People rise money all their lives to buy the expensive car, the expensive house, the latest iPhone.... Anything for the image but sometimes they end up having less than more ;)

10 Things That Stop Us From Becoming Rich and Ways to Fix Them

If you want to become wealthy one day, here’s some good news for you — in 2016, 78% of dollar millionaires came from poor, or middle-income families. That means that each of us can become rich one day.

We at Bright Side wish you to succeed financially. Now, have a look at the 10 things that potentially stop you from getting rich.

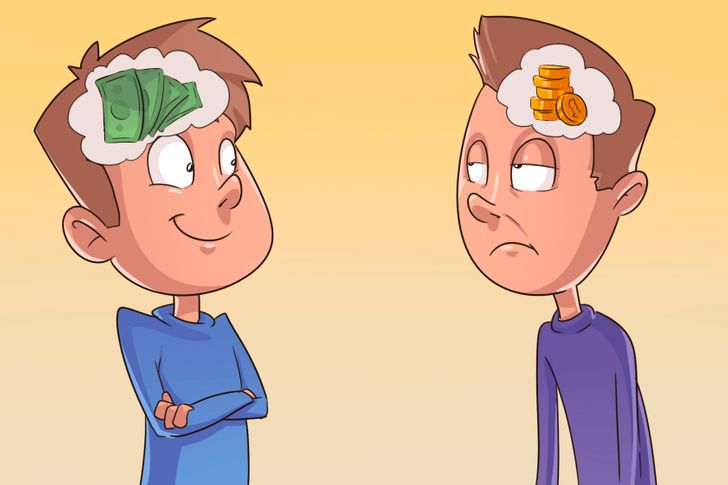

1. Your decisions are influenced by appearance.

People tend to evaluate the same situation differently depending on the environment. This was proven by an experiment where people were asked to evaluate products that were located in 2 areas, one with laminate flooring and another with carpet. Respondents walking on the carpet gave the same products better feedback.

For instance, when choosing a job, you might accept one with a nice office, while rejecting another opportunity with better career growth. So to make decisions that will lead you to financial success, try to make sure that visual attributes don’t affect you.

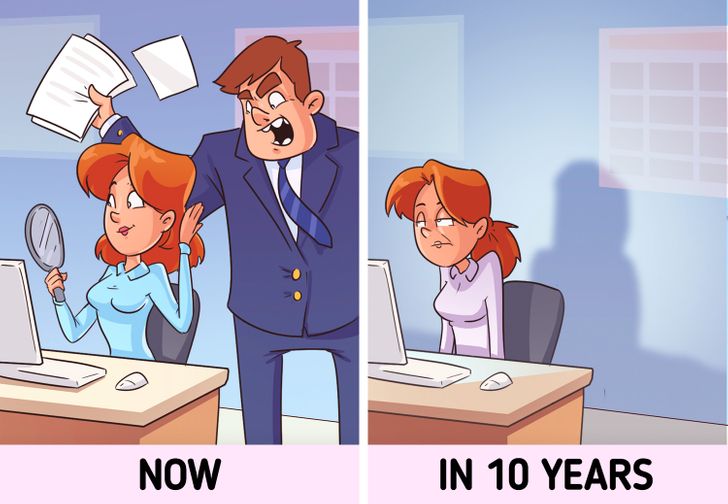

2. You tend to ignore negative things.

We often tend to ignore difficulties and unpleasant tasks, hoping that they’ll solve themselves. However, these things might hinder your financial success. Negative feedback from your boss, unpaid bills, conflicts, and more are stopping you from becoming rich.

Being a “Pollyanna” is an adjective given to people who tend to agree with positive comments about themselves exclusively, ignoring all negative information. It originated from the book, Pollyanna, a novel about a girl that could find positive things in everything.

To avoid this mistake, try to take into account all information and evaluate it critically. Accepting problems and taking criticism isn’t easy, but ignoring these things can prohibit the opportunity to improve.

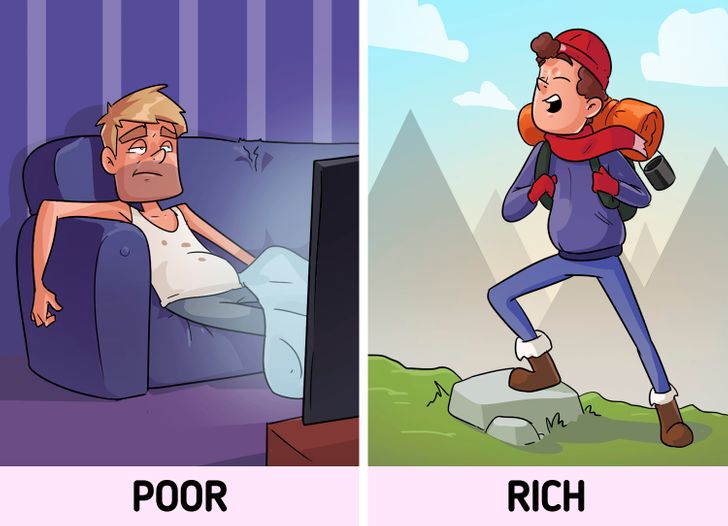

3. You underestimate the influence of laziness.

Researchers conducted an experiment where people were told to imagine that they were doctors that were choosing a type of therapy for a patient. They had a choice: to try the treatment, which led to death in 15% of cases; or not to try any treatment, which was lethal 20% of the time.

13% of people chose to not try any treatment because they’d feel less responsible if the patient died. This cognitive trap makes us believe that not doing anything is safer than trying and taking a risk.

It seems like being passive and watching TV doesn’t cost a lot, but think about all the time you waste. You can work extra hours to earn money, learn new skills, or think about your own business — it simply requires you to take a risk to make some additional income for the future.

4. You don’t use the assets you have.

The amount of sharing economy users is expected to double by 2021. For those who don’t know, the sharing economy is a way that consumers can share and use services either for free, for a fee, or through bartering and exchanging goods. Some good examples of this are companies like Airbnb, Uber, and eBay. These platforms give us an opportunity to make extra income from the assets we have. You can rent out your garage, your land, or even the tools you have. Take a look at your possessions and see what things could be useful for others. Creating an ad doesn’t take much time and it will give you an opportunity to make some additional weekly income.

5. You plan your budget for a period of less than a year.

Some expenses have to be planned many years in advance. If you want to buy a car, it’s better to save money in advance instead of acquiring credit. If you don’t have long-term goals, you’re at risk of spending all your savings or taking on a loan.

6. You don’t know prices.

Unless you’re familiar with prices, you’ll end up spending more. Marketers are experts at tricking us, making the temptation to buy products with discounts high — but remember, the same product might be much cheaper in a different store.

7. You don’t spend any money on entertainment.

If you decide that films can be seen at home, eating out isn’t for you, or that concert tickets are way too expensive, after some time, you’ll feel burnout and become dissatisfied with your life. While cutting your expenses, you can reduce entertainment spending, but don’t get rid of this entirely. For example, meet up with your friends, but instead having a chat in a restaurant, invite them to your place for a cup of tea.

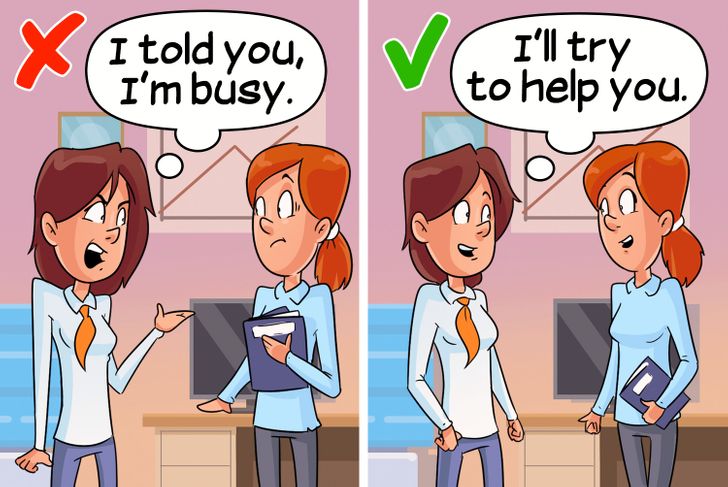

8. You’re a bad negotiator.

You can’t succeed alone, so negotiating skills are an indispensable trait in wealthy people. The best negotiators always have the best salary, working environment, and support from their boss. If negotiations are like taking bullets for you, try different online courses for guidance, and if you want to become affluent, don’t miss the importunity to practice in real life.

9. You don’t know how to establish relationships.

People who are rich tend to have several close friends while the poorest people are among the loneliest. While focusing on finance, we tend to forget about our friends. But the problem with this is that friends have a positive influence on all aspects of our lives, including finance. Having someone who believes in you and is always there for you shouldn’t be overlooked.

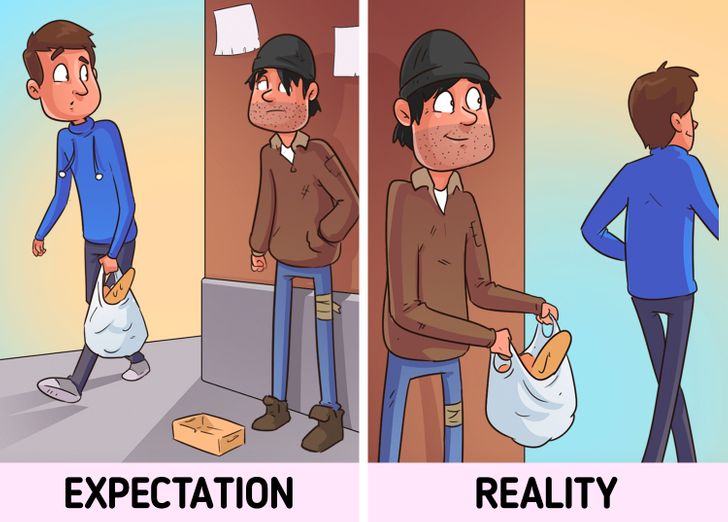

10. You believe that being rich is bad.

Some people think of being rich as evil, but don’t forget there are good people everywhere. You can become rich and stay a nice person. In fact, if you become rich, you can make this world a better place. Take a look at some of the most warm-hearted billionaires — they donate not only their money but their time and resources as well.

What are you doing to become wealthier? Share the things that tend to get in your way.

Comments

Yes, but it's better to cry in a Porsche hahah

Working with the budget is one of the best advices ever. Truly. When I started budgeting everything I started having more money aside to do the things I love.

Really, how do you do it? :p

I use an app in my phone and I add a monthly busget and then I add every expense and income I get during the month and I aim to set something aside also - savings.

*budget

It's all about connections and investing your money. Spend what you can miss not what you own!

Great illustrations! I really like them! Now about the post ? I agree! Especially the laziness part... I am trying to be more productive but it's a hard habit to break

Don't worry it's a natural thing! The brain wants to be lazy

Related Reads

14 Stories That Prove Kindness Can Turn Regular People Into Heroes

I Refuse to Sacrifice My Retirement Dream for My Unemployed Son

I’m 100% Remote: I Refused My Boss’s New Rule to Work From the Office—HR Got Involved

I Refuse to Split My Stepmom’s Inheritance With My Stepsiblings, I’m Not a Charity

I Refuse to Be Exploited as a Free Babysitter on My Hard-Earned Retirement Cruise

I Tried to Be the Husband My Wife Needed — She Figured Out What I Was Actually Doing

My DIL Shut Me Out of the Family Vacation but I Didn’t Hold My Tongue

13 Family Conflicts That Sound Straight Out of a Soap Opera

10 Travelers Who Took “Breaking the Rules” Way Too Far

15+ Raw Stories About Jealousy That Can Leave You Speechless

15 Insider Stories From Cabin Crew You Might Not Hear on a Plane

10 Mothers-in-Law Who Know How to Stir the Pot