They took out loans in your name without you knowing it? Get a lawyer and get the police involved.

I Refused to Expose My Salary to My Parents, Now My Life Is Falling Apart

Hidden financial secrets within families can create major stress and strain relationships. Many adult children discover unexpected debts, like loans or unpaid bills, leaving them feeling blindsided, overwhelmed, and unsure how to handle money, trust, and boundaries.

Letter from Rory:

Hello, Bright Side!

This is a wild ride, and honestly, I’m still kind of in shock. A few weeks ago, I got a big raise at work. Super happy about it; felt like a big adult milestone or whatever.

Went to dinner with my parents to celebrate (thought it’d be chill), and as soon as the check comes, my dad asks how much I make. I said, “That’s private.” He straight up snapped, “We have a right to know!” Before I could even respond, my mom jumped in with, “You’d be nothing without us!”

I just left. Like, literally got up and walked out. Spent the next few weeks avoiding them, mostly because I didn’t even know how to process the mix of rage, hurt, and betrayal I was feeling.

Then, out of nowhere, an envelope shows up at my place. I open it, and I freeze. Inside? Student loan papers. Loans I’d never seen before.

Turns out, my parents took out $80,000 in Parent PLUS loans for my education without telling me. And get this, the attached payment plan had my name listed as the responsible party.

On top of that, there’s a sticky note that says, “Time to pay us back. Monthly payment: $1000.” I feel blindsided, angry, and honestly a little sick.

I get that they might’ve thought they were helping, but this is huge. It’s my credit on the line, my financial future, and they never even talked to me about it. I’m torn between being furious, feeling completely betrayed, and honestly being kind of scared about how to handle this.

So, Bright Side, would I be an awful daughter if I told them to figure this out with the bank themselves? Or am I obligated to pay them back just because they threw my name on the loans?

Thanks,

Rory!

Lawyer up, you didn’t know your parents took loans out in your name.

Thank you so much for sharing your story with us, Rory. It takes a lot of courage to open up about something this intense. Hopefully, our advice gives you a little clarity and a sense that you’re not alone in dealing with something so overwhelming.

- Separate emotions from action — We know you’re furious, but don’t make any snap decisions while the adrenaline’s high. Sleep on it. Take a weekend. Then decide what you’re actually willing to do, not just what your anger wants.

- You don’t have to carry their mistakes — They made a huge decision without you. That’s on them, not you. It’s wild, we know, but their “help” doesn’t automatically become your debt to repay. Start framing it in your mind: you’re not a bank, you’re not a safety net.

- Trust yourself over their expectations — They’re trying to dictate your adult life, but you’re the adult now. You have the raise, the skills, and the bank account. Your decisions about money, career, and life are yours.

It’s terrifying, but also kind of freeing. Trust that you know what’s right for you, not what they want.

While these situations can feel overwhelming, taking control of your finances and setting clear boundaries can help restore a sense of stability and confidence. With the right steps and support, it’s possible to navigate the challenges and come out stronger on the other side.

Read next: “I Refuse to Keep Funding Family Christmas—I’m Not the Family’s Credit Card”

Comments

Should you pay your parents back? Maybe. But if they took out student loans in your name without you knowing that's fraud. Talk to a good lawyer and find out your options. Remember you might want to consider paying them back anyway. If it really was fraud in addition to paying them back you might want look into putting it in theirs and pay at a rate that you can comfortably afford and not what they're demanding.

When parents need your help. You should . Considering your means and how much you can spare is to be worked out by mutually discussing it in an amicable manner.

That's fraud. Get a lawyer. Go no contact. Seriously, they've shown you who they are. Believe them.

you could have just said what is a comfortable fugure to you, you know, to avoid all this drama. if they are retired now, then yes, be the big adult and pay the bank.

Related Reads

My Parents Wanted a ‘Family Vacation’ on My Budget—I Made One Move They Didn’t Expect

I Kicked My Parents Out of My Graduation—They Didn’t Contribute to My Education

My Family Excluded My Girlfriend From Christmas Because We’re Not Married

10 Times a Painful Truth Turned Into Kindness That Saved a Soul

I Refuse to Host My Sister—I Don’t Care If She’s Homeless With 3 Kids

I Refused to Give My Brother My $40K Wedding Fund—My Family’s Revenge Was Brutal

I Got Fired for Refusing to Let My Boss Humiliate Me in Front of Everyone

11 Quiet Acts of Kindness More Powerful Than the Loudest Thunder

I Refuse to Accept Zero Bonus Just Because I Was on Maternity Leave, I Brought More Money Than Anyone

20+ Moments That Prove Happiness Is Not About the Big Things

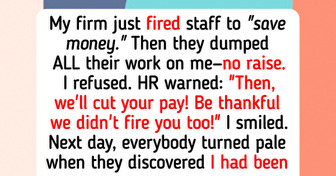

I Refused to Do Extra Work Without a Raise — Now HR Will Cut My Salary

I Refused to Help My Homeless Mom After She Spent All My Inheritance on My Sick Sister