WHAT?? A stay at home wife(not mum!), & now making the financial decisions! How disrespectful to her husband for one & particularly being that its in regard to helping his mother! The woman who was generous to them.

And..whats the load you have?? Maybe husband could tell his wife he'd like it if she would help the mother out..with food & cooking while she's struggling..& any errands that needed done down the road!

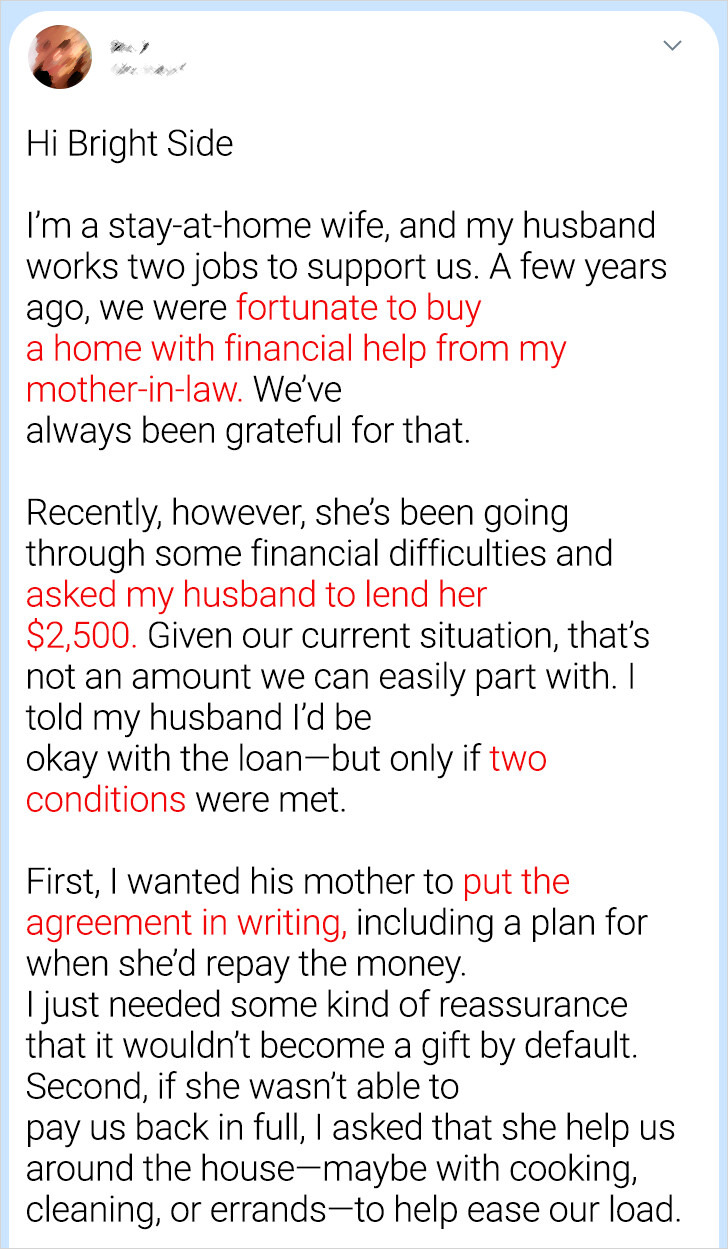

My Husband Wants to Lend His Mom $2,500 — But Not Unless My Conditions Are Met

Standing up for your family’s financial situation requires one to put their foot down, hard. But our reader, Vanessa, ended up offending her mother-in-law after she added conditions to her mother-in-law’s request to borrow some money. To navigate this tricky situation and avoid further drama, she reached out to Bright Side for advice.

The content provided herein is for informational purposes only and should not be construed as legal, tax, investment, financial, or other advice. Always consult with a qualified professional regarding your specific circumstances before making any investment, financial, or legal decision.

'Stretched pretty thin'..Just the two of them & wife is not working-cant be that stretched??

Of course MIL would be offended by such rude demands!! And if the wife can't see it, it could be that she might be too wrapped in herself!

The weak husband allowed his wife to put the terms to his mother then grizzled after. She nit only disrespected the mother but also him the way she took charge in the matter. However, allowed it & caused his mother pain. Clearly wife doesn't see her as 'mum'.

He better step up else this wife will not respect him..he should have had the last say in the matter. He's the man!

Thank you, Vanessa, for trusting us with your story. Finances can often be a cause for conflict in many families — here’s some advice that we think might help.

Understand that your mother-in-law has a right to be offended.

You need to see where your husband and his mom are coming from. Your “conditions” feel like a burn to the mother-in-law who helped you out when you were in a tough financial crisis. Her kindness came with no strings attached, but now that the situation is reversed, yours has conditions, and that feels unfair to her.

You’re not wrong for trying to consider your family’s long-term stability, but your mother-in-law is part of that family too.

Do you have a reason to doubt her?

Do you have any reason to doubt that she’ll keep her word and pay you back or can you trust her? If you’re not comfortable with giving such a high amount, then you could lend an amount that you’re comfortable giving and let everyone know that’s how far you’re willing to give. Both you and your husband should be okay with the amount, and if not, then someone has to compromise.

Acknowledge her past help.

When discussing the situation, take the time to express your deep gratitude for the support your MIL provided in helping you buy your house. Make it clear that you recognize and appreciate the significant role she played in giving your family a stable home.

It’s important to emphasize that your conditions for the loan are not intended to dismiss or diminish her past generosity. Instead, they are meant to ensure that your family’s financial situation remains stable in the long run. Explain that these conditions are a way to protect both your household and her from future financial stress.

Consider other ways to generate an income.

Instead of keeping a tight hold on the money that’s already in the family, you could try helping the family’s finances by finding ways to generate more income into your home. Look into getting a job, starting a small business or try the many side hustling ideas that are developing this year.

You could even get your mother-in-law involved and help each other improve your financial situations so that neither of you find yourselves needing to borrow from anyone.

This is what some of our readers advised:

I think this daughter in law sounds quite cold & heartless. This reminds me of a story in the Bible. A man was cleared of a huge debt but immediately went out & saw a man who owed him a little & was told that he must pay his debt in full. More or less-or else. How quickly the forgiven man forgot the good he'd received!

Anyway..why is 'stay at home wife(not mum!!)..making all the decisions without her husband's say so..after all he's the one working hard & they do have the money. Plus men are the head of the home (supposed to be according to Gods word!)..supposed to be!

He's so weak to let her make the call..fancy allowing the wife to make those conditions!

DIL knows it something that they should gladly give without expectation to have her pay it back even thiugh she probably would. Now DIL has ruined things to the point where if it were me, Id be saying: 'forget I even asked..Im sorry I did!'.

The things is: if there was savings but was needed for a special thing coming up..why not say:'Mum we're happy to help, but right now it will have to be a loan because we have this to do soon & could you manage to have it paid by... I'm sorry we can't just give it as a gift right now as you so generously did us. I hope that is ok.'.

To me it sounds like they are takers..husband too as he did not speak up as a man!

I have made lots if comments..even repeating myself..its probably not an actual honest case but I know they exist & its mean!!

- FAMILY HELPS FAMILY; your MIL helped you when you needed it, and helping her out with a $2,500 loan is completely reasonable. This isn’t some distant second cousin with a gambling problem, for Pete’s sake ! This is your husband’s mother, and your “conditions” ARE insulting . You should GIVE her the money, but at the very least make it a loan with the understanding that she may never be able to pay it back. © Carrie Matteson / Bright Side

- Give her back what she gave you to help you buy a home. © Jacqueline Burse / Bright Side

- Did you repay her for the help she gave you? If no, then why the “conditions” at all? Why not get a job to help out your financial stability, even if it’s just temporary. © Angela Hannegan / Bright Side

- First the MIL should get paid back pretty selfish to take money from her interest free I might add and not give anything back. That 2500 should be a payment back to her. © Earl Beam / Bright Side

- Hello, your mil helped you buy a house and all she asked for was 2500. I’d help my mil no matter what. © Cynthia Hodges / Bright Side

Finances seem to have a way of bringing out the worst in people. One couple’s seemingly perfect marriage began to unravel when unexpected boundaries are crossed.

Comments

This drama happens everywhere. She wouldn't say a word if her parents ask money and even fights with her husband and even make a social media drama saying they raised her. But when it comes to husband parents, all this reasoning comes.

You are not going to win this one lady.

Related Reads

I’m a Nanny and Let the Kids Watch Videos, but It Almost Cost Me My Job

I Went on a Date With a Vegan and Ordered a Burger—Her Reaction Was Priceless

HR Fired Me Right Before My Vacation, So I Used It Against Them

My Sister Tried to Turn Our Family Cabin Into Her Free Resort, So I Changed the Rules

20+ Gifts That Prove It’s the Thought That Truly Counts

I Refuse to Forgive My Parents After They Took My Inheritance for Being Childless

My DIL Refuses to Let Me Babysit My Grandson, She Wasn’t Ready for My Payback

15 Times Someone Showed Kindness Without Saying Anything

11 People Who Chose Humanity Over Hatred in the Darkest Moments

14 Quite Acts of Kindness That Changed Someone’s Life Forever

I Refuse to Let My Sister Hijack My Pregnancy Announcement

My Boyfriend’s Mom Kept Mocking My Career—My Response Silenced the Whole Table