stepchildren don’t automatically inherit under intestacy rules — meaning if there’s no will, they’re usually left out. But the law does offer some ways to challenge this and seek fairness.

1. Contesting the Will

A stepchild may be able to challenge the validity of a will if there’s proof of issues like undue influence, lack of mental capacity, or that the step-parent didn’t fully understand what they were signing. However, to do this, the stepchild must be what’s called a “disappointed beneficiary” — someone who was included in an earlier will but later left out.

2. Making an Inheritance Act Claim

If the court agrees they didn’t receive reasonable financial provision, they may be granted a share of the estate.

Family battles “Mine vs. Yours”

One of the toughest parts of blended families is navigating inheritance. Biological children may feel they deserve more, while stepchildren often fear being left out entirely. The situation becomes even more complicated when kids come from different marriages.

Take this example: if a surviving spouse inherits everything, they might later pass it all to their own children, leaving their partner’s children with nothing. Without thoughtful estate planning, these choices can spark painful conflicts, resentment, and lasting family rifts.

How to Prevent a Family Feud.

Fortunately, there are ways to prevent your family from facing this kind of painful conflict.

Set Up Trusts: A trust lets you earmark assets for each child — biological or step — so no one feels left out. It also ensures that your wishes, not a court’s, decide who gets what.

Update Beneficiaries: Many people forget this step. Life insurance and retirement accounts often bypass a will, so make sure old designations don’t accidentally leave money to an ex instead of your current family.

Use Legal Agreements: Beyond a will, prenuptial and postnuptial agreements can clarify ownership from the start. That way, both children and stepchildren know they’re protected.

Most Important: Communicate. Talk openly with your spouse and the kids. Clear conversations about your intentions now can save everyone from heartbreak later.

Estate planning in blended families isn’t just about paperwork — it’s about protecting bonds, avoiding resentment, and making sure your legacy reflects love, not conflict.

Perhaps the hardest part of navigating a family is that “fair” doesn’t always mean “equal,” and the only balance you can truly control is your own.

I Refuse to Support My Aging Parents—Because I Don’t Owe Them Anything

Comments

test1

Related Reads

I Refused to Give Up My Holiday Leave to a Coworker With Kids—Just Because I’m Child-Free

15 Stories Where Kindness Showed Up When Nothing Else Did

15 Moments That Prove Kindness and Mercy Are Quietly Saving the World

18 Seniors Whose Sharp Wit Proves Humor Only Gets Better With Age

I Lost a $120K Job Over a Ridiculous Interview Test

15 Stories That Prove Kindness Wins When Everything Else Falls Apart

I Refused My Manager’s Instagram Request and It Cost Me My Job

I Kicked Out My Sister and Her Son After His Behavior Crossed a Line

My Parents Refused to Fund My Education, So I Turned the Tables on Them

11 Stories That Prove Kindness Still Shines When the World Feels Dark

My Parents Kicked Me Out for Getting Pregnant, Now They Want Me to Care for Them

My Brother Has No Kids but Refuses to Share His Inheritance With Mine—I’m Furious